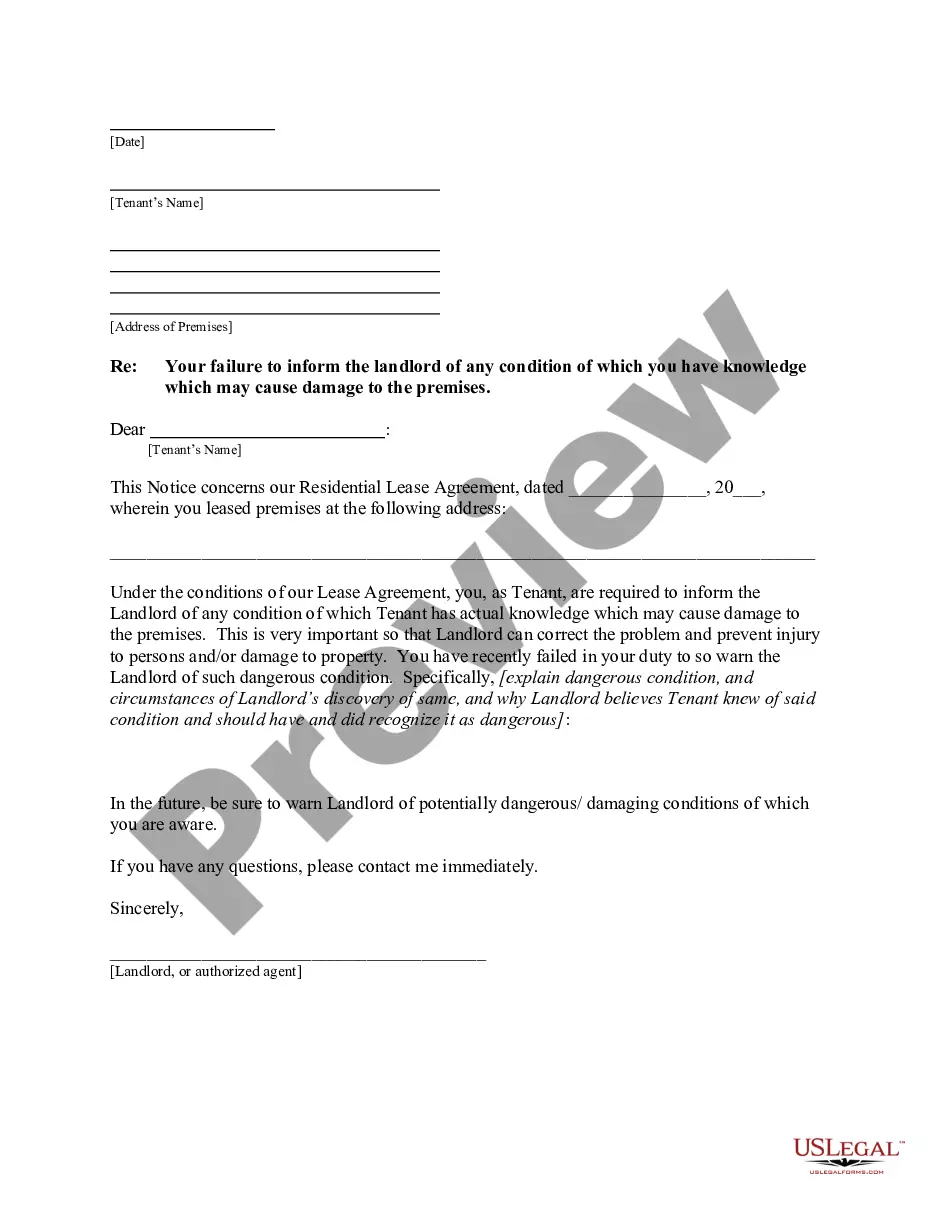

This form is a sample letter in Word format covering the subject matter of the title of the form.

Offer To Sell Land Letter Sample For Tax Purposes In Collin

Description

Form popularity

FAQ

Total exemptions may be granted for public properties or those owned by qualifying organizations such as churches, schools, or charitable organizations. Homestead, over sixty-five, and disabled veterans exemptions are examples of partial exemptions, which reduce the taxable value on qualifying property.

Structuring the Letter Introduction. Start with the purpose of your letter - your land is for sale and you're notifying nearby landowners. Description. Include a brief description with what you know about the land. Include an Image. They say a picture's worth a thousand words, which holds here. Contact Info.

The following should be provided in the protest: Taxpayer's name and address, and a daytime telephone number. A statement that taxpayer wants to appeal the IRS findings to the Appeals Office. A copy of the letter proposed tax adjustment. The tax periods or years involved.

The first step in contesting your property tax assessment is to file a grievance with your local assessor's office. This is usually done by submitting a form called the RP-524, Complaint on Real Property Assessment, which you can obtain from your local assessor's office or their website.

Protests to the ARB must be filed by mail, in person, drop-box (available 24/7) or, if eligible, an owner may file their protest through the appraisal district's Online Appeals eFile site. If your appraisal notice includes a secure PIN to eFile, we strongly encourage you to use the eFile site to file your protest.

Information for any follow-up inquiries Keep a copy of your appeal. And any supporting documents forMoreInformation for any follow-up inquiries Keep a copy of your appeal. And any supporting documents for your. Records.

How to Write a Property Tax Appeal Letter? Craft a Clear and Concise Introduction. Begin your appeal letter with a clear and concise introduction. Include a Detailed Property Description. Highlight Comparable Sales. Address Any Special Circumstances. Request Reassessment.

Six Steps to Appeal Your Property Tax Bill Step 1: Know the rules. Step 2: Check for the property tax breaks you deserve. Step 3: Go set the record straight. Step 4: Check the comparables. Step 5: Gather evidence and build your case. Step 6: Consider a professional appraiser.

To apply for the homestead exemption, download and print the Residential Homestead Exemption Application and mail the completed application to: Central Appraisal District of Collin County, 250 W. Eldorado Pkwy, McKinney, TX 75069.