This form is a sample letter in Word format covering the subject matter of the title of the form.

Settlement Confirmation Letter Without Insurance

Description

How to fill out Settlement Confirmation Letter Without Insurance?

Precisely composed formal paperwork is one of the essential safeguards for preventing complications and legal disputes, but obtaining it without the assistance of an attorney may require time.

Whether you need to swiftly locate a current Settlement Confirmation Letter Without Insurance or any other documents for work, family, or business purposes, US Legal Forms is always available to assist.

The procedure is even easier for current users of the US Legal Forms library. If your subscription is active, you just need to Log In to your account and click the Download button next to the chosen file. Additionally, you can retrieve the Settlement Confirmation Letter Without Insurance at any time since all documents acquired on the platform remain accessible within the My documents section of your profile. Save time and resources on preparing official documents. Experience US Legal Forms today!

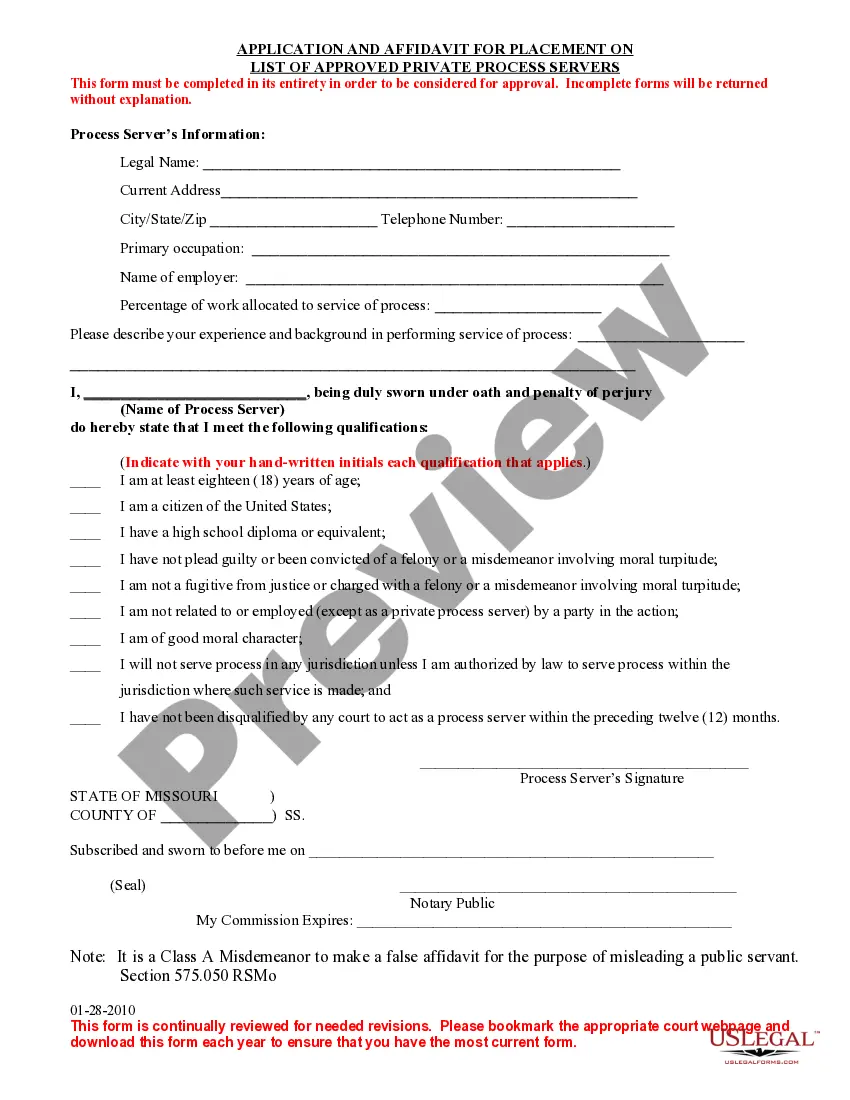

- Ensure that the form aligns with your circumstances and area by reviewing the description and preview.

- Search for another example (if necessary) using the Search bar in the page header.

- Click Buy Now after you identify the suitable template.

- Choose the pricing option, sign in to your account or create a new one.

- Select your preferred payment method to acquire the subscription plan (via credit card or PayPal).

- Choose PDF or DOCX format for your Settlement Confirmation Letter Without Insurance.

- Click Download, then print the template to complete it or upload it to an online editor.

Form popularity

FAQ

Yes, you can file your own personal injury claim if you feel confident in managing the process. Start by gathering all necessary documentation and evidence to support your case. As you navigate this path, you might want to prepare a settlement confirmation letter without insurance to effectively communicate your expectations for an outcome.

You can send a settlement letter via certified mail for tracking purposes or by email if that is preferred by the recipient. Ensure that you keep a copy of the letter for your records, along with any proof of delivery. Follow up to confirm they received it and anticipate a response that includes a settlement confirmation letter without insurance.

To write a settlement letter, begin with a clear introduction stating the purpose of your letter. Provide a detailed account of the situation, outlining any damages or losses incurred. Be sure to specify the amount you are offering or expecting as a settlement, along with a request for a formal settlement confirmation letter without insurance.

An example of a claim settlement letter should start with your information, followed by the insurance company’s details, and an introduction to your claim. Include factual details about the incident, any injuries sustained, and the financial impact. Use this letter to articulate your request for compensation effectively, referencing the expectation of a settlement confirmation letter without insurance.

Filing a personal injury claim without a lawyer requires preparation and organization. Start by gathering all necessary documentation, such as medical records and incident reports. Prepare a well-structured claims letter outlining your case and desired settlement; you may need to reference a settlement confirmation letter without insurance to support your request.

When sending a debt settlement letter, address it to the creditor and include your account details, along with your offer to settle the debt. Make sure to clearly outline the reasons for your settlement proposal and any supporting documentation. After sending the letter, keep an eye out for their response, ideally a settlement confirmation letter without insurance.

To draft a letter for an insurance claim settlement, clearly state your intention to settle and include all relevant details, such as your claim number and the specifics of the incident. Be detailed about your losses and why you believe the settlement amount is justified. Conclude by requesting a prompt response and mentioning that you expect a settlement confirmation letter without insurance.

To craft a strong settlement letter, begin with a clear introduction of your case, followed by specific facts that support your position. Clearly state the compensation you seek, and back it up with logical reasoning and any relevant documentation. This structured approach not only enhances your argument but also reinforces your request for a settlement confirmation letter without insurance.

Writing a letter for final settlement requires clarity and precision. Start by detailing the circumstances surrounding the settlement, such as previous agreements and the amount in discussion. Close the letter by requesting specific confirmation, ensuring your intent is understood and that you eventually receive your settlement confirmation letter without insurance.

To request a final settlement letter, communicate directly with the relevant party involved, whether it is an insurance company or another entity. Clearly state your request, include your claim details, and mention any pertinent information to expedite the process. This letter serves as your settlement confirmation letter without insurance, so ensure you follow up if needed.