Hiring Overseas Contractor For Bad Work In King

Description

Form popularity

FAQ

Conversely, if the independent contractor is not a US person and did not perform any of their services within the US, you will not be required to issue Form 1099. Instead, the foreign contractor will have to complete and file Form W-8BEN.

Generally, the steps to hiring a foreign contractor are similar to hiring an independent contractor from the US. The differences lie in the laws you'll need to be compliant with, including both labor laws and relevant tax regulations. You're not just subject to the laws of the US.

Form 1099 is used to report payments made to an independent contractor. Expat business owners may need to file Form 1099 when working with contractors abroad. Failing to file Form 1099 as required could result in penalties.

While this opens doors to diverse talent and skill sets, it also introduces unique challenges in terms of tax compliance. One critical aspect of this compliance involves Form 1099, which US-based businesses may need to issue to foreign contractors for reporting payments made during the tax year.

Foreign remote contract workers don't require visas because they are based outside of the US. While these workers may have to come into the country occasionally to fulfill their contractual obligations, they shouldn't have any issues entering as long as they can provide proof that their stay will be temporary.

Foreign independent contractors must submit IRS Form W-8BEN or W-8BEN-E to certify their foreign status and claim any applicable tax treaty benefits. The US company may also need to file Form 1099-NEC if certain conditions are met, though this is more common for domestic contractors.

Today, it's possible to hire independent contractors from any part of the world, thanks to improvements in technology and communications. It's a great idea to consider Mexico if you're looking to expand your team. Its proximity and strong economic ties to the US are definite advantages.

Foreign vendors do not complete the Substitute Form W-9; foreign persons or entities must submit one of five available forms. The vendor must determine the one most appropriate to their United States tax status for reportable transactions.

However, the IRS doesn't require a company to withhold taxes or report any income from an international contractor if the contractor is not a U.S. citizen and the services provided are outside the U.S. filing forms 1099 is required if: The contractor is located internationally but is a U.S. citizen.

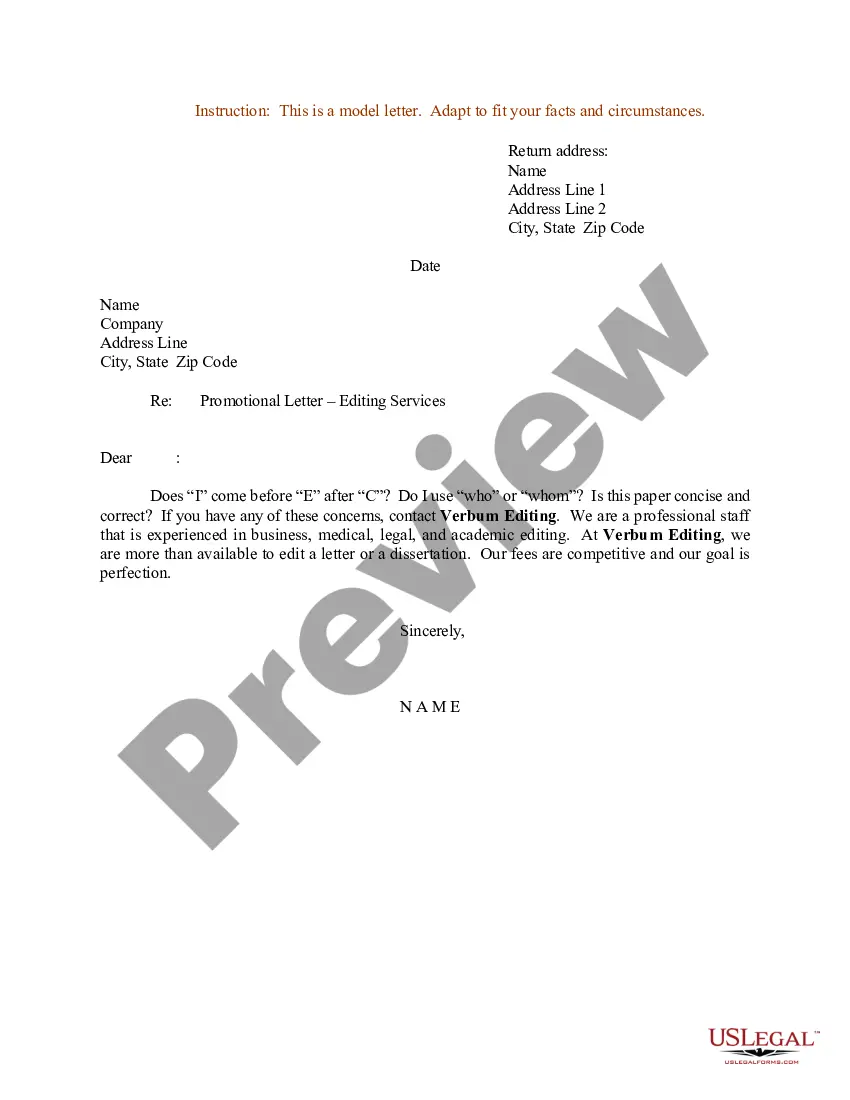

You call them and explain your dissatisfaction with the work that was done. Next, you let them know what you expect to be done to correct the situation and set a timeframe. Follow up with a letter summarizing the problem,conversation, agreement and expectations.