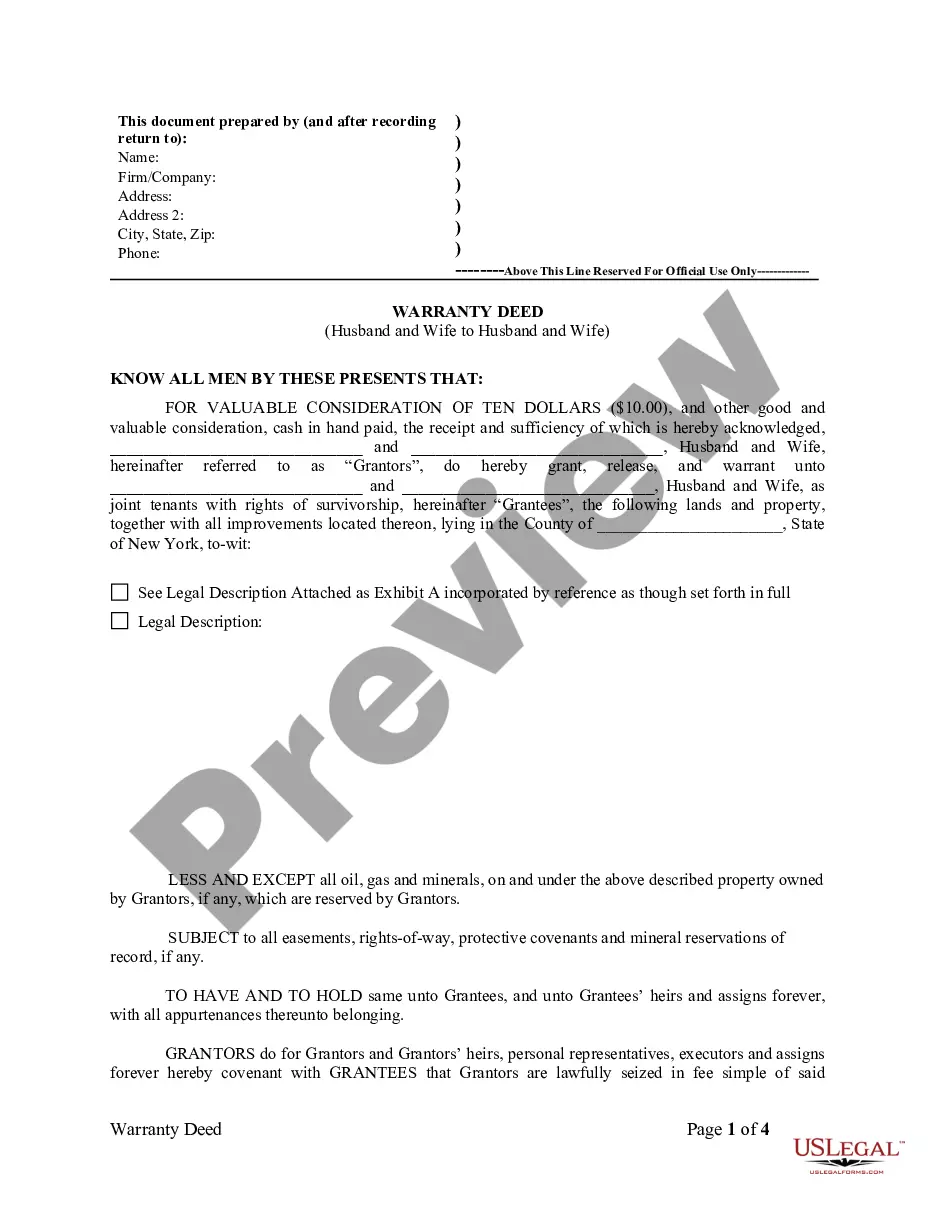

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Types Of Homestead Exemptions In Bronx

Category:

State:

Multi-State

County:

Bronx

Control #:

US-0032LTR

Format:

Word;

Rich Text

Instant download

Description

Form popularity

More info

You can get information about your property tax benefits, including: Application status, Current benefit amounts, Proposed benefit for the upcoming tax year. Principal Residence Required: The Homestead Exemption in New York only applies to the debtor's primary residence.Exemption applications must be filed with your local assessor's office. See our Municipal Profiles for your local assessor's mailing address. The City of New York offers tax break down known as exemptions to seniors, veterans, clergy members, people with disabilities, and others. Homestead exemption protect property assets from probate. Properties recognized under laws of homestead are off-limits to creditors seeking attachment. Different forms are used when filing for exemptions for the first time, when changing an exemption, and when renewing an exemption. In New York, the homestead exemption applies to real property, including your home, condominium, or co-op. It also applies to a mobile home.