Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Florida Tax Exemptions For Seniors In Hillsborough

Description

Form popularity

FAQ

Qualifications. At least one owner is 65 years of age or older on January 1. The residence must also receive homestead exemption.

Qualifying seniors receive deductions off their tax bills because they are senior citizens. The senior citizen exemption reduces the tax bill by a sum certain each year. The actual deduction is $5,000 times the local tax rate.

Senior Citizen Exemption You are 65 years of age, or older, on January 1; You qualify for, and receive, the Florida Homestead Exemption; Your total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

All owners of the property must be 65 or older, unless the owners are spouses or siblings. If you own the property with a spouse or sibling, only one of you must meet this age requirement.

Who qualifies for a senior property tax exemption? he eligibility criteria for senior property tax exemptions vary by location. Generally, they are available to homeowners who are at least a certain age (often 65 or older) and meet specific income or property value requirements.

Formally known as the “Credit for the Elderly or the Disabled,” the federal senior tax credit is a credit of $3,750 to $7,500 that lowers federal tax bills for older adults and people who retired on permanent and total disability.

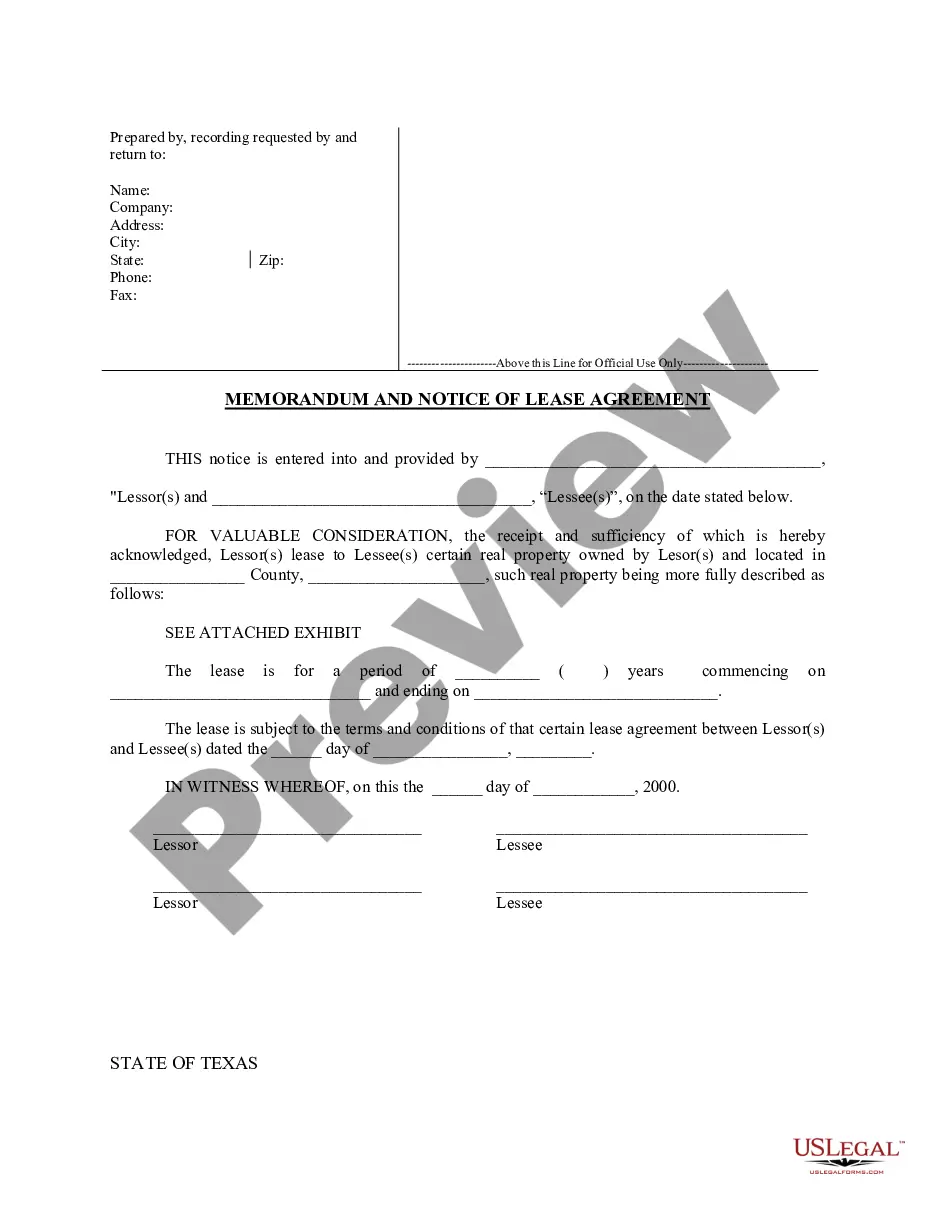

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

Taxes aren't determined by age, so you will never age out of paying taxes. People who are 65 or older at the end of 2024 have to file a return for tax year 2024 (which is due in 2025) if their gross income is $16,550 or higher. If you're married filing jointly and both 65 or older, that amount is $32,300.

Every person who owns and resides on real property in Florida on January 1st and makes the property his or her permanent residence is eligible to receive a Homestead Exemption up to $50,000. The first $25,000 applies to all property taxes, including school district taxes.