Corporate Resolution To Sell Real Estate With A Trust In Santa Clara

Description

Form popularity

FAQ

The primary disadvantage of an irrevocable trust is that the grantor cannot change the terms or conditions once the trust is established. Consequently, you should be very careful in naming beneficiaries, trustees, and distributions.

Changes to an Irrevocable Trust The trustee and any named beneficiaries would need to agree to a change mutually. They would need to decide that removing assets would best serve the trust and would need to go to court to explain the reasoning. Even then, the assets could not come back to you directly.

It will be important to contact the corporation about your decision and fill out the necessary documentation to transfer stock to a Trust, which is often an Assignment of Stock document. You will then submit this document to the corporation to have them file it.

To close the sale, you'll need to supply sufficient proof that the trust is valid and the trustee has the right to sell the property. This will normally require a Certification of Trust signed by a trust attorney, a death certificate of the trust creator, and a tax ID number.

They can be sold, but these transactions are typically more complicated than traditional home sales. Selling a home in California will take time. Even if you have a motivated buyer, the transaction still might not be completed for several weeks or months after an offer has been accepted.

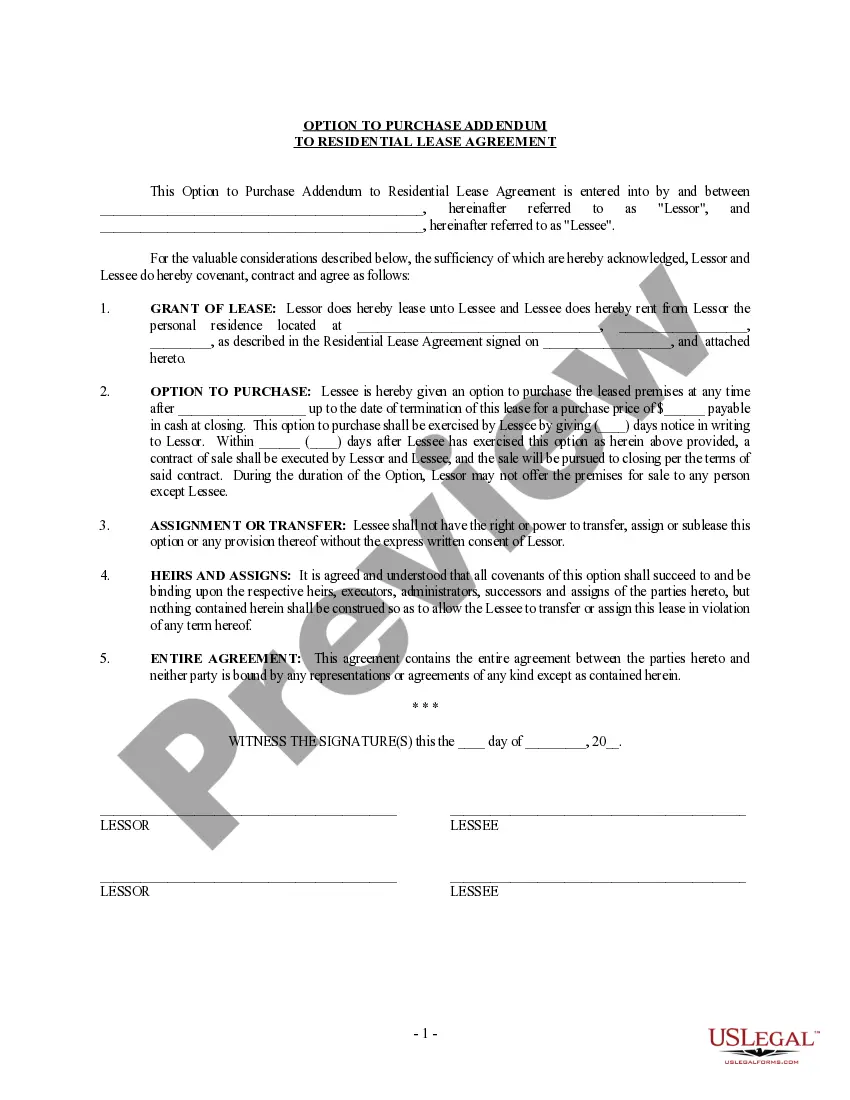

In the event that a company decides to sell its property, it will require a corporate resolution to sell real estate. This is a straightforward document that cites the name of the buyer and the location of the company's property. The location of the real estate sold may be at a street address, section, block, or lot.

Putting a house in an irrevocable trust protects it from creditors who might come calling after your passing – or even before. It's removed from your estate and is no longer subject to credit judgments. Similarly, you can even protect your assets from your family.

A corporate resolution is a legal business document created and written by a board of directors that describes and declares major corporate decisions. This document may explain who is legally allowed to sign contracts, prepare assignments, sell real estate or determine other decisions related to business transactions.

Whilst board resolutions can be passed by a simple majority vote, directors' written resolutions can only be passed by unanimous agreement of all directors who are entitled to vote unless any provision in the articles states to the contrary.