Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Florida Homestead Exemption For Military In Bronx

Description

Form popularity

FAQ

To get a homestead deduction on your Florida taxes, you have to fill out an application form, the DR-501, and demonstrate proof of residence by March 1 of the year for which you wish to qualify.

Real estate owned by certain religious, charitable or educational entities that are used for religious, charitable or educational purposes is exempt from property taxation. An exemption must be applied for through the Property Appraiser's office. The exemption is not automatic.

All exemptions except the Deployed Military Property Tax Exemption use the Florida Department of Revenue, Original Application for Homestead and Related Tax Exemptions to apply. VA of 10% or more are eligible for an exemption from taxes on their property up to $5,000 in assessed value.

Florida State Benefits for 100% Disabled Veterans Veterans Homes. Basic Property Tax Exemptions. Homestead Exemption. Florida Driver's License/ License Plates/ Disabled Parking Permit. Florida Veteran Hiring Preference For Government Jobs. Congressman C.W. Bill Young Tuition Waiver Program. Purple Heart Recipient Waivers.

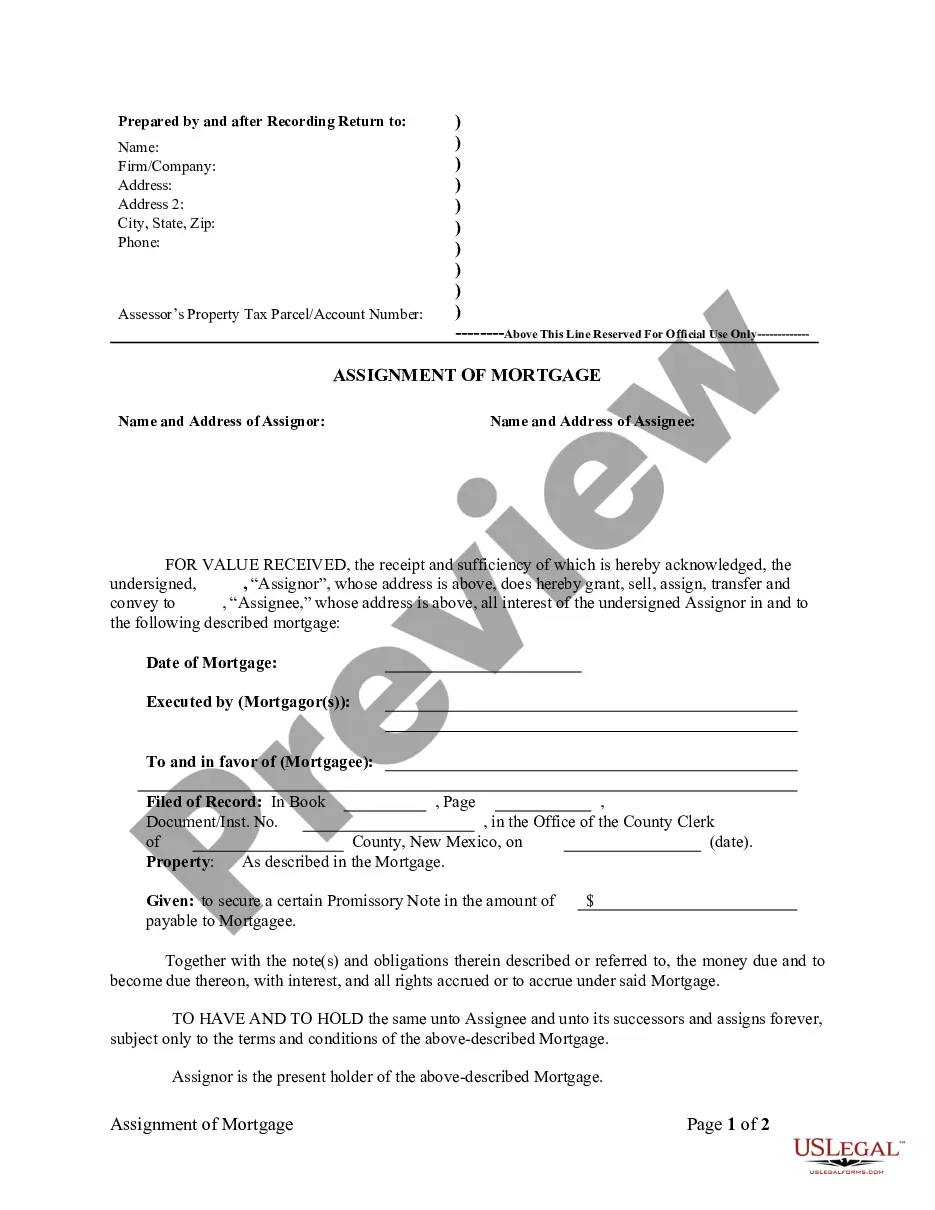

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.