Generic form with which a corporation may record resolutions of the board of directors or shareholders.

Example Of Corporate Resolution To Dissolve In Cuyahoga

Description

Form popularity

FAQ

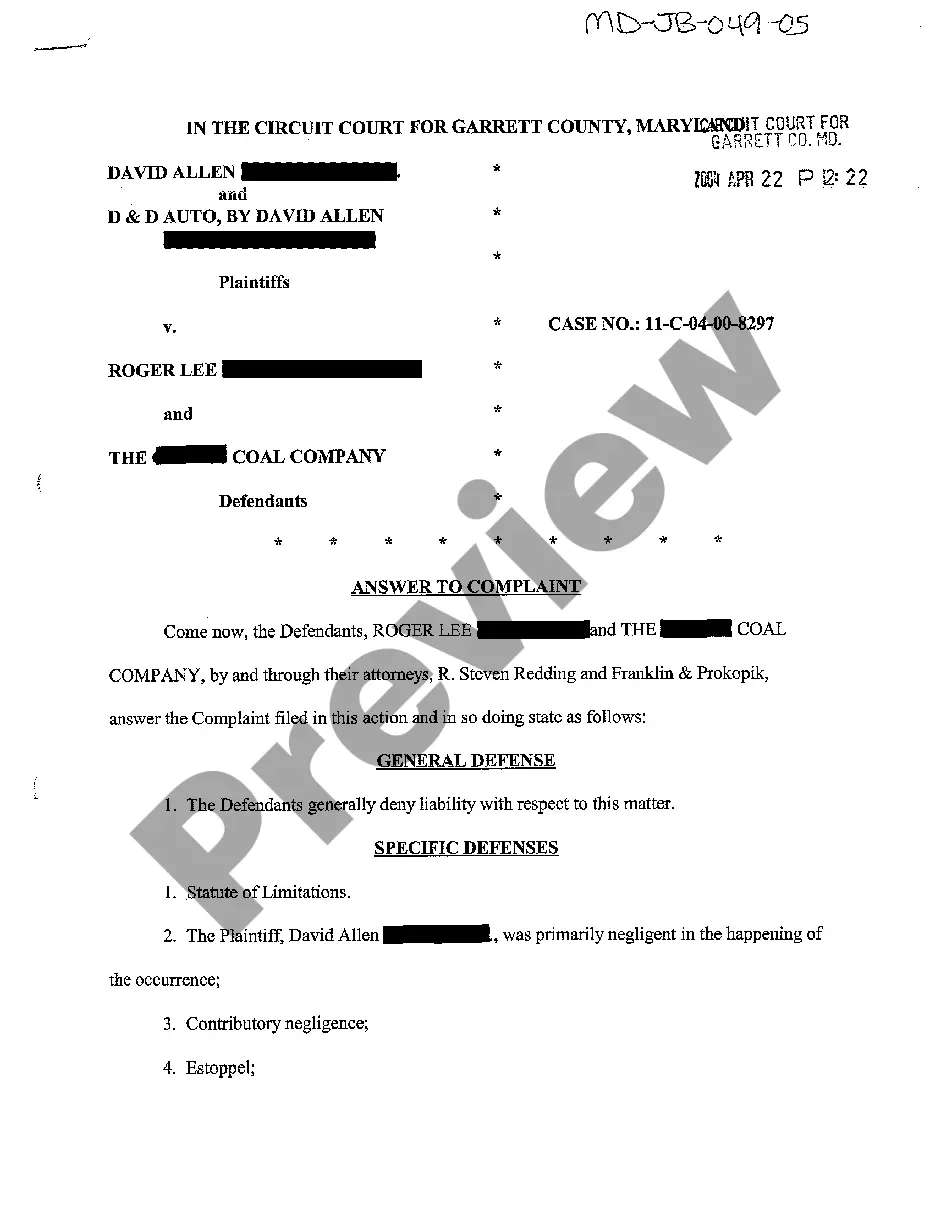

To comply with corporation formalities, the board of directors should draft and approve the resolution to dissolve. Shareholders then vote on the director-approved resolution. Both actions should be documented and placed in the corporate record book.

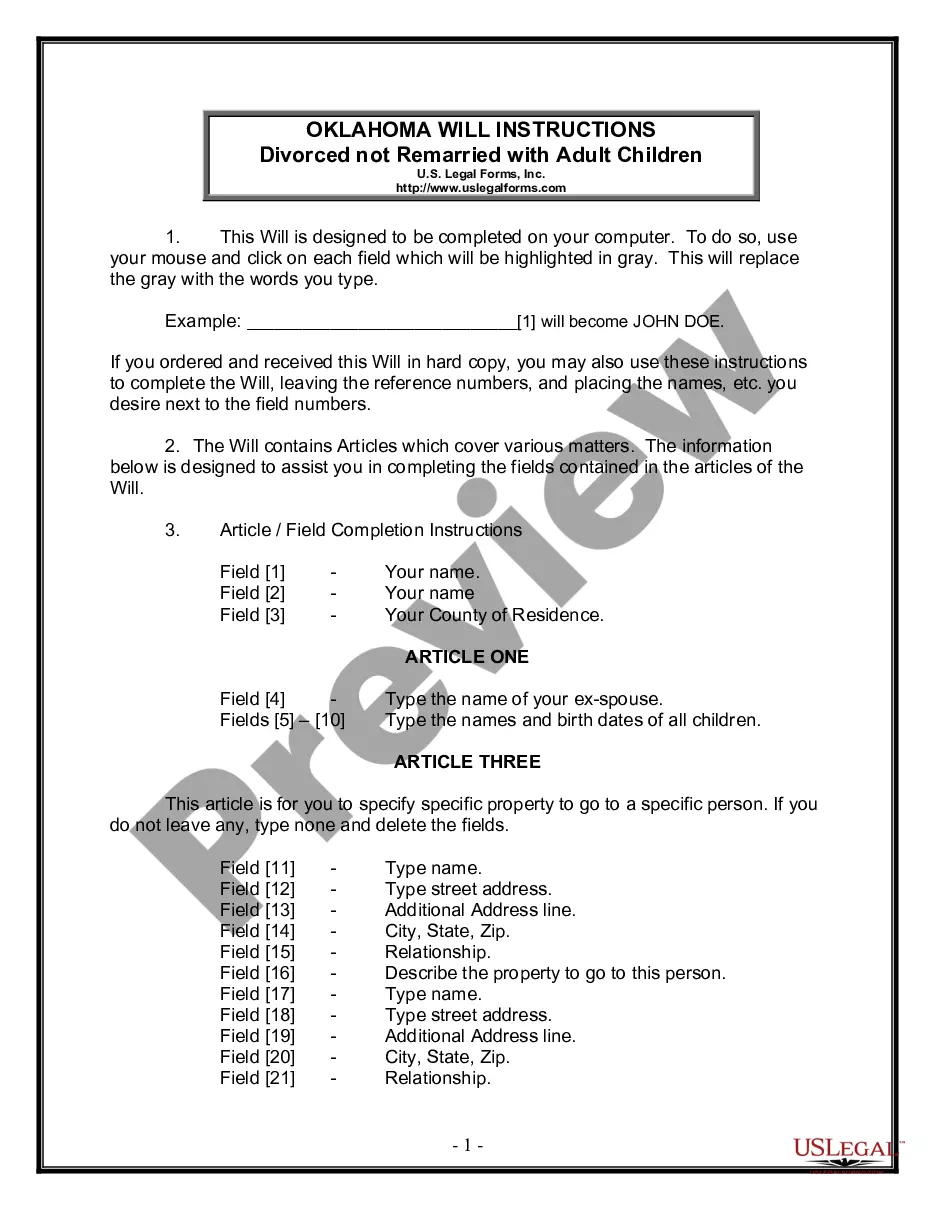

What should corporate resolutions include? Your corporation's name. Date, time and location of meeting. Statement of unanimous approval of resolution. Confirmation that the resolution was adopted at a regularly called meeting. Resolution. Statement authorizing officers to carry out the resolution.

Dissolution can be accomplished by either filing an action with the superior court or by complying with voluntary dissolution procedures. Note: Please expect 30-90 days to process filings (forms and/or supporting documentation) from the date received.

The notice should include essential details such as the effective date of dissolution, the reasons for dissolution, and instructions for handling any outstanding obligations or claims. It is essential to ensure that the notice complies with state laws and any specific provisions outlined in the partnership agreement.

Corporation filing requirements (includes S corporations), updated December 6, 2023. You must file Form 966, Corporate Dissolution or Liquidation, if you adopt a resolution or plan to dissolve the corporation or liquidate any of its stock. You must also file your corporation's final income tax return.

Obtaining A Dissolution In Ohio By law, a dissolution must be completed within 30-90 days from the day the case is filed with the court. In order to file for a dissolution in Ohio at least one of the spouses must have been a resident in the State of Ohio for at least 6 months before filing the case.

Just as you would file articles of incorporation to start your corporate entity and to bring it into existence, you must also file articles of dissolution (also known as a certificate of dissolution) to notify the state that you are terminating or dissolving the corporation.

A corporation consists of shareholders, a board of directors, and officers. When you form a corporation, you must organize the owners and managers—give them responsibilities and rights—ing to the rules laid out in your state's corporation laws.