This form is a sample letter in Word format covering the subject matter of the title of the form.

Offer To Sell Land Letter Sample For Tax Purposes In King

Description

Form popularity

FAQ

You can sell tax deeds that are vacant land, commercial property, multi-family, residential, etc… There is appetite for all sorts of tax deed properties since they typically do not demand full retail value on resells.

Determining if you owe back taxes may be as simple as filing or amending a previous year's tax return. Contact the IRS at 800-829-1040. You can also call the IRS to get more information on your outstanding tax bill.

Take a look at the links in the description below to learn more. If you have any questions or wantMoreTake a look at the links in the description below to learn more. If you have any questions or want to share your thoughts leave a comment we're here to help thanks for watching our video.

New York State tax warrants expire after 20 years. Importantly, the statute of limitations period starts to run on the first day a tax warrant could have been filed by the Tax Department, not when the warrant was actually filed.

How to Write a Property Tax Appeal Letter? Craft a Clear and Concise Introduction. Begin your appeal letter with a clear and concise introduction. Include a Detailed Property Description. Highlight Comparable Sales. Address Any Special Circumstances. Request Reassessment.

In NYS under Article 11 of the Real Property Tax Law Foreclosure may begin after two years of delinquency on the taxes. However counties and cities have different policies and can extend that period to three to four years from the date of the delinquency.

If your dream house has a tax lien on it, it doesn't automatically mean you should give up. When you work with an experienced tax lawyer, you can often find ways to lift the lien, obtain a mortgage, and close on the house.

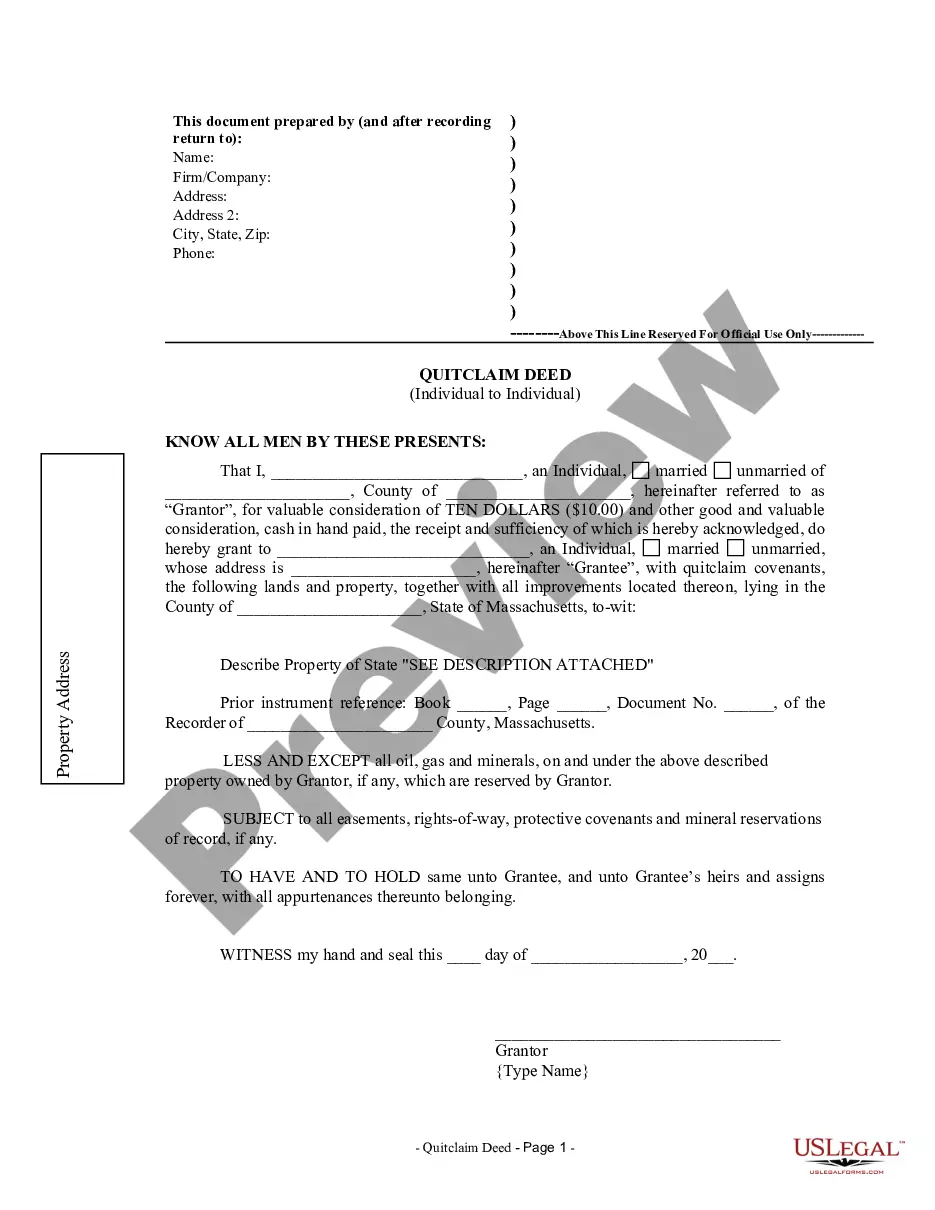

Structuring the Letter Introduction. Start with the purpose of your letter - your land is for sale and you're notifying nearby landowners. Description. Include a brief description with what you know about the land. Include an Image. They say a picture's worth a thousand words, which holds here. Contact Info.

Tips For Writing An Offer Letter For a House Confirm You Can Submit A Letter. Address The Seller(s) By Name And Introduce Yourself. Highlight What You Like Best About The House. Keep It Short. Avoid Talking About Planned Changes To The House. Don't Talk About Financials. End With A Thank You. Proofread Your Letter.