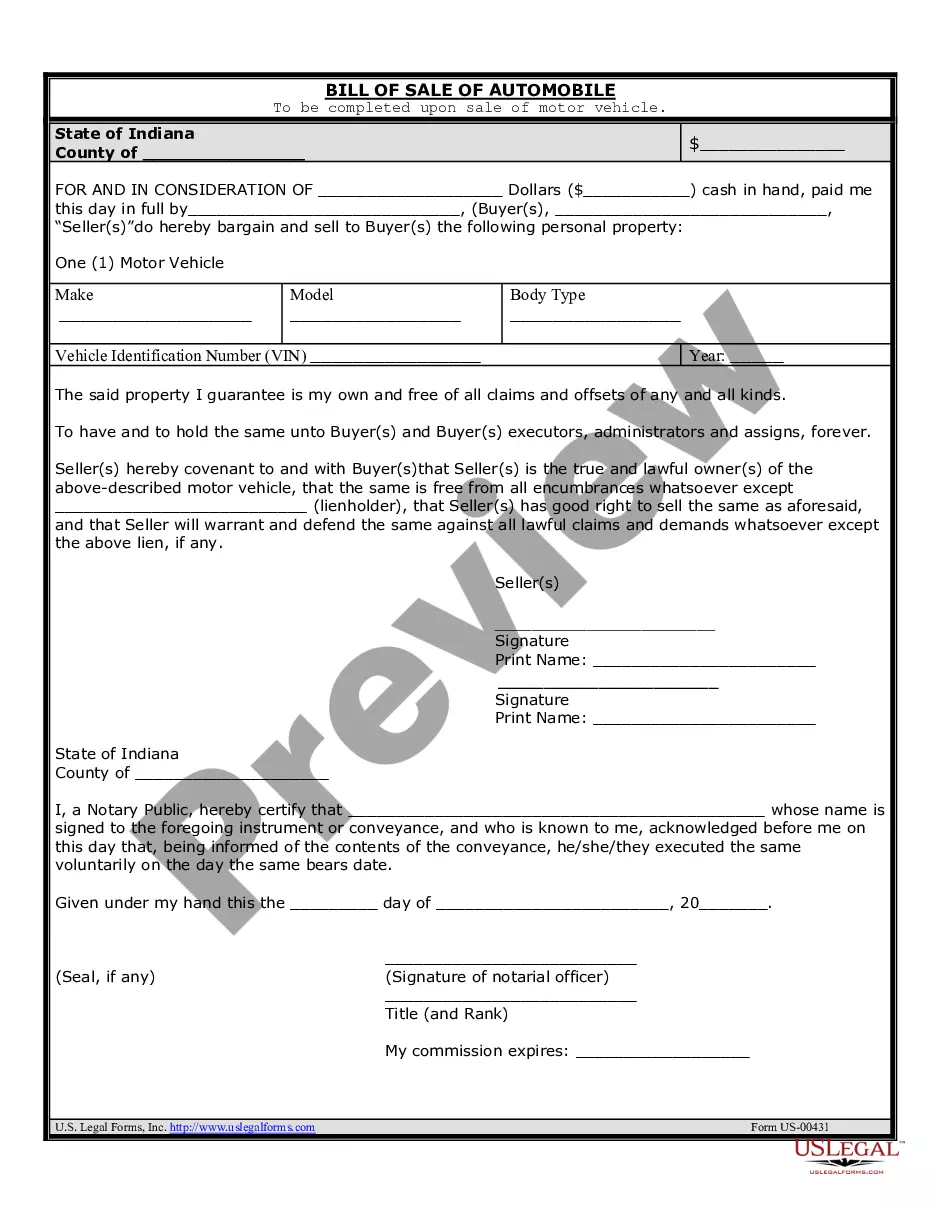

This form is a sample letter in Word format covering the subject matter of the title of the form.

Offer To Sell Land Letter Sample For Tax Purposes In Michigan

Description

Form popularity

FAQ

How to Write an LOI in Commercial Real Estate Structure it like a letter. Write the opening paragraph. State the parties involved. Draft a property description. Outline the terms of the offer. Include disclaimers. Conclude with a closing statement.

In Michigan, the transfer tax for real estate transactions is composed of both a state and a county component. The state transfer tax rate is $3.75 for every $500 of the property's value. The county transfer tax rate is $0.55 for every $500 of the property's value.

The 163 form is more commonly known as the Commercial Auto Driver Information Schedule. This application is a one page form used to collect pertinent details on additional drivers that do not fit on the 127.

In order to claim an exemption from sales or use tax, a purchaser must provide a valid claim of exemption to the vendor by completing one of the following: Michigan Sales and Use Tax Certificate of Exemption (Form 3372) Multistate Tax Commission's Uniform Sales and Use Tax Certificate.

There are several steps you must take when you sell or close a business. You must notify the Registration Section of the Michigan Department of Treasury by completing a Form 163 Notice of Change or Discontinuance. Mail Form 163 to: Michigan Department of Treasury. Registration Section.

Complete all sections that apply. Changes provided on this form may also be completed electronically at mto.treasury.michigan. If using this form, sign and mail to: Michigan Department of Treasury, Registration Section, PO Box 30778, Lansing MI 48909.

There is absolutely no reason you would get a call from the Michigan Treasury Department. This is a scam and you should NOT call them back. If you do, you'll be told you owe taxes and will be subject to an arrest. THat's not how the government works, however.