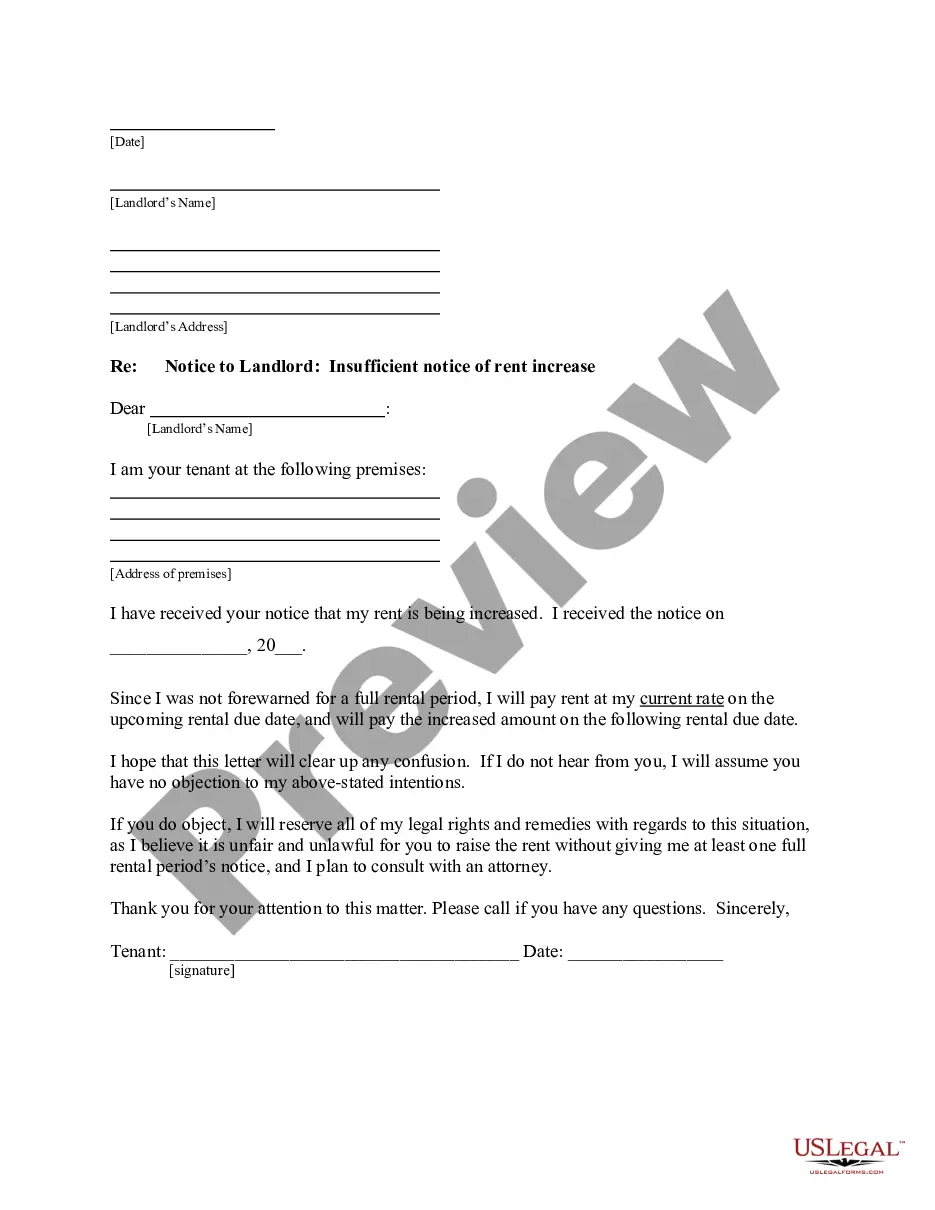

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Exemption Fort Myers In Harris

Description

Form popularity

FAQ

There are multiple ways to file a Homestead Exemption application Form 50-114, however the online option is the fastest, and details are provided in the transcript below.

County taxes: Harris County provides a 20% optional homestead exemption to homeowners within the area. If your home is valued at $200,000, the exemption will reduce its taxable value by $40,000 bringing it down to $160,000.

First-time Homestead Exemption applicants and persons applying for the Homestead Assessment Difference (Portability) can file online.

Harris County Online Application. Apply using the Form 11.13 with a scanned copy of your Texas Driver's License. Mobile App. You can also file your exemption using their mobile app in Android or in iOS with a photo of your Texas Driver's License.

Return to Harris County Appraisal District, P. O. Box 922012, Houston, Texas 77292-2012. The district is located at 13013 Northwest Fwy, Houston, TX 77040. For questions, call (713) 957-7800.

To receive the benefit of the homestead exemption, the taxpayer must file an initial application. In Lee County, the application is filed with the Tax Assessors Office. The application must be filed between January 1 and April 1 of the year for which the exemption is first claimed by the taxpayer.