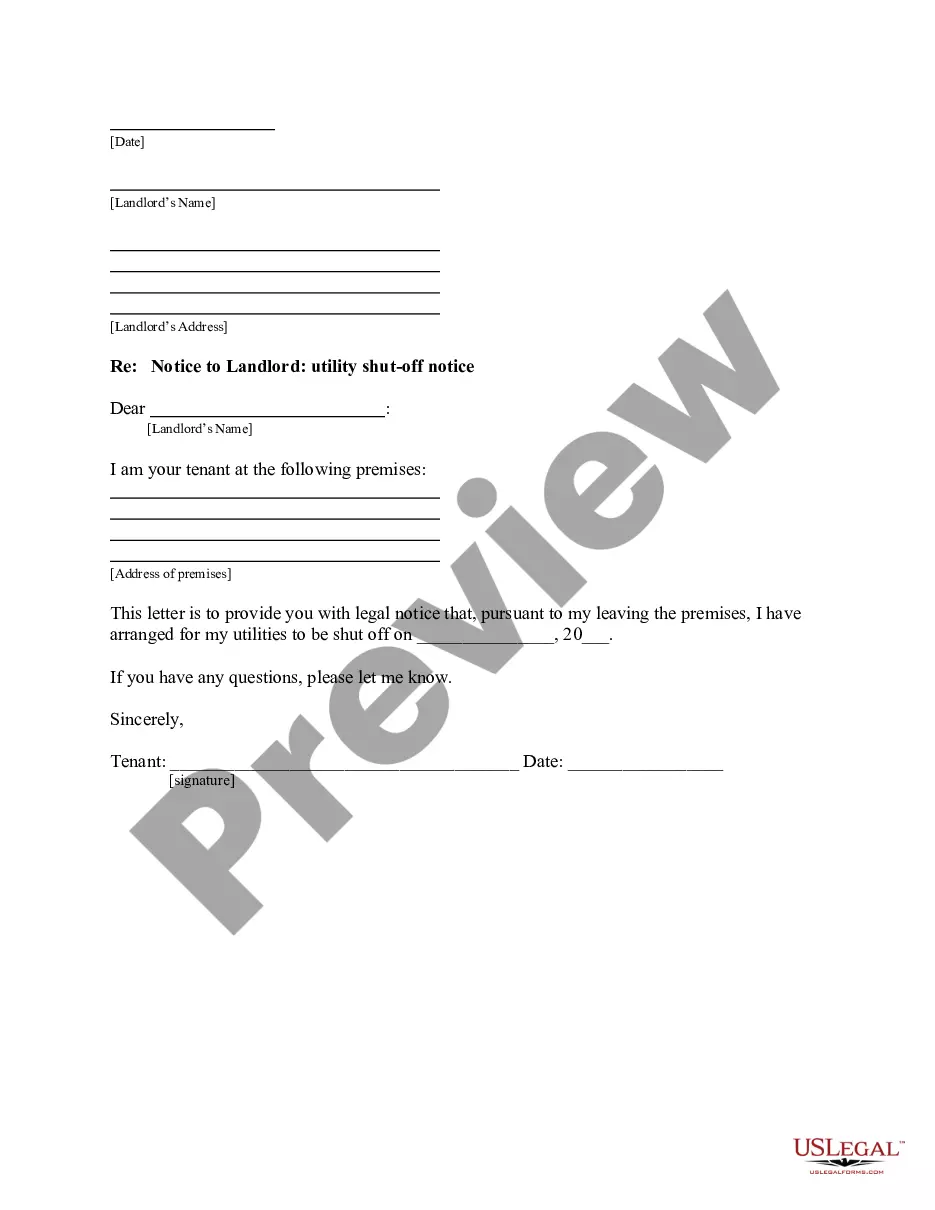

This form is a sample letter in Word format covering the subject matter of the title of the form.

Confirmation Of Settlement Letter Without Insurance In Dallas

Description

Form popularity

FAQ

If your health insurance company pays for your treatment following an accident, they may seek reimbursement from any settlement or judgment you receive.

Tracking Your Settlement Check One of the best ways to track your settlement check is by reaching out to your personal injury attorney for help. Your attorney will be the middleman between the defendant and your settlement funds.

Minor Accidents with Minimal Injuries: For accidents resulting in minor injuries such as whiplash, bruises, or small cuts, settlements typically range from $10,000 to $25,000. These cases often involve short-term medical treatment and minimal lost wages.

No uniform timeframe exists between sending the demand letter and arriving at a settlement. In addition to the insurance company's review, there will be negotiations between the insurance company and your attorney, and those can take a long time. You can count on the process taking more than two months.

Your letter should clearly: State that the offer you received is unacceptable. Refute any statements in the adjustor's letter that are inaccurate and damaging to your claim. Re-state an acceptable figure. Explain why your counteroffer is appropriate, including the reasons behind your general damage demands.

Treat the following as a set of general guidelines: Gather complete information before you start writing. Describe your injuries and medical treatment. List your medical expenses, lost wages, and non-economic damages. Make a settlement demand. Include a deadline for legal action if you want to, but don't bluff.

7 Tips for Writing a Demand Letter to the Insurance Company Detail Your Version of Events. Gather & Organize Your Expenses. Calculate Anticipated Expenses. Detail the Negative Impact the Accident Has Had on Your Life. Discuss Your Road to Recovery. Include a Fair and Reasonable Demand Amount.

State the settlement offer you are willing to accept and the reasons why. You can repeat the position you stated in the first demand letter. Your attorney can advise you on whether you should stick with the amount stated in your first demand letter or if you should present a counteroffer.

To properly reject an insurance settlement offer, you must communicate the rejection in writing through a formal demand letter. This letter should clearly state the reasons for rejecting the offer, such as it not providing maximum compensation for the damages incurred.

Write a Formal Dispute Letter: Draft a letter to your insurance company disputing the settlement offer. Clearly state why you believe the offer is insufficient, referring to specific evidence and policy terms. Attach copies of all relevant documents. Keep the tone professional and factual.