Residential Property Lease With Guarantor In Los Angeles

Description

Form popularity

FAQ

By acting as your lease guarantor, Insurent® takes the stress away and get your your dream apartment. Our program eliminates the hassle of finding a suitable co-signer. Best of all, you can get approved in 30 minutes at the lowest guaranty prices, and the Guaranty is normally issued within 24 hours.

If a prospective renter doesn't meet those criteria, they should consider finding a guarantor who has a credit score of 700 or higher and an annual income of at least 80 times the monthly rent. For example, if the rent is $2,000 a month, the guarantor would need to make at least $160,000 a year.

Financial Requirements Income: Guarantors need to have a much higher income than what is needed for the tenant to qualify. This is usually about 80-100 times the monthly rent. Credit Score: As we mentioned above, a good credit history is crucial for guarantors. Landlords often look for a credit score of 700 or higher.

Financial Requirements Income: Guarantors need to have a much higher income than what is needed for the tenant to qualify. This is usually about 80-100 times the monthly rent. Credit Score: As we mentioned above, a good credit history is crucial for guarantors. Landlords often look for a credit score of 700 or higher.

You can search for properties that already work with us at by typing a city or zip code into the "Your Next Building Address" field. Buildings that appear in the drop-down accept TheGuarantors.

In this situation, as a guarantor, you are likely to be responsible for whatever any of the joint tenants owe the landlord, not just what the tenant you are helping may owe. You may also be responsible for any damage caused by other tenants, not just the one you're wanting to help.

A guarantor is typically someone with a strong financial background and excellent credit history who is willing to take on the responsibility of your lease. Some of the common choices for a guarantor include parents, family members, close friends, or even employers.

Typically, a Guarantor Agreement is appended to the end of a lease agreement as an addendum. If, for whatever reason, you need to add a guarantor to a lease that has already been signed, be sure to have all tenants sign the agreement as well as the guarantor.

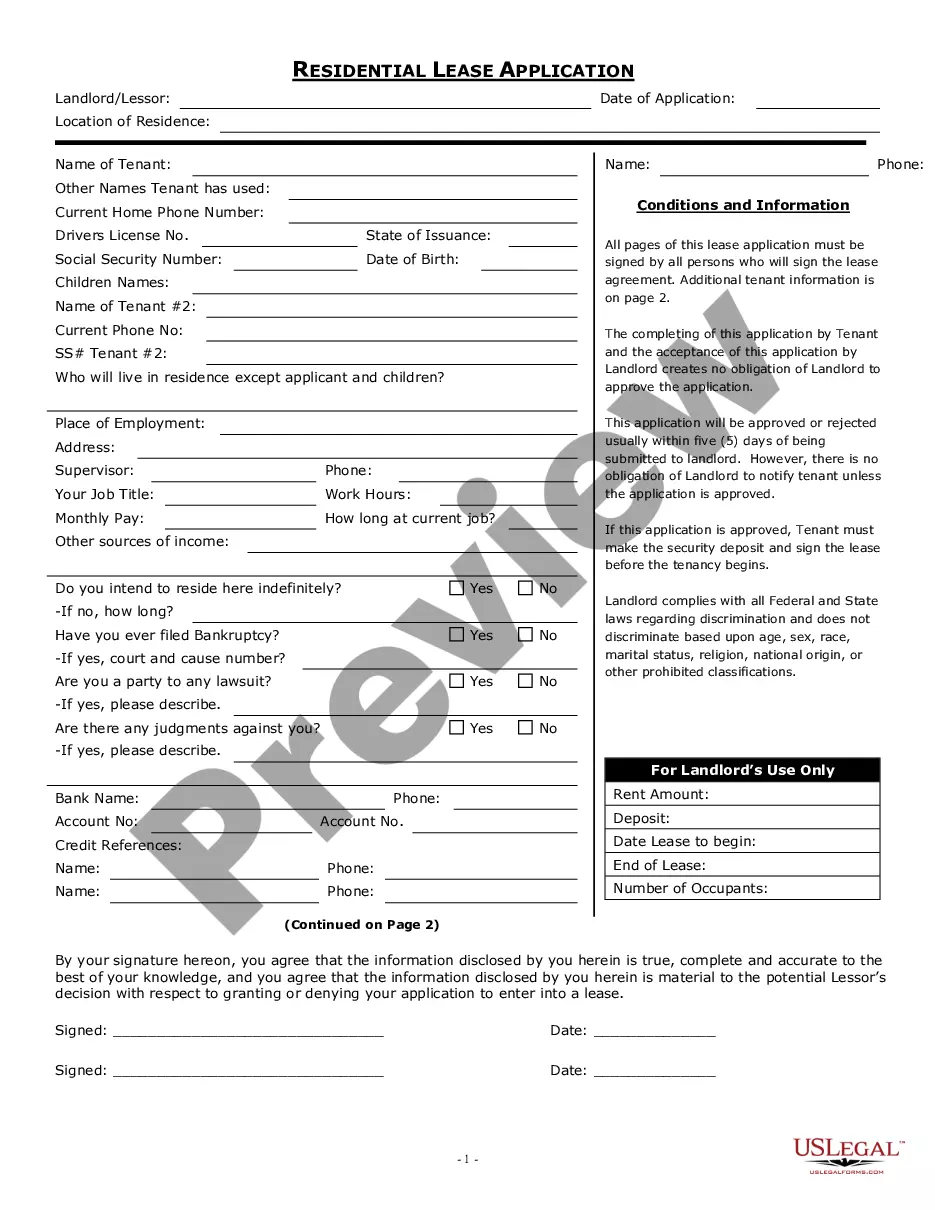

A guarantor's form should include a space to fill in the home address, work address, phone number, and email address. The contact details are what will be used to contact the guarantor in the future if the principal fails to meet agreement terms. This is a very important feature of the guarantor's form.