Homestead Exemption With In Arizona

Description

Form popularity

FAQ

The Basic Rules. The homestead exemption is available to any adult (18 or over) who resides within the state. Only one homestead may be held by a married couple or a single person. The value of the homestead refers to the equity of a single person or married couple.

Does Arizona have any property tax exemptions? Widows/Widowers: Arizona allows a property tax exemption for widows and widowers who meet specific income and property value criteria. Disabled Individuals: Arizona residents who are totally and permanently disabled can qualify for a property tax exemption.

Key Benefits of the Arizona Homestead Exemption Debt protection – Experiencing financial hardships or filing bankruptcy can often lead to debt collection and lawsuits, but homestead exemption can shield primary residences from certain creditor claims.

Qualifications. Age: At least one property owner must be the minimum qualifying age of 65 at the time of application. Residence: The property must be the owner(s) primary residence. A "primary" residence is that residence which is occupied by the property owner(s) for an aggregate of nine months of the calendar year.

The Basic Rules. The homestead exemption is available to any adult (18 or over) who resides within the state. Only one homestead may be held by a married couple or a single person. The value of the homestead refers to the equity of a single person or married couple.

Age: At least one property owner must be the minimum qualifying age of 65 at the time of application. Residence: The property must be the owner(s) primary residence.

Between the affordable prices of homestead land, wide open spaces, and lenient homesteading laws, Arizona is the perfect place to build your self-sufficient lifestyle. The desert climate might be a bit of a challenge to get used to at first, but overall, it offers a lot of advantages for homesteaders.

This does not freeze your property tax bill, but it does freeze the property valuation. To qualify, you must meet the following criteria: Property owner must be 65 years of age or older. Property must be the primary residence and the owner(s) must have resided at the residence for at least 2 years.

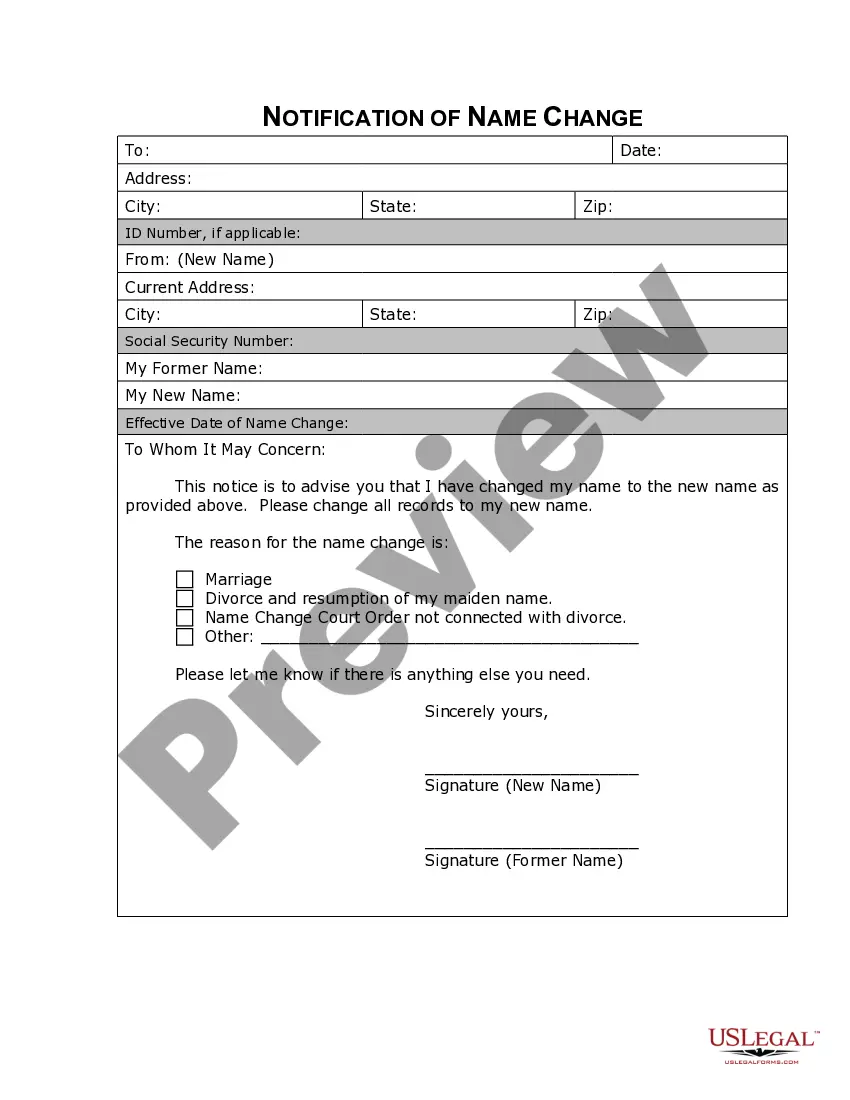

You can file a declared homestead by taking these steps: Buy a declared homestead form from an office-supply store, or download a form from the Registrar-Recorder's website. Fill out the form. Sign the form and have it notarized.