Independent Contractor Contract Example In Sacramento

Description

Form popularity

FAQ

Independent contractors generally report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if your net earnings from self-employment are $400 or more.

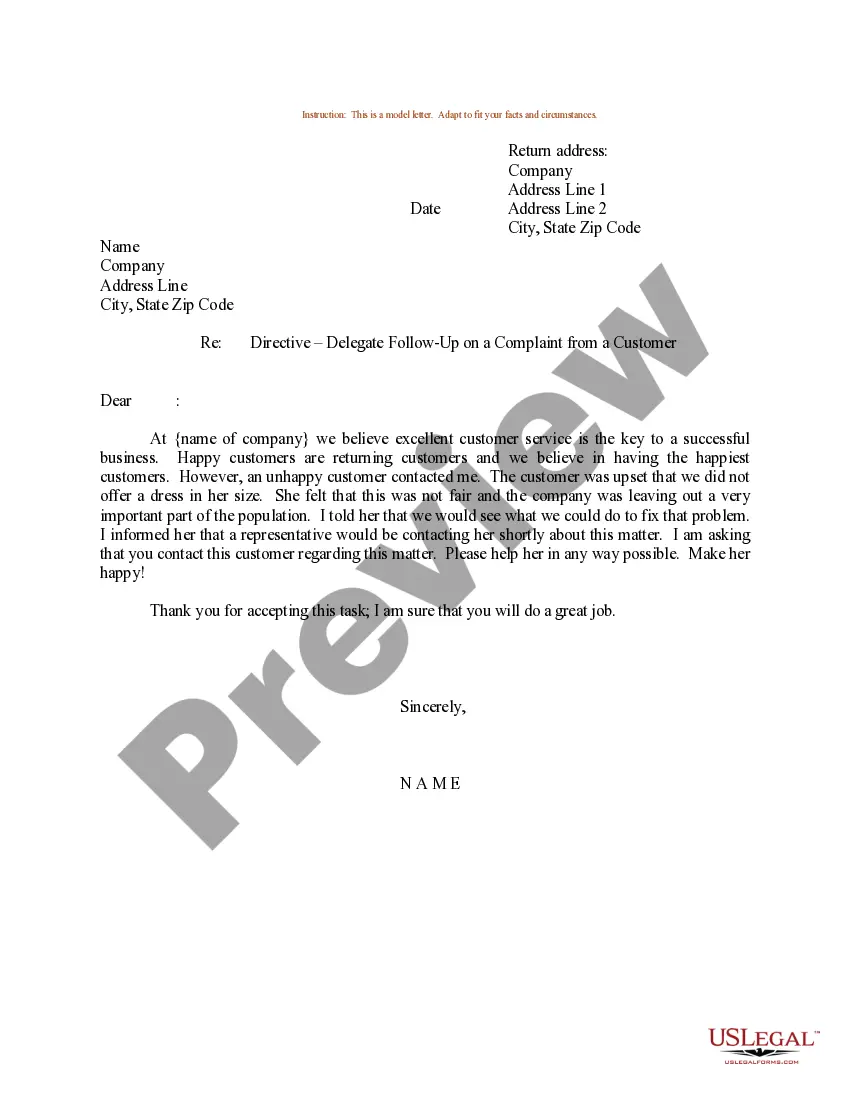

A contractor agreement should describe the scope of work, contract terms, contract duration, and the confidentiality agreement. It should also include a section for the two parties to sign and make the agreement official. If the contract doesn't meet these requirements, it may be inadmissible in a court of law.

A: Working as an independent contractor in California does not always require a business license. Whether or not you need permits or licenses can depend on your industry and where you operate the business.

Factors that show you are an independent contractor include working with multiple clients instead of just one, not receiving detailed instructions from hiring firms, paying your own business expenses such as office and equipment expenses, setting your own schedule, marketing your services to the public, having all ...

In general, an independent contractor is someone who is in business for himself or herself. Independent contractors usually perform work that requires a specialized skill or trade that is not part of a company's regular business.

A contract is an essential legal component of establishing a consultant-client relationship. You should always make sure a signed contract is in place before starting any work. A contract will define the relationship between you and your client, clearly stating that you are an independent contractor.

What to Include Party Details. The agreement will name the contractor and the client and provide the mailing addresses where invoices and correspondence can be sent. Term. The one-page contract must state the dates the contractual relationship begins and ends. Services. Compensation. Expenses. Signatures.

There are many situations in which a business will want to engage the services of an independent contractor instead of hiring an employee. In these situations, both parties must sign an independent contractor agreement.

The new rule, which becomes effective March 11, 2024, rescinds the 2021 independent contractor rule issued under former President Donald Trump and replaces it with a six-factor test that considers: 1) opportunity for profit or loss depending on managerial skill; 2) investments by the worker and the potential employer; ...

The new rule, which becomes effective March 11, 2024, rescinds the 2021 independent contractor rule issued under former President Donald Trump and replaces it with a six-factor test that considers: 1) opportunity for profit or loss depending on managerial skill; 2) investments by the worker and the potential employer; ...