This form is a sample letter in Word format covering the subject matter of the title of the form.

Offer To Sell Land Letter Sample For Tax Purposes In Queens

Description

Form popularity

FAQ

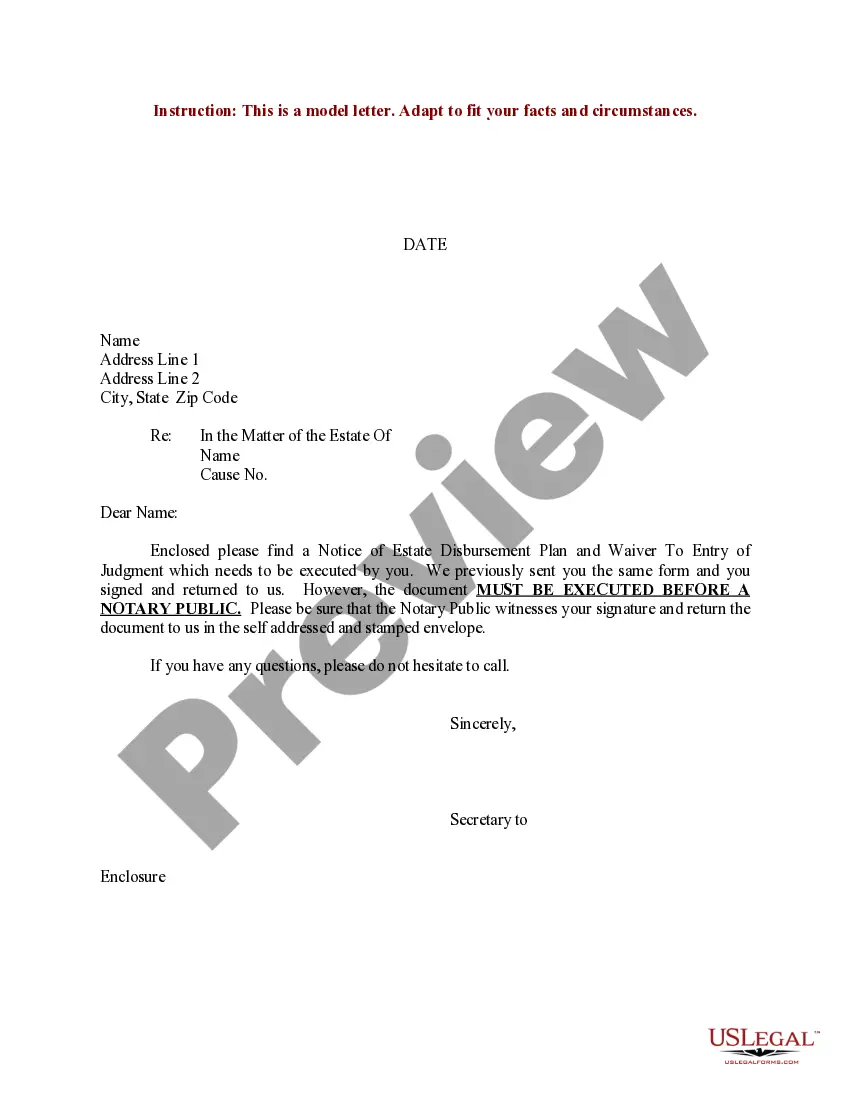

Income eligibility Property owners with income less than $250,000: If your adjusted gross income as reported on your federal tax return (Line 11 for Form 1040) is less than $250,000, you will likely qualify for the rebate.

Also known as the co-op and condo tax abatement, the cooperative and condominium property tax abatement allows owners of a co-op or condo in New York City to reduce their property taxes from 28.1% to 17.5% depending on the average assessed value of the property.

To be eligible for SCHE, you must be 65 or older, earn no more than $58,399 for the last calendar year, and the property must be your primary residence. The exemption must be renewed every two years. Learn more and get answers to frequently asked questions.

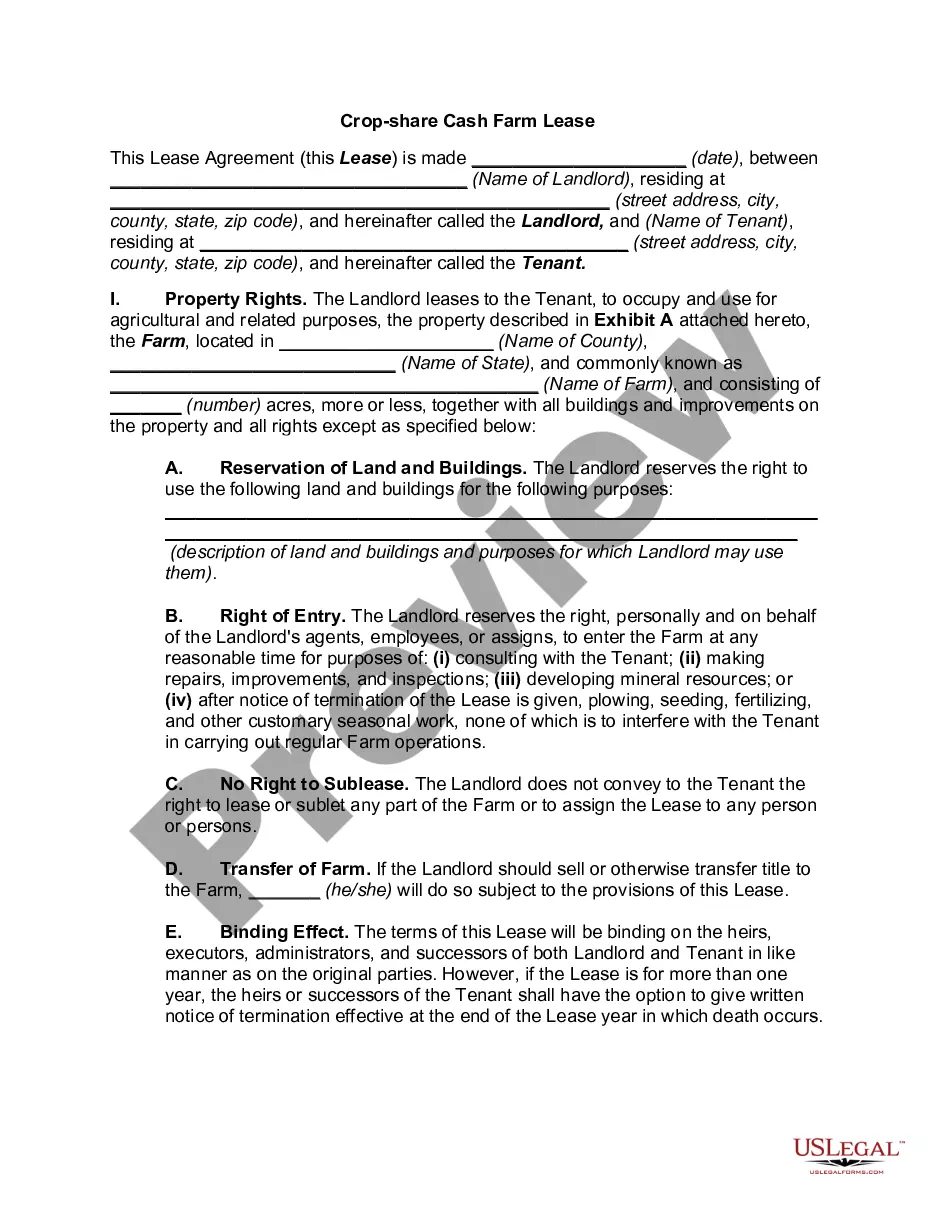

You can sell tax deeds that are vacant land, commercial property, multi-family, residential, etc… There is appetite for all sorts of tax deed properties since they typically do not demand full retail value on resells.

Abatements reduce your taxes after they've been calculated by applying dollar credits to the amount of taxes owed. Building management, boards of directors, or other official representatives like managing agents must apply for the co-op or condo abatement on behalf of the eligible building units.

Instead you own the debt The property owner must repay you the amount of the </S> lean. Plus.MoreInstead you own the debt The property owner must repay you the amount of the </S> lean. Plus. Interest And if the property owner fails to repay. You may eventually foreclose on the property.

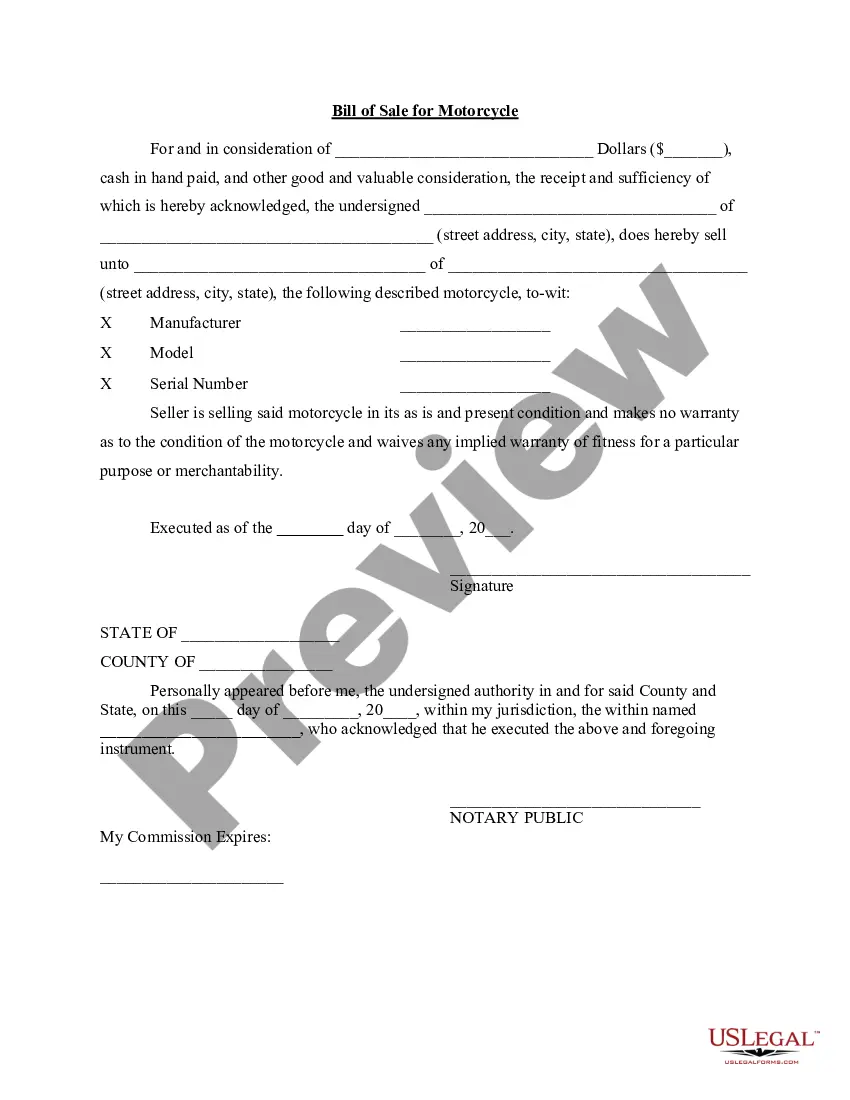

Tips For Writing An Offer Letter For a House Confirm You Can Submit A Letter. Address The Seller(s) By Name And Introduce Yourself. Highlight What You Like Best About The House. Keep It Short. Avoid Talking About Planned Changes To The House. Don't Talk About Financials. End With A Thank You. Proofread Your Letter.

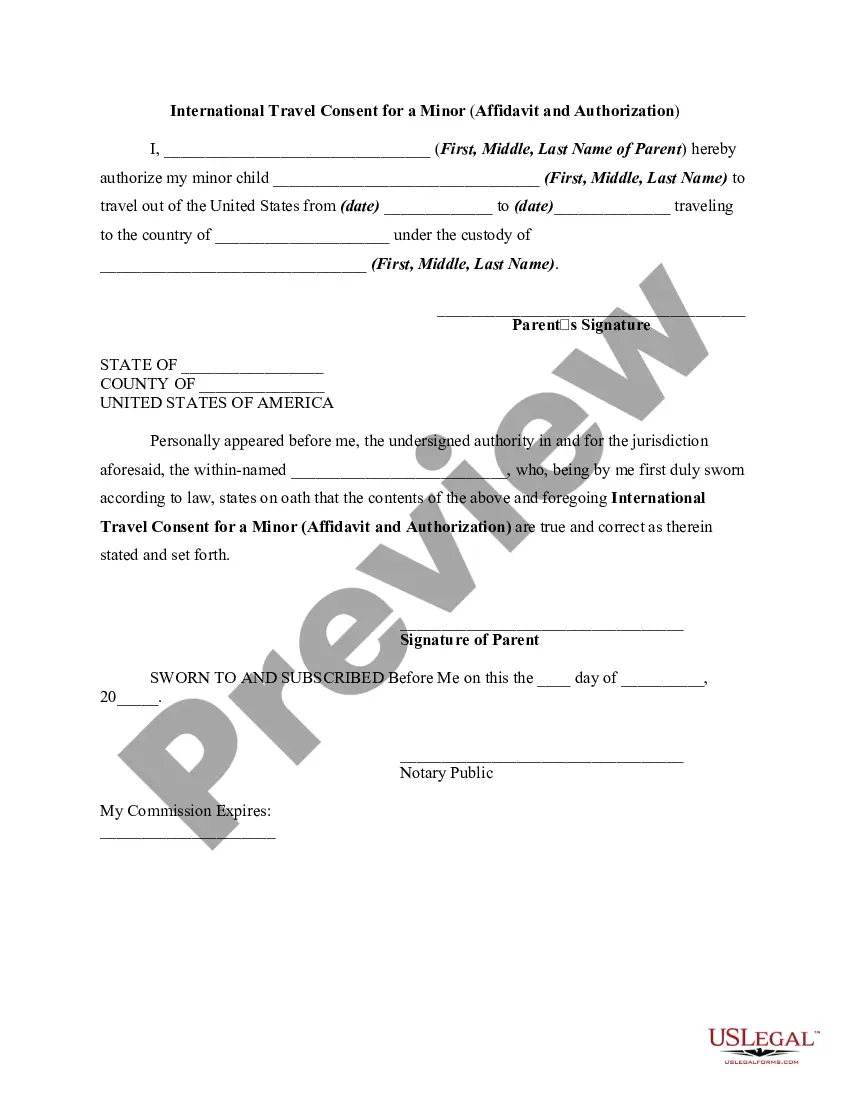

While a letter of intent is not a legal document and need not be notarized, it is wise to discuss what it should include with a well-informed estate planning attorney before you begin.

Components of a LOI Opening Paragraph: Your summary statement. Statement of Need: The "why" of the project. ( ... Project Activity: The "what" and "how" of the project. ( ... Outcomes (1–2 paragraphs; before or after the Project Activity) ... Credentials (1–2 paragraphs) ... Budget (1–2 paragraphs) ... Closing (1 paragraph) ... Signature.

How to Write an LOI in Commercial Real Estate Structure it like a letter. Write the opening paragraph. State the parties involved. Draft a property description. Outline the terms of the offer. Include disclaimers. Conclude with a closing statement.