International Contractor Agreement For Accountant And Bookkeeper In Texas

Description

Form popularity

FAQ

Both accountants and bookkeepers work to maintain accurate records of finances, and sometimes the terms are used interchangeably. Generally, bookkeepers focus on administrative tasks, such as completing payroll and recording incoming and outgoing finances.

What is a Bookkeeper? A Bookkeeper is responsible for recording and maintaining a business' financial transactions, such as purchases, expenses, sales revenue, invoices, and payments. They will record financial data into general ledgers, which are used to produce the balance sheet and income statement.

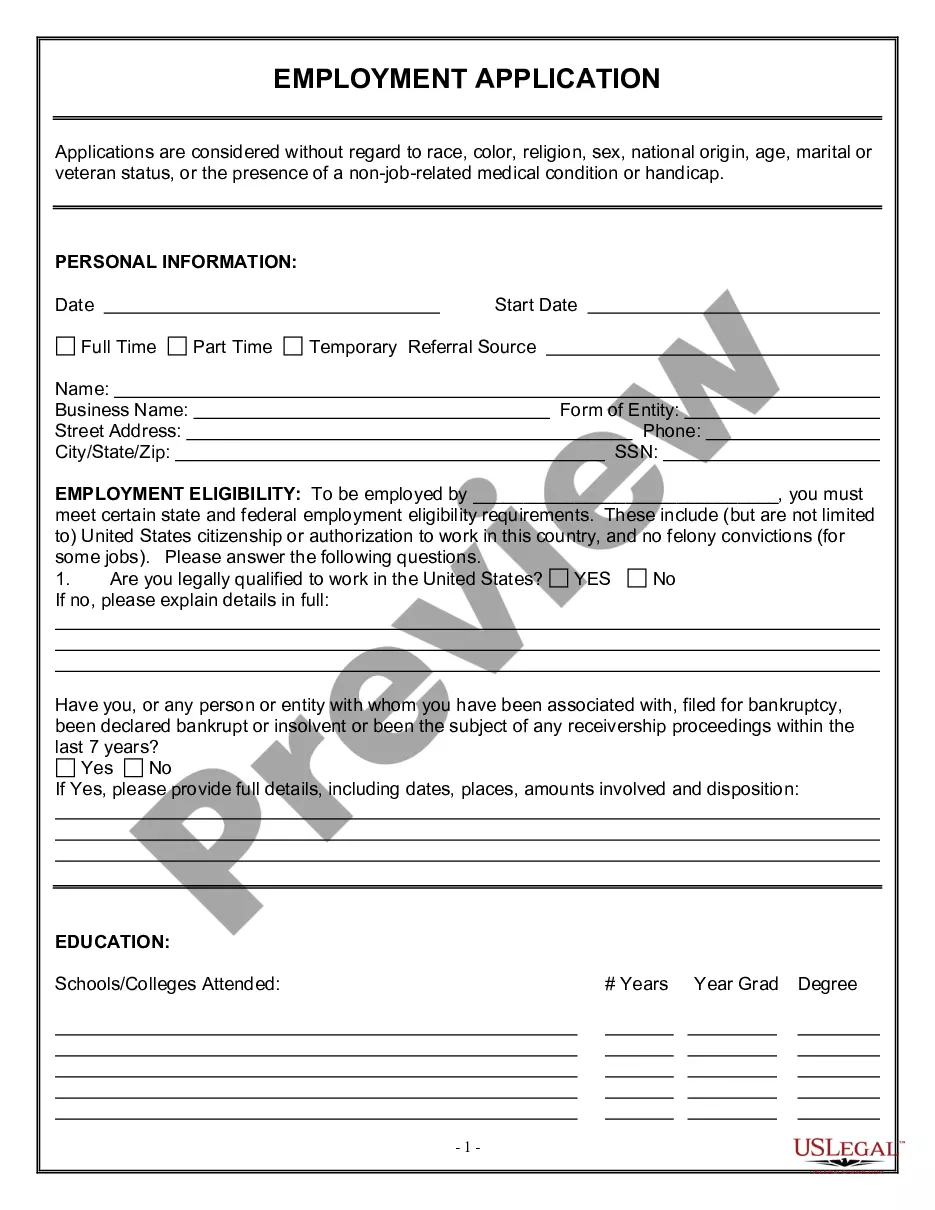

When creating your accounting and bookkeeping contract, be sure to include the following details: Identifying information for both parties. Effective date and contract term. Description of services to be performed. Fees. Representations. Confidentiality clause. Termination conditions. Legal terms.

Dual status of bookkeepers and accountants. Quite often, the bookkeeper and accountant render services under conditions that are a combination of employee and independent contractor. For example, an employee on one job and an independent contractor on another job.

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, subcontractors, public stenographers, or auctioneers who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

A bookkeeper comes to the organization once a week to do the bookkeeping. If he has other clients, controls when the work will be done, and gives the client the results (i.e., monthly financial statements), it is pretty clear he is an independent contractor.

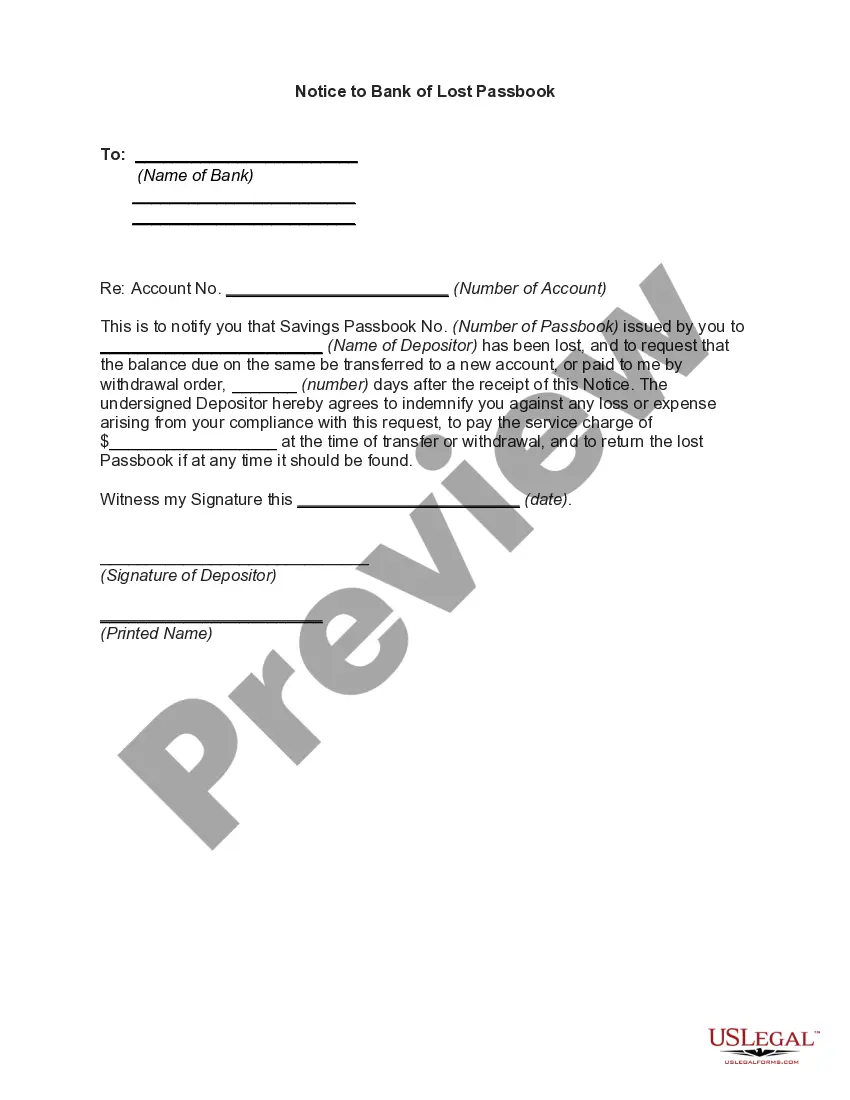

If you have your own bookkeeping business, you are most likely a contractor and will receive 1099s from your clients (this is also a service I offer to my clients where I can prepare their 1099s for any other contractors who work for them).

What type of businesses is QuickBooks Solopreneur for? QuickBooks Solopreneur is designed for one-person businesses, who may or may not use 1099 contractors. It includes easy to use organization, tax and growth focused tools to help drive financial stability.

However, the IRS doesn't require a company to withhold taxes or report any income from an international contractor if the contractor is not a U.S. citizen and the services provided are outside the U.S. filing forms 1099 is required if: The contractor is located internationally but is a U.S. citizen.

The freelance bookkeeper can work remotely or on-site, depending on the needs of the business. The freelance bookkeeper will typically invoice the business for its services every month. They will keep track of the business's income and expenses and prepare financial statements and reports as needed.