Nonprofit Resolution Template For 501c3 In Bronx

Description

Form popularity

FAQ

The bylaws describe the organizational structure and how decisions are made. Bylaws are usually only changed by the vote of the faculty. Policies define what is allowed and not allowed, including the rules or parameters governing decision-making. They describe why things are done the way they are done.

What NOT to Put in Your Nonprofit Organization's Bylaws Organizational Policies and Procedures. Specifically Targeted Policies that Adversely Affect Future Boards. Provisions that Violate State Laws. Inconsistencies with the Articles of Incorporation. Making Bylaws Too Inflexible. Incorporating Robert's Rules of Order.

How many board members does a charitable corporation have to have? A corporation formed in New York must have at least three board members.

Federal tax law does not require specific language in the bylaws of most organizations. State law may require nonprofit corporations to have bylaws, however, and nonprofit organizations generally find it advisable to have internal operating rules.

A new corporation's bylaws are typically created by the person or persons who initiated the incorporation process (called the "incorporator"), or they may be written or formally adopted by the new corporation's board of directors as one of the board's first actions.

Email: charities.bureau@ag.ny. Charities Bureau Phone: (212) 416-8401. The complaint form must be printed, filled out, scanned and sent to charitiesplaints@ag.ny. The complaint form is available here: .

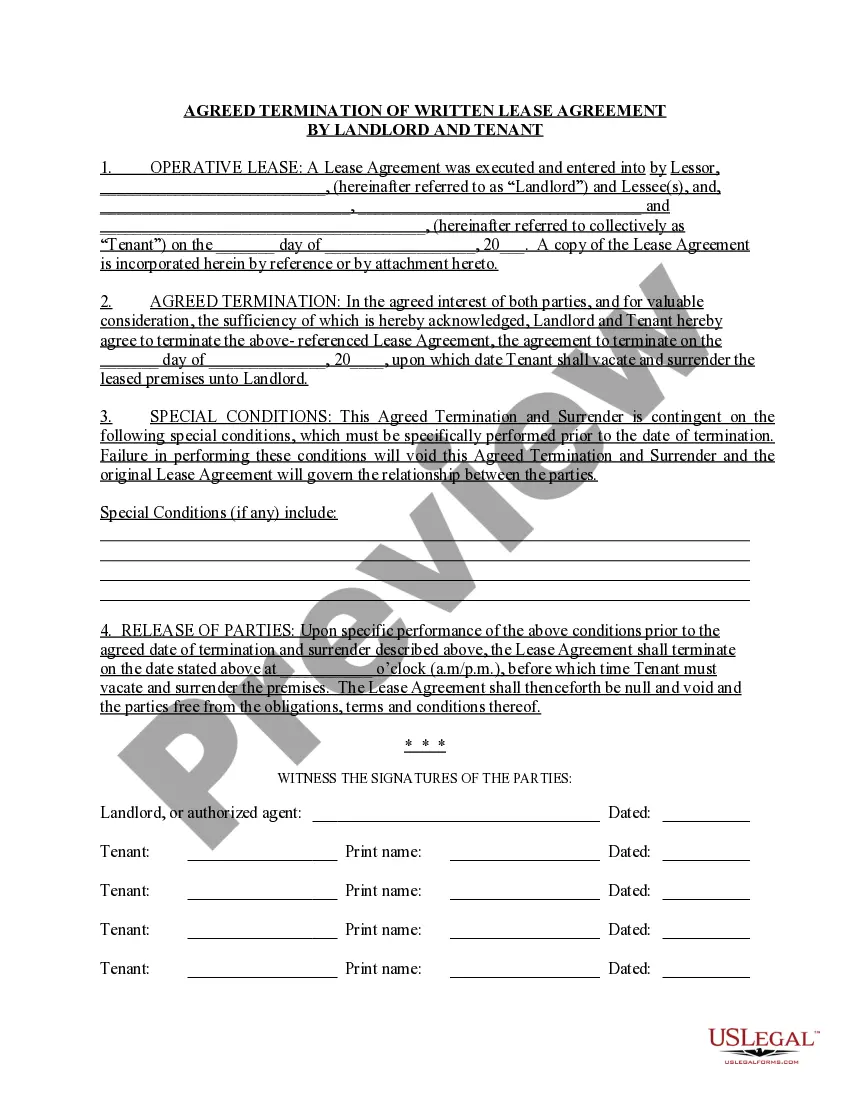

What Are the Components of a Nonprofit Board Resolution Template? The board meeting date. The number of the resolution. A title of the resolution. The resolution itself (what is being voted on) The name and vote of each voting member of the board. The Chairperson's name and signature.

How to Write Nonprofit Bylaws in 7 Simple Steps Decide Whose Responsibility it is. Research Bylaw Requirements for Your Type of Nonprofit. Create a First Draft. Review Your Draft Internally. Manage the Scope of What's Included. Get a Professional Opinion. Review Review Review! ... Are nonprofit bylaws public record?