Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Exemption Forms Without In California

Description

Form popularity

FAQ

And provide additional information about the homestead exemption. Application process it isMoreAnd provide additional information about the homestead exemption. Application process it is important to ensure that the property ID is accurate when submitting your exemption.

Obtain the claim form from the County Assessor's office where the property is located. Submit the completed form to the same office. Once the exemption has been granted, it remains effective until a change in eligibility occurs, such as selling or moving out of the home. Annual filing is not required.

Lower My Property Taxes Decline In Value / Prop 8. Calamity / Property Destroyed. Disabled Veterans' Exemption. Homeowners' Exemption. Nonprofit Exemptions. Transfers Between Family Members. Transfer of Base Year Value to Replacement Dwelling. Assessment Appeal.

You must occupy the dwelling as your principal residence as of January 1 of each year to qualify for the Homeowners' Exemption for that year.

A homestead can protect the $50,000. There are two types of homesteads, automatic and declared.

To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located. The claim form, BOE-266, Claim for Homeowners' Property Tax Exemption, is available from the county assessor.

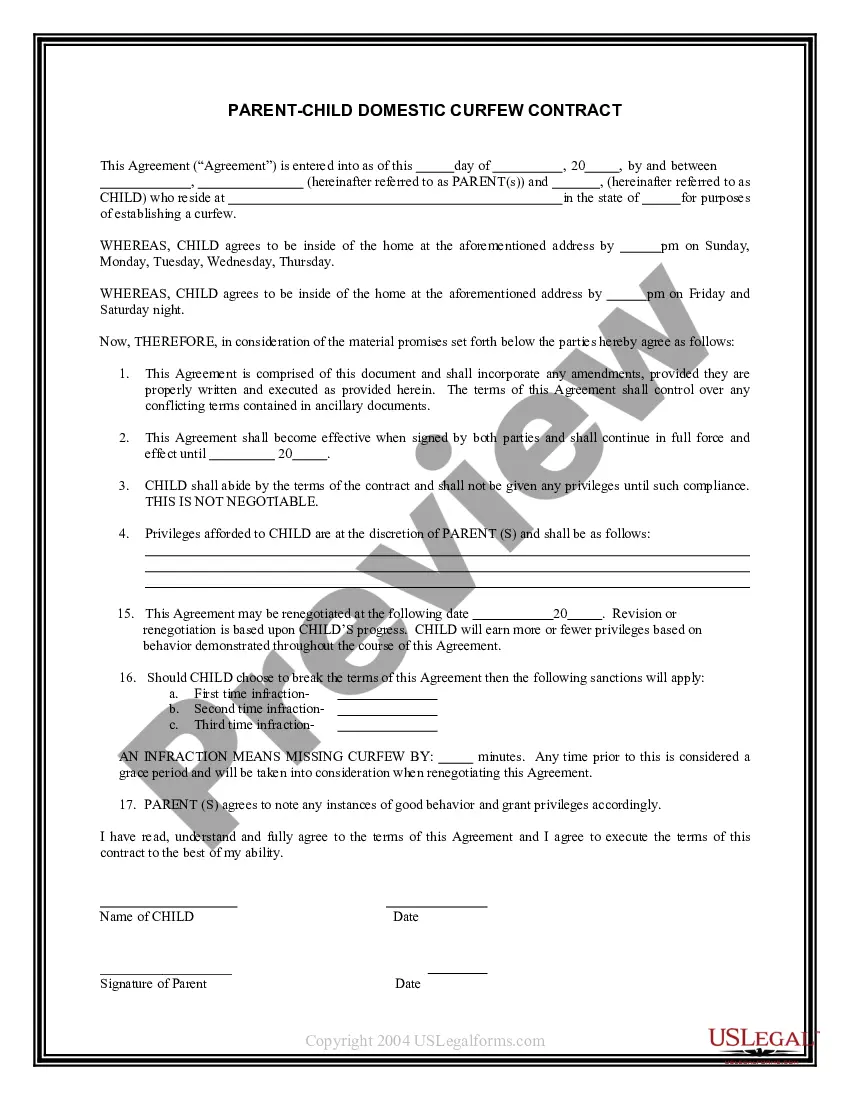

Filing a homestead declaration typically requires three steps. Complete a homestead declaration form. Sign your declaration in front of a notary. Record the homestead declaration form with your county recorder's office.

The protected amount is called the “homestead exemption.” All homeowners automatically have a homeowner's exemption, which protects part of their equity from involuntary sales (foreclosures). Recording a declaration of ownership extends this protection to voluntary sales.