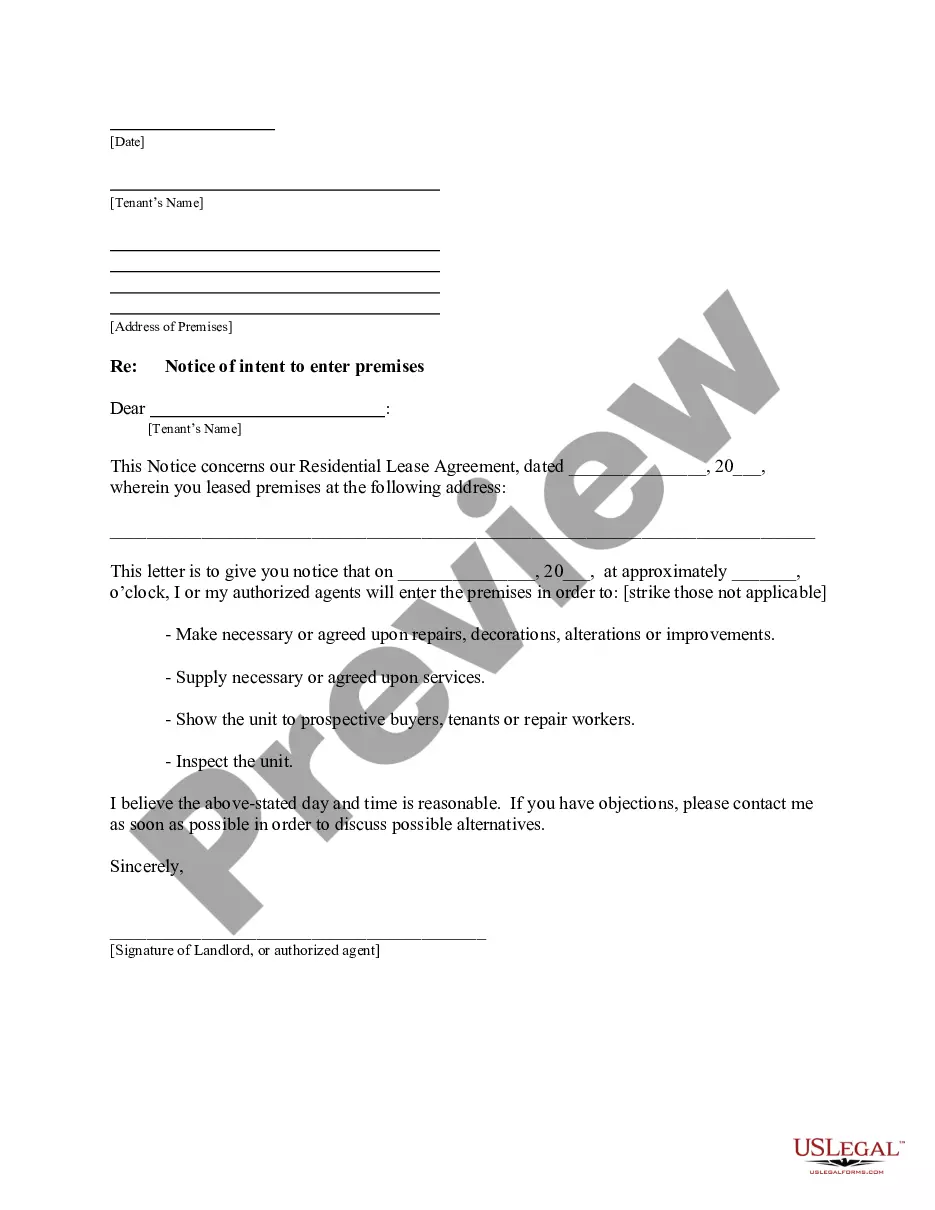

This form is a sample letter in Word format covering the subject matter of the title of the form.

Confirmation Of Settlement Letter For Credit Card In Bronx

Description

Form popularity

FAQ

When you write the hardship letter, don't include anything that would hurt your situation. Here are some examples of things you shouldn't say in the letter: Don't say that your situation is your lender's fault or that their employees are jerks. Don't state that things will likely turn around for you.

Write a Hardship Letter: This letter should explain your circumstances and why you believe a hardship dismissal is necessary. It should include details such as job loss, illness, or other factors contributing to your financial situation. Be honest and clear in your explanation.

Treat the following as a set of general guidelines: Gather complete information before you start writing. Describe your injuries and medical treatment. List your medical expenses, lost wages, and non-economic damages. Make a settlement demand. Include a deadline for legal action if you want to, but don't bluff.

The Nuts and Bolts of a Demand Letter Gather complete information before you start writing. Describe your injuries and medical treatment. List your medical expenses, lost wages, and non-economic damages. Make a settlement demand. Include a deadline for legal action if you want to, but don't bluff.

What things should be included in the Full and Final Settlement Letter? Settlement Amount: Clearly state the finalized amount to be settled. Settlement Cheque: Provide details regarding the issuance of the settlement cheque. Resignation/Termination Date: Specify the date on which the employee resigned or was terminated.

A fair settlement offer typically falls between 30% and 50% of the total amount owed. However, it's imperative to note that this can vary based on several factors, including how delinquent the account is.

Your debt settlement proposal letter must be formal and clearly state your intentions and what you expect from your creditors. You should also include all the key information your creditor will need to locate your account on their system, which includes: Your full name used on the account. Your full address.