Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Florida Homestead Exemption For First Responders In Collin

Description

Form popularity

FAQ

The Online Services Portal is available to ALL owners that would like to conduct business with the Appraisal District electronically. This service includes filing an exemption on your residential homestead property, submitting a Notice of Protest, and receiving important notices and other information online.

First-time Homestead Exemption applicants and persons applying for the Homestead Assessment Difference (Portability) can file online.

Note: Applications will be processed in the order they are received. We strive to process exemptions as quickly as possible, but at times processing could take up to 90 days to process, per Texas Property Tax Code Section 11.45.

(2) Any real estate that is owned and used as a homestead by a person who has a total and permanent disability as a result of an injury or injuries sustained in the line of duty while serving as a first responder in this state or during an operation in another state or country authorized by this state or a political ...

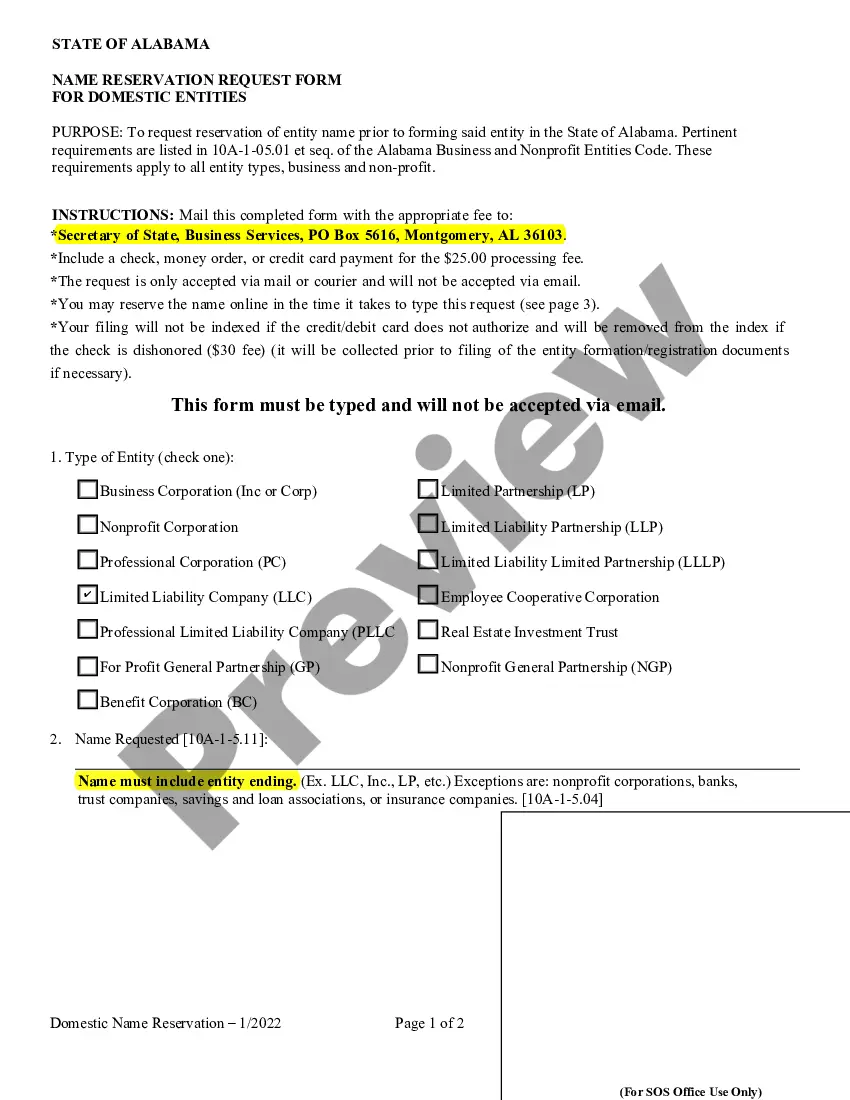

Tax Rates and Exemptions 2023 EntityExemptions OfferedOV65 Amount Celina ISD (SCL) DP, FR, HS, OV65 $10,000 Collin College (JCN) DP, FR, GIT, HS, OV65 $100,000 Collin County (GCN) DP, FR, HS, OV65 $30,000 Collin County MUD #1 (WCCM1) DP, FR, GIT, OV65 $10,00042 more rows

To apply for the homestead exemption, download and print the Residential Homestead Exemption Application and mail the completed application to: Central Appraisal District of Collin County, 250 W. Eldorado Pkwy, McKinney, TX 75069.

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to receive a homestead exemption that would decrease the property's taxable value by as much as $50,000.

Real estate owned by certain religious, charitable or educational entities that are used for religious, charitable or educational purposes is exempt from property taxation. An exemption must be applied for through the Property Appraiser's office. The exemption is not automatic.

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000.