Pays Foreign Independent Contractors Withholding Tax In Palm Beach

Description

Form popularity

FAQ

Therefore, payments made to NRFCs for cross-border services are subject to 25% (FWT) and 12% final withholding value-added tax (FVAT).

Corporations and individuals engaged in business are required to withhold the appropriate tax on income payments to non-residents, generally at the rate of 25% in the case of payments to non-resident foreign corporations and for non-resident aliens not engaged in trade or business (see the Income determination section ...

Payments to a foreign corporation in exchange for personal services performed in the US by either a US citizen or alien is considered to be US-sourced income and is usually subject to withholding. (Can be wages or self-employment income.)

The IRS requires a flat 30% withholding on ALL types of payments to foreign national individuals UNLESS: The individual has a U.S. tax identification number (SSN or ITIN) and qualifies for a tax reduction under the tax treaty between the U.S. and their country of tax residency.

Non-resident withholding tax is a mechanism employed by Canada to ensure that individuals or entities considered residents for tax purposes still contribute their fair share. It's like Canada's way of saying, “Hey, even if you're not a permanent resident here, you may still have tax obligations.”

Federal Withholding Tax and Tax Treaties In most cases, a foreign national is subject to federal withholding tax on U.S. source income at a standard flat rate of 30%. A reduced rate, including exemption, may apply if there is a tax treaty between the foreign national's country of residence and the United States.

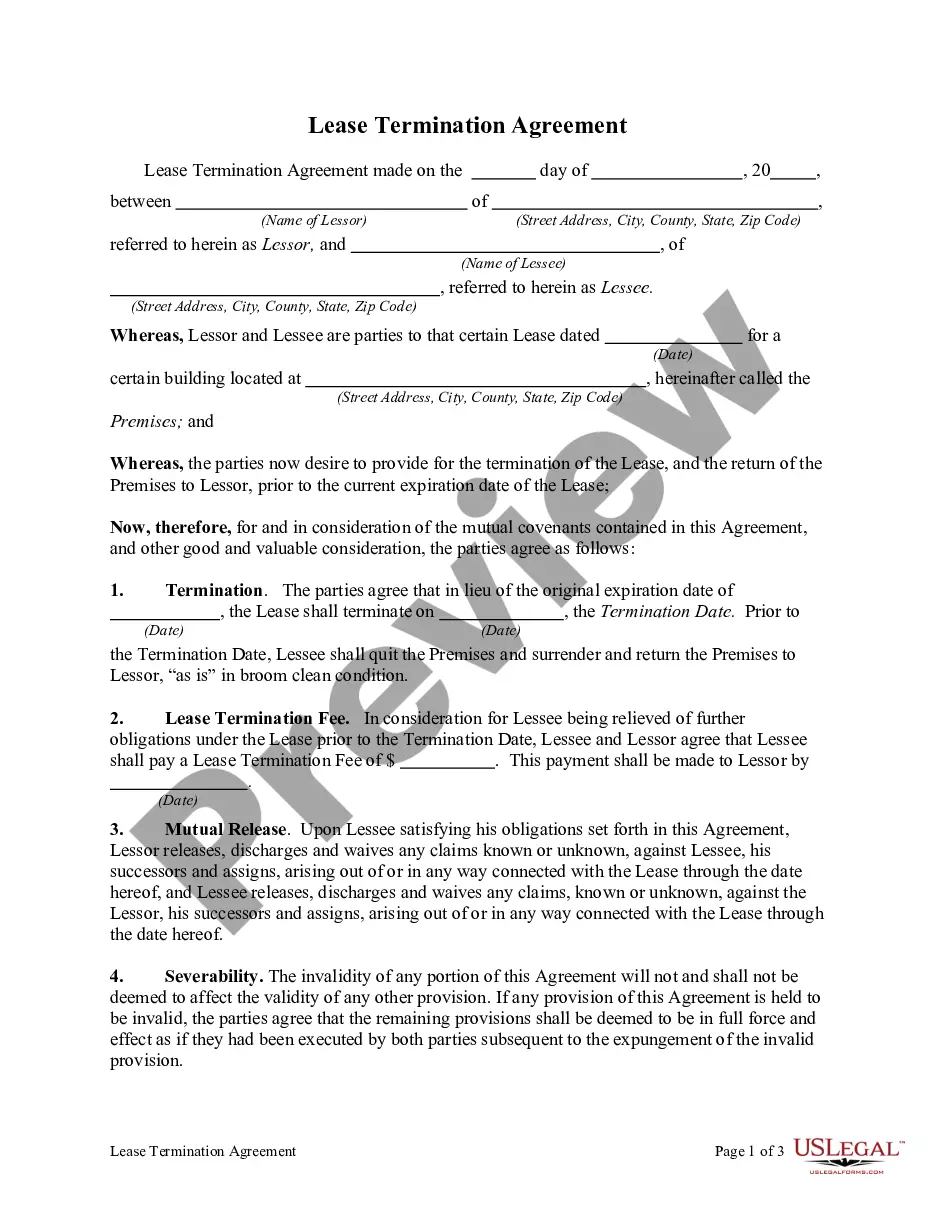

Today, it's possible to hire independent contractors from any part of the world, thanks to improvements in technology and communications. It's a great idea to consider Mexico if you're looking to expand your team. Its proximity and strong economic ties to the US are definite advantages.

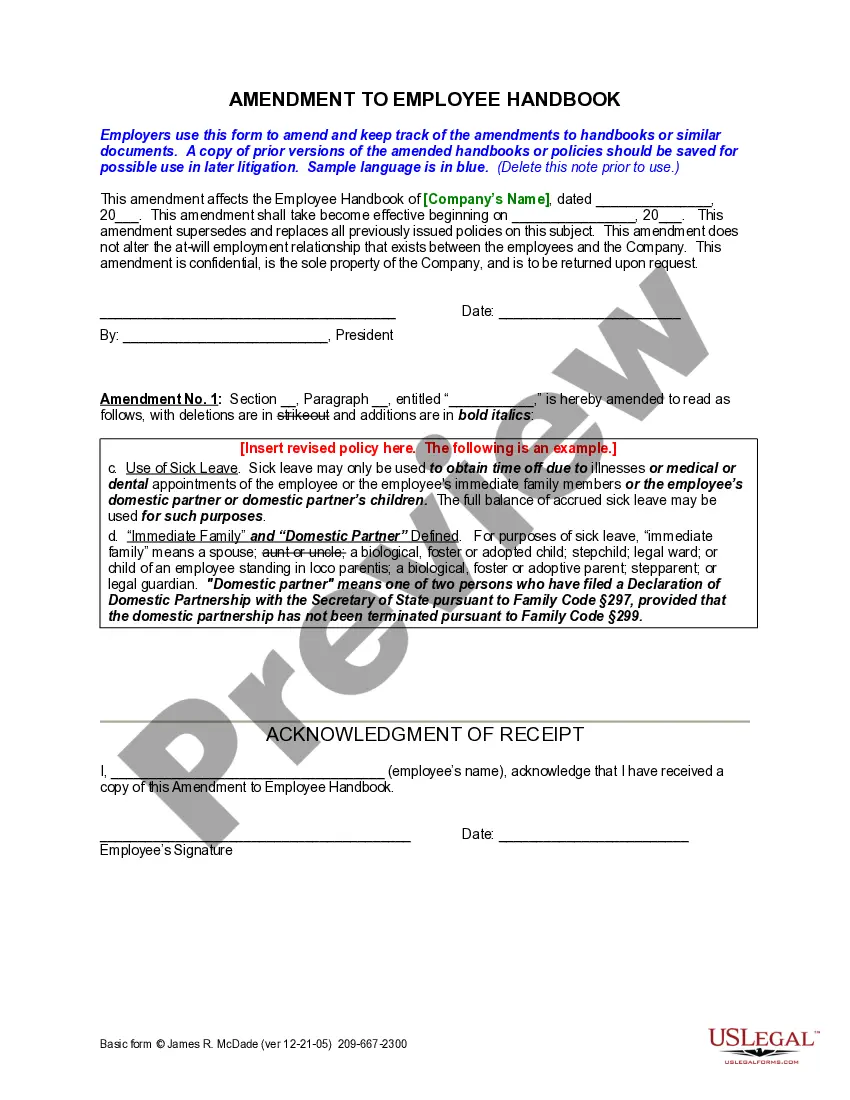

Employers and their HR teams need to know which kind of staff they are hiring to offer a legal employment contract to each kind of team member. An independent contractor in the state of Florida is defined as someone who: Reports payment of $600 or more per year on the IRS form 1099.

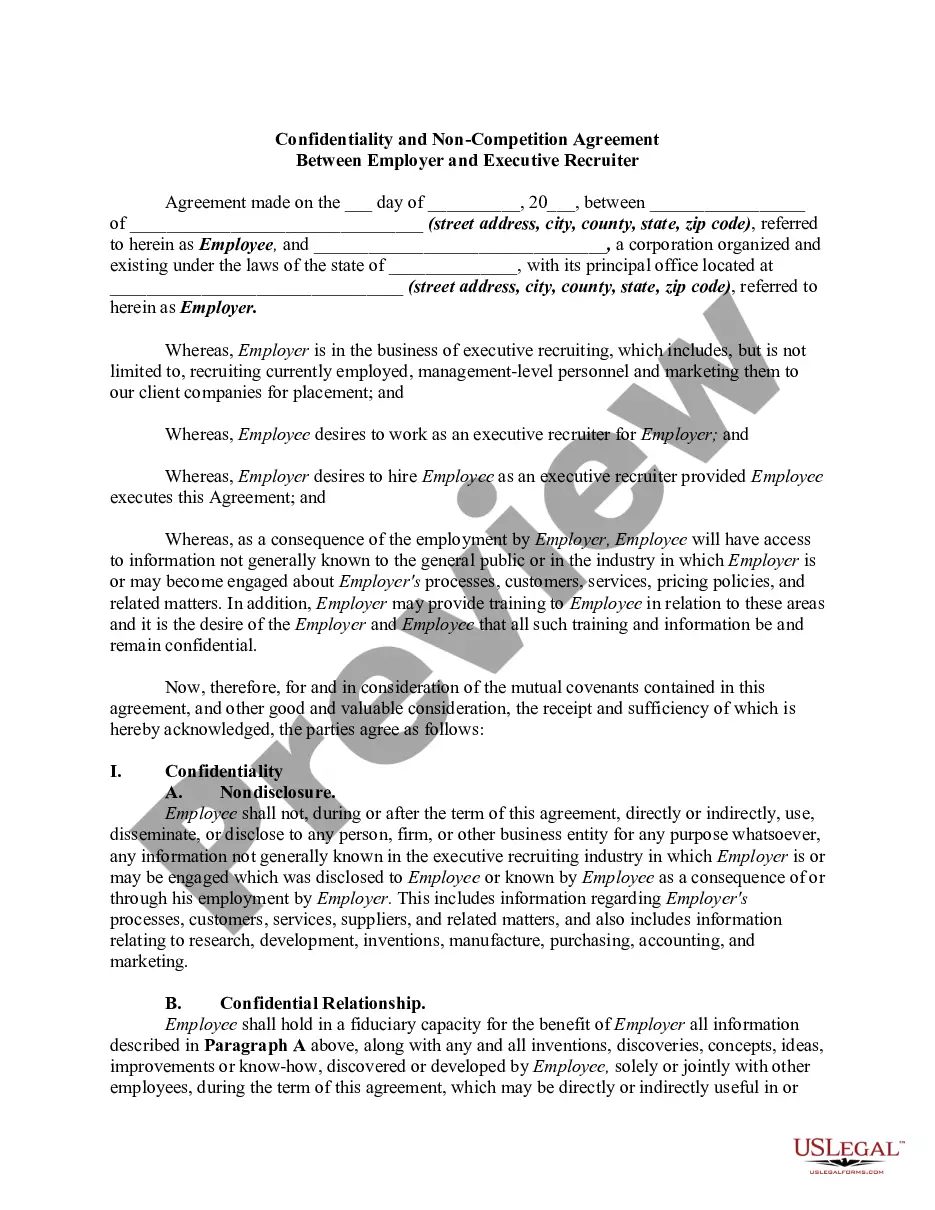

Under Florida law, in certain circumstances, an independent contractor agreement can contain an enforceable non-compete clause.