Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Exemption With No Mortgage In Bexar

Description

Form popularity

FAQ

The standard homestead deduction is either 60% of your property's assessed value or a maximum of $45,000, whichever is less. The supplemental homestead deduction is based on the assessed value of your property and equals: 35% of the assessed value of a property that is less than $600,000.

And how to apply for a homestead. Exemption. To learn more check out these links which you can clickMoreAnd how to apply for a homestead. Exemption. To learn more check out these links which you can click in the description.

Note: Applications will be processed in the order they are received. We strive to process exemptions as quickly as possible, but at times processing could take up to 90 days to process, per Texas Property Tax Code Section 11.45.

There are multiple ways to file a Homestead Exemption application Form 50-114, however the online option is the fastest, and details are provided in the transcript below.

To qualify for the general residence homestead exemption, a home must meet the definition of a residence homestead and an individual must have an ownership interest in the property and use the property as the individual's principal residence.

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to receive a homestead exemption that would decrease the property's taxable value by as much as $50,000.

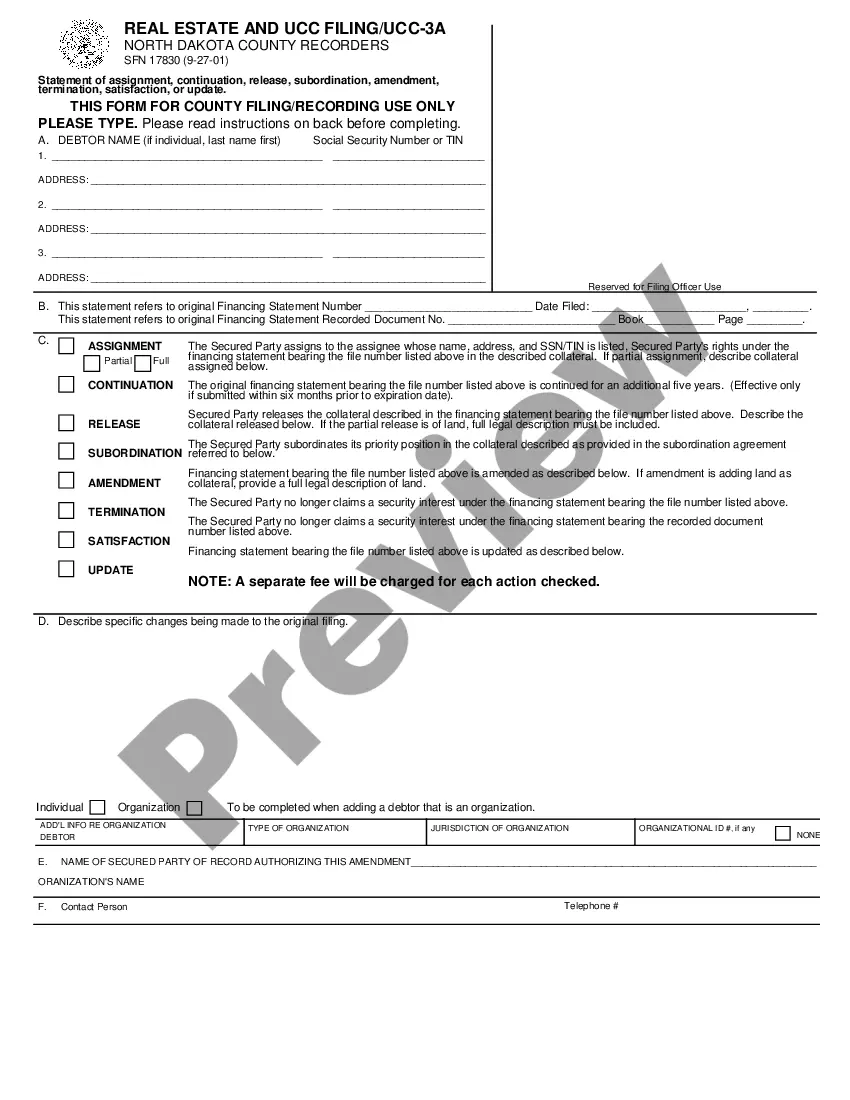

REQUIRED DOCUMENTATION Attach a copy of each property owner's driver's license or state-issued personal identification certificate. The address listed on the driver's license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested.

Applications for exemptions must be submitted to the Bexar Appraisal District. The Residential Homestead Exemption Form along with other forms used at the Bexar Appraisal District can be found on their website. See the Calendar For Property Owners and the Historical Property Tax Rate Table for more information.

2022 Official Tax Rates & Exemptions NameCodeHomestead Alamo Community College District 9 n/a Hospital District 10 n/a Bexar County 11 5,000 or 20% San Antonio River Authority 19 5,000 or 4%65 more rows