Foreign Contractor Withholding Tax Us In Sacramento

Description

Form popularity

FAQ

Use Form 587, Nonresident Withholding Allocation Worksheet, to determine if withholding is required and the amount of California source income subject to withholding. Withholding is not required if payees are residents or have a permanent place of business in California. Get FTB Pub.

The maximum foreign earned income exclusion amount is adjusted annually for inflation. For tax year 2023, the maximum foreign earned income exclusion is the lesser of the foreign income earned or $120,000 per qualifying person. For tax year 2024, the maximum exclusion is $126,500 per person.

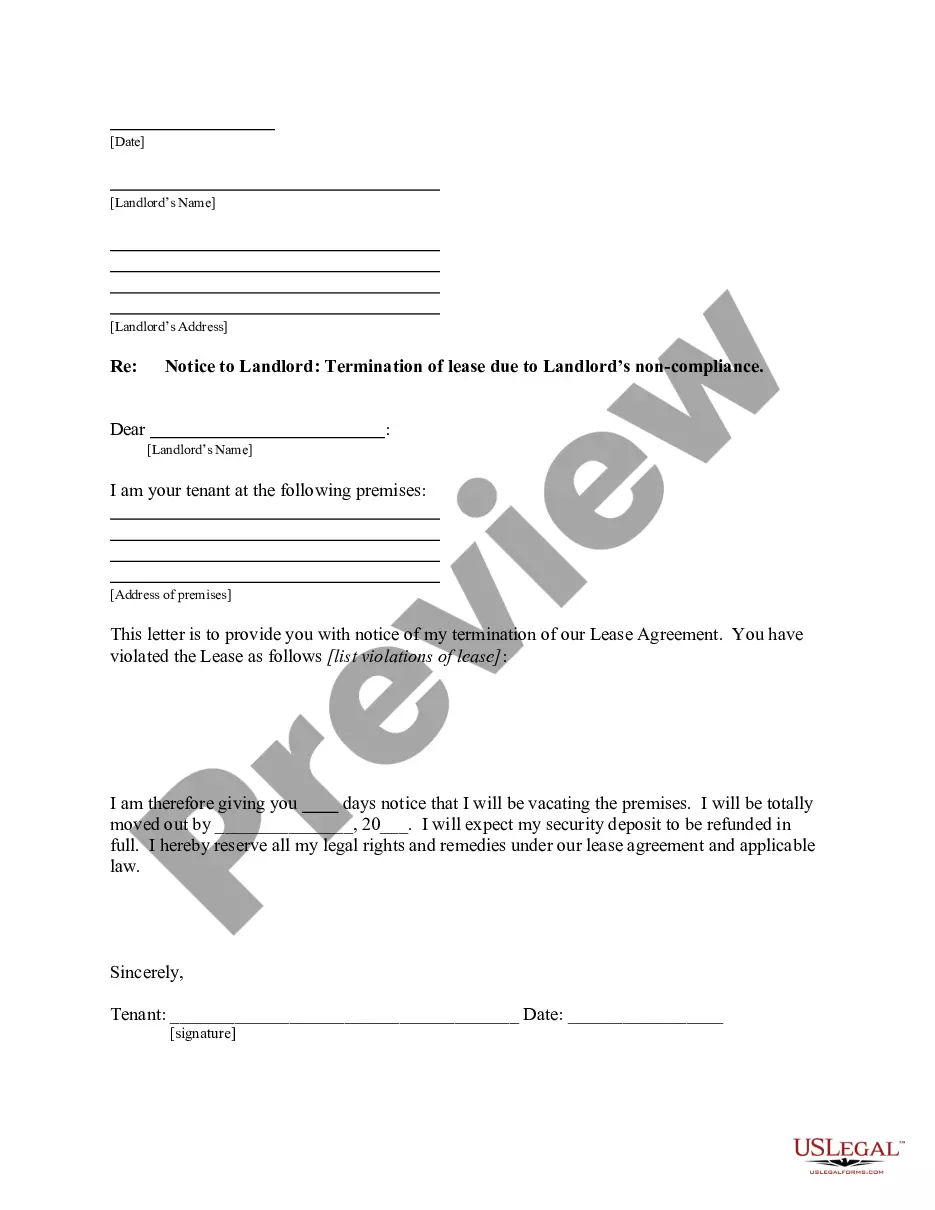

Without this form, you must withhold 30% of your payments to foreign contractors for taxes. IRS Form W-8BEN-E is similar but is for foreign businesses rather than individuals. For example, if you work with a foreign contractor who has formed a business entity, they may need to file W-8BEN-E instead of W-8BEN.

Federal Withholding Tax and Tax Treaties In most cases, a foreign national is subject to federal withholding tax on U.S. source income at a standard flat rate of 30%. A reduced rate, including exemption, may apply if there is a tax treaty between the foreign national's country of residence and the United States.

Under US domestic tax laws, a foreign person generally is subject to 30% US tax on the gross amount of certain US-source income.

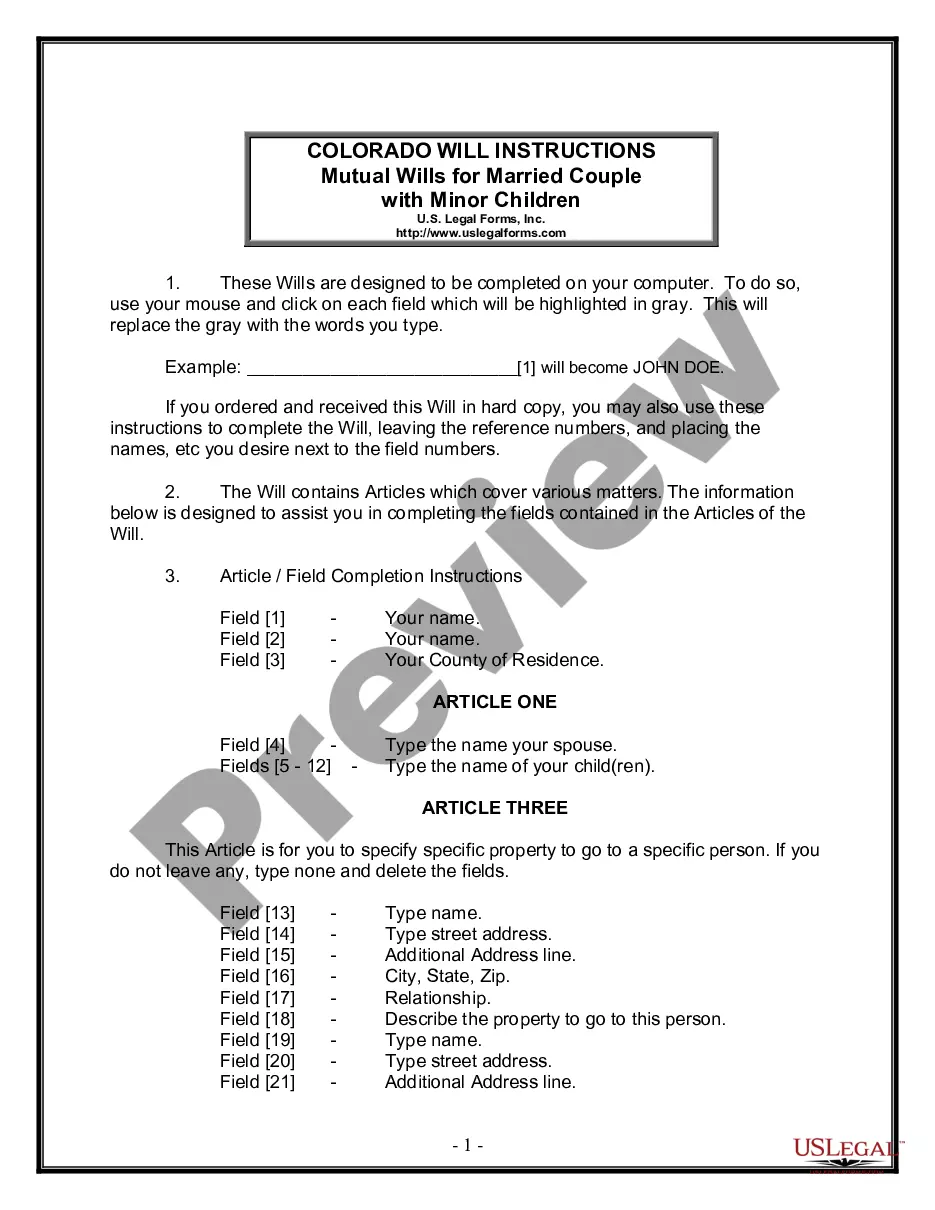

FTB Form 590, Withholding Exemption Certificate, listing CHCF as the withholding agent and certifying exemption from the withholding requirement. CA Form 587, Nonresident Income Allocation Worksheet, which allocates the expected income under CHCF's contract for work completed within and outside of California.

The form confirms that the contractor isn't a U.S. citizen and isn't working within the United States. If both of these things are true, the contractor isn't subject to American taxes. Without this form, you must withhold 30% of your payments to foreign contractors for taxes.

C. When the number of payees entered on Form 592, Schedule of Payees, exceeds 250, Form 592 must be filed with the FTB electronically using FTB's Secure Web Internet File Transfer (SWIFT) instead of paper. However, withholding agents must provide payees with copies of Forms 592-B.

Your payer must take 7% from your CA income that exceeds $1,500 in a calendar year. This is called nonresident withholding.