Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Act Information With One Another In Florida

Description

Form popularity

FAQ

You cannot transfer your homestead exemption when you move from a previous Florida homestead to a new Florida homestead. However, you may be able to transfer all or part of your homestead assessment difference.

Where can I find information on my homestead exemption? Tax exemption information can be found on the Property Appraiser's website .mcpafl.

The answer is yes. You can have two separate houses that both qualify for the Florida homestead exemption so long as the land is contiguous and under the 160-acre limit.

You are 65 years of age, or older, on January 1; You qualify for, and receive, the Florida Homestead Exemption; Your total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

You will receive a receipt by mail as proof that your exemption application was received and processed within 45 days of filing. If you wish to confirm the status of your application, you may view your property record utilizing the Property Search function. See the Taxable Values and Exemptions section.

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

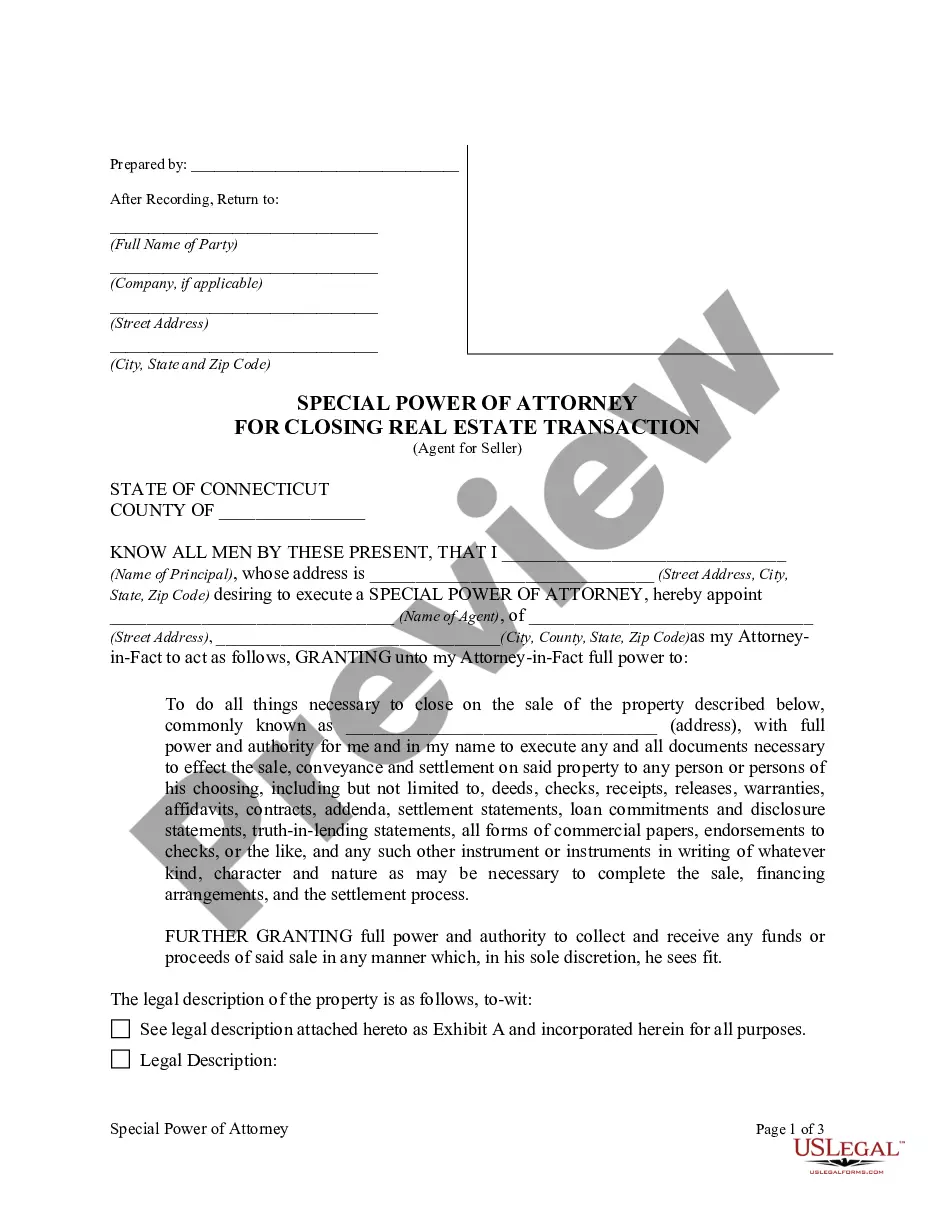

Declaration or Designation of Homestead Explanation It's a simple legal document that will protect your most valuable asset – YOUR HOME EQUITY - from liens, judgments and unsecured creditors, and it has nothing to do with your local county homestead property tax exemption.

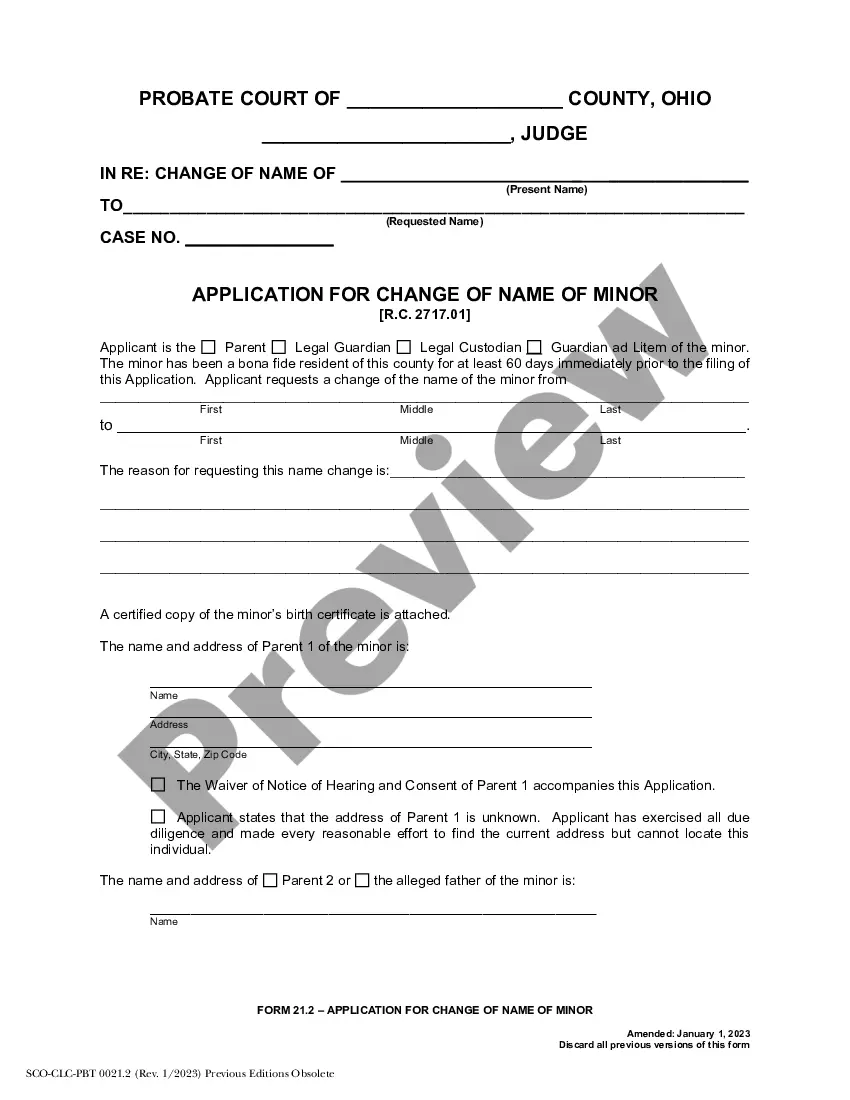

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.