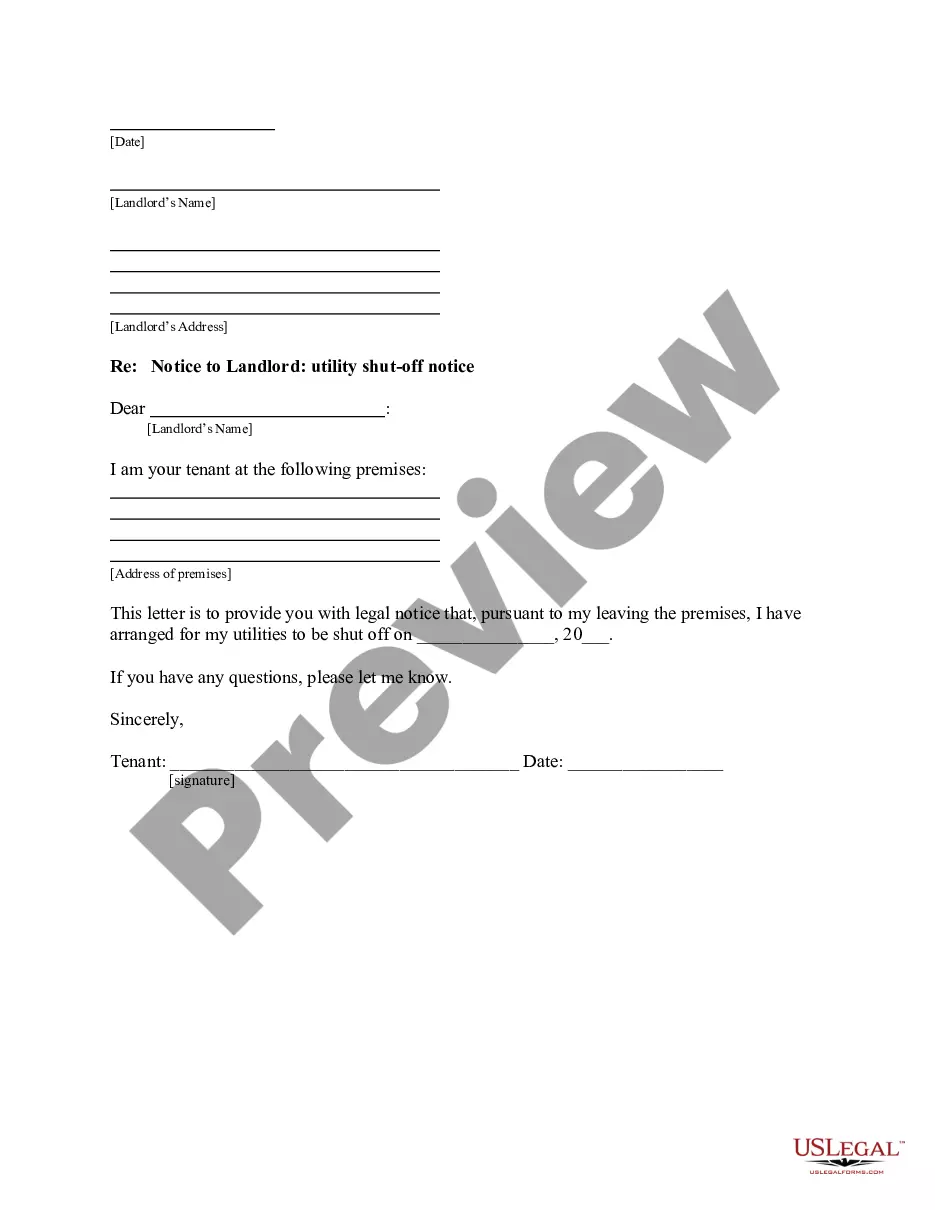

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Exemption For Texas In Arizona

Description

Form popularity

FAQ

To qualify for the general residence homestead exemption, a home must meet the definition of a residence homestead and an individual must have an ownership interest in the property and use the property as the individual's principal residence.

While the specifics can vary by state, generally, homestead exemptions are only available for an individual or family's primary residence. This means you cannot claim homestead exemptions in multiple states.

To be eligible for the Arizona Homestead Protection, a person must be at least eighteen years old and reside within the state of Arizona. The exemption applies to the following types of property, not to exceed $150,000 in value: 1. A person's interest in their house and the land the house sits on; 2.

The Basic Rules. The homestead exemption is available to any adult (18 or over) who resides within the state. Only one homestead may be held by a married couple or a single person. The value of the homestead refers to the equity of a single person or married couple.