Foreign Independent Contractor Agreement Template For Nonprofit In Michigan

Description

Form popularity

FAQ

Exemption requirements - 501(c)(3) organizations In addition, it may not be an action organization, i.e., it may not attempt to influence legislation as a substantial part of its activities and it may not participate in any campaign activity for or against political candidates.

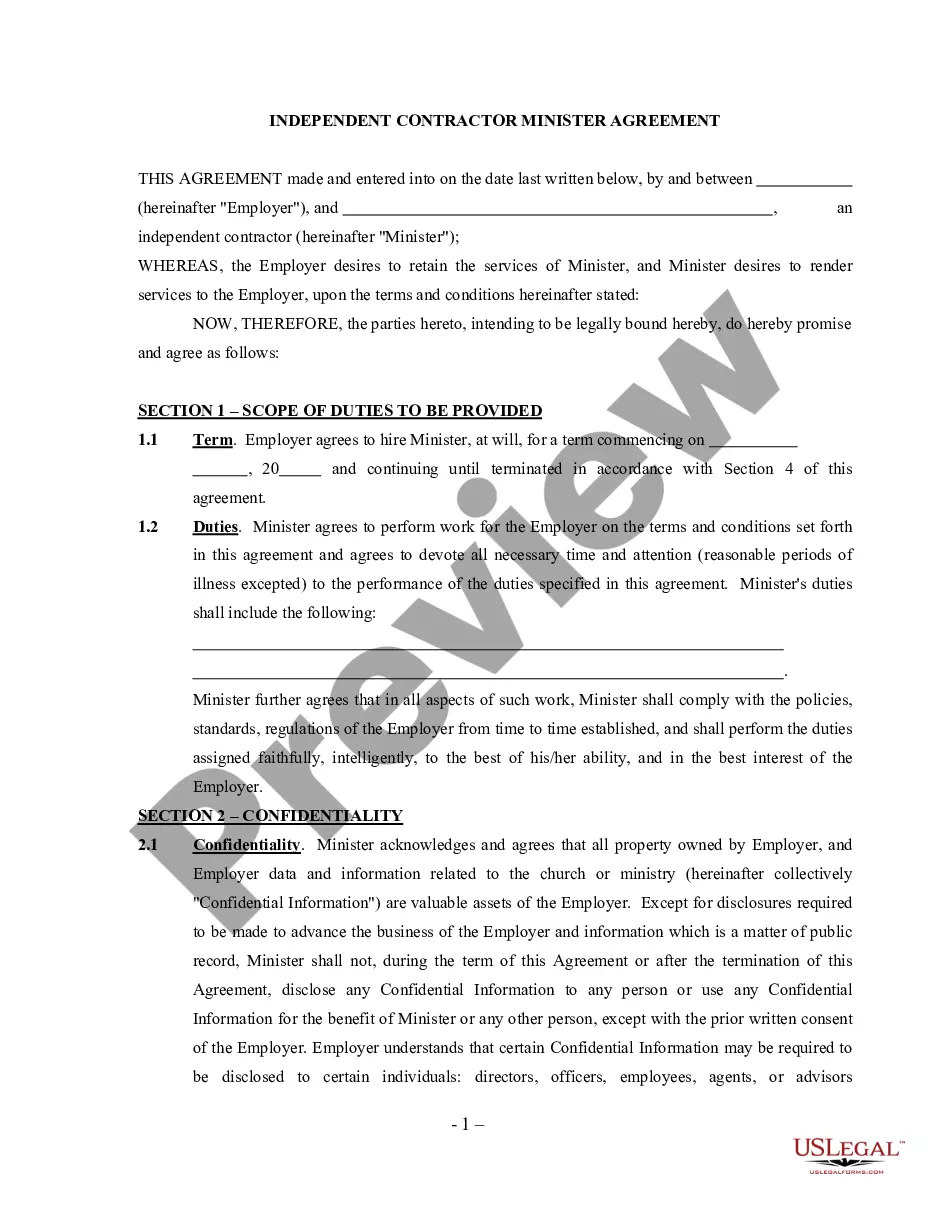

Nonprofits that rely on independent contractors for important elements of their operations should examine their obligations under AB 5 to ensure they are in compliance. An individual's employment status has many consequences, including taxes, workers' compensation insurance, and wage protections.

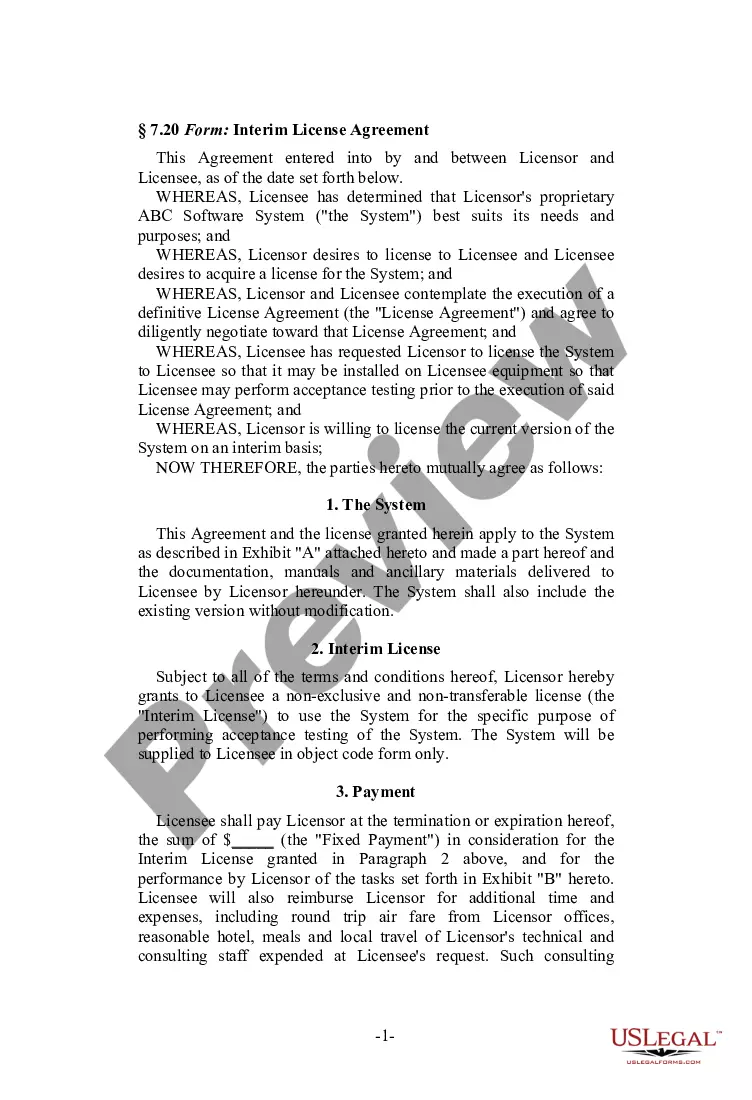

1099s are an important part of running any entity, and nonprofits are no exception. In fact, tax-exempt organizations have to issue 1099s under the same circumstances that require for-profit businesses to do so.

Form 1099 is used to report payments made to an independent contractor. Expat business owners may need to file Form 1099 when working with contractors abroad. Failing to file Form 1099 as required could result in penalties.

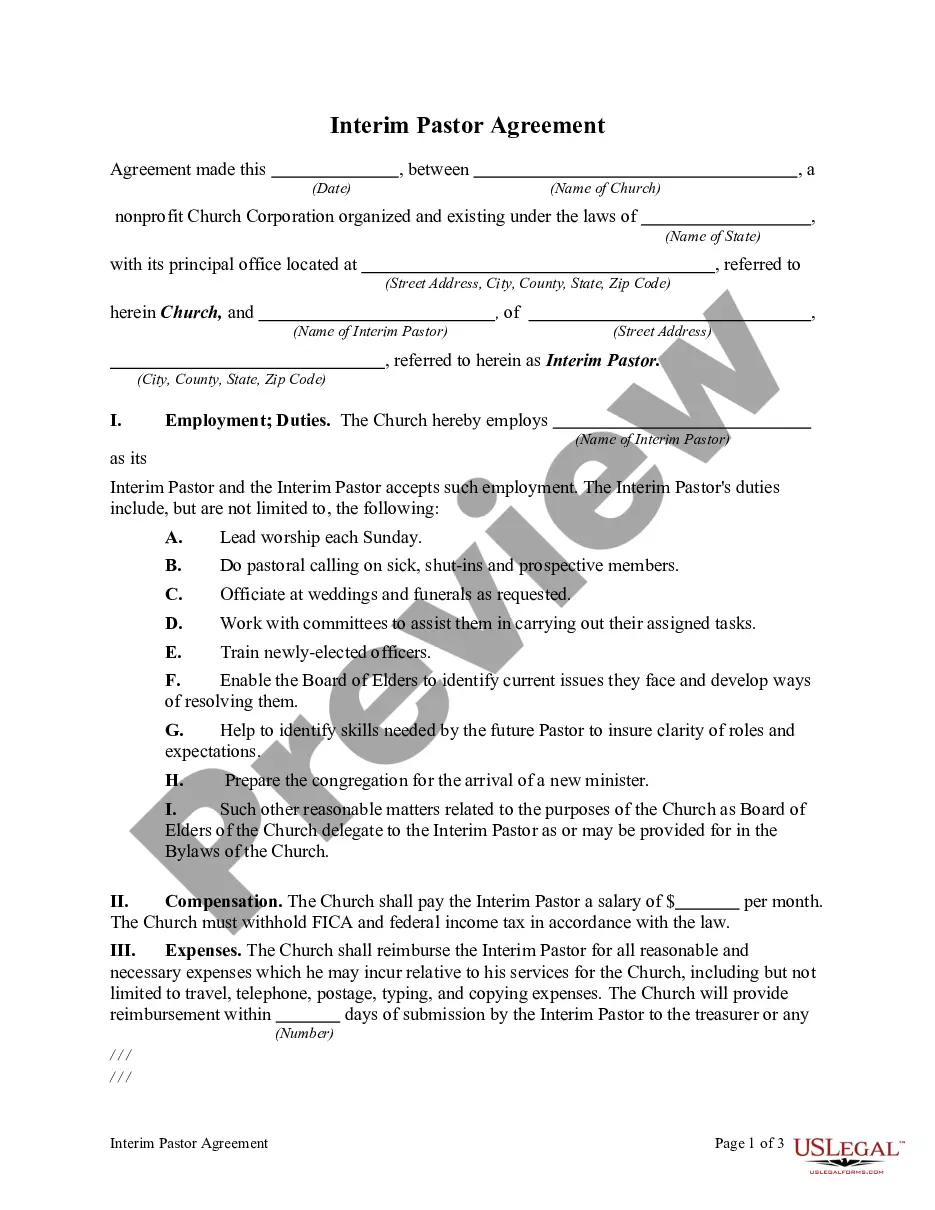

A Michigan independent contractor agreement establishes a working arrangement wherein an independent contractor is hired to perform a service for a client. The document should contain all the terms and conditions necessary to protect both parties and create a mutual understanding of the business relationship.

An independent contractor agreement is a contract that lays out the terms of the independent contractor's work. It covers the contractual obligations, scope, and deadlines of the work to be performed. It affirms that the client and contractor are not in an employer-employee relationship.

The general rule is that an individual is an independent contractor if the person for whom the services are performed has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

Paying Taxes as an Independent Contractor You'll need to file a tax return with the IRS if your net earnings from self-employment are $400 or more. Along with your Form 1040, you'll file a Schedule C to calculate your net income or loss for your business.

However, the IRS doesn't require a company to withhold taxes or report any income from an international contractor if the contractor is not a U.S. citizen and the services provided are outside the U.S. filing forms 1099 is required if: The contractor is located internationally but is a U.S. citizen.