Example Of Corporate Resolution To Dissolve In Pennsylvania

Description

Form popularity

FAQ

To start the process, a nonprofit corporation must1: ▪ Have a petition from 10% of its voting members recommending voluntary dissolution; or ▪ Have an action through a majority of its board of directors; or ▪ Follow any other methods for proposing or adopting a dissolution resolution provided for in the corporation's ...

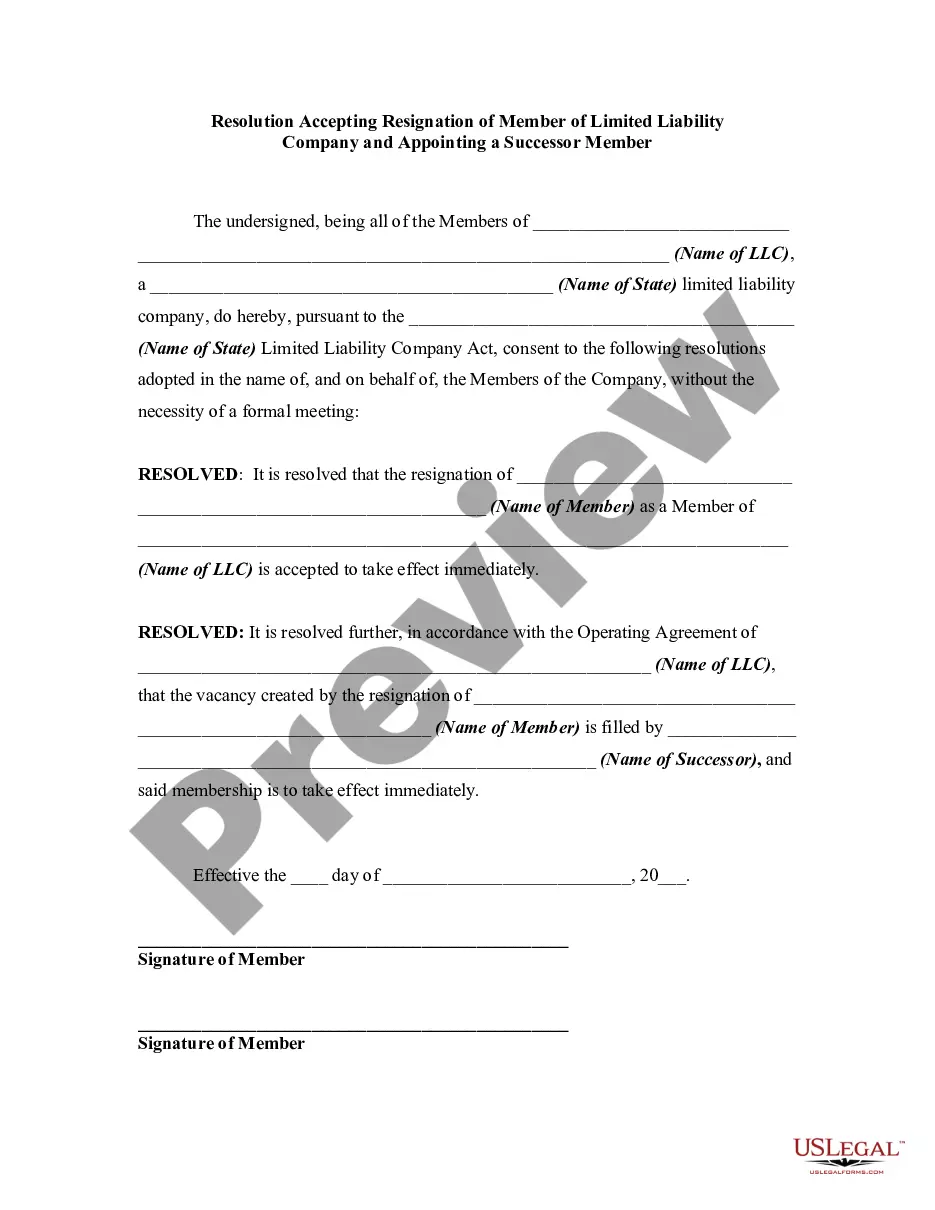

To comply with corporation formalities, the board of directors should draft and approve the resolution to dissolve. Shareholders then vote on the director-approved resolution. Both actions should be documented and placed in the corporate record book.

Dissolution can be accomplished by either filing an action with the superior court or by complying with voluntary dissolution procedures. Note: Please expect 30-90 days to process filings (forms and/or supporting documentation) from the date received.

Once you have submitted your papers, it will take between 30 and 60 days for your LLC to be dissolved in Pennsylvania, as long as there are no issues with your request. Dissolving an LLC is a pretty straightforward process once you know what steps need to happen.

Corporate or LLC dissolution is an official filing with the state where your business was originally formed. The action will terminate the legal existence of your company — wherever it does business.

To comply with corporation formalities, the board of directors should draft and approve the resolution to dissolve. Shareholders then vote on the director-approved resolution. Both actions should be documented and placed in the corporate record book.

Just as you would file articles of incorporation to start your corporate entity and to bring it into existence, you must also file articles of dissolution (also known as a certificate of dissolution) to notify the state that you are terminating or dissolving the corporation.

Corporations can be dissolved via a vote of the shareholders, partners in a partnership can elect to dissolve the businesses, and (depending upon the language in the articles of organization and operating agreement) LLCs can be dissolved by a vote of the LLC members.

Hold a board meeting Unlike a sole proprietorship, a corporation is required to appoint a board of directors. The board will need to hold a vote to dissolve the company. While some states don't require a minimum vote, others might require that a majority or two-thirds of the board vote in favor of dissolution.