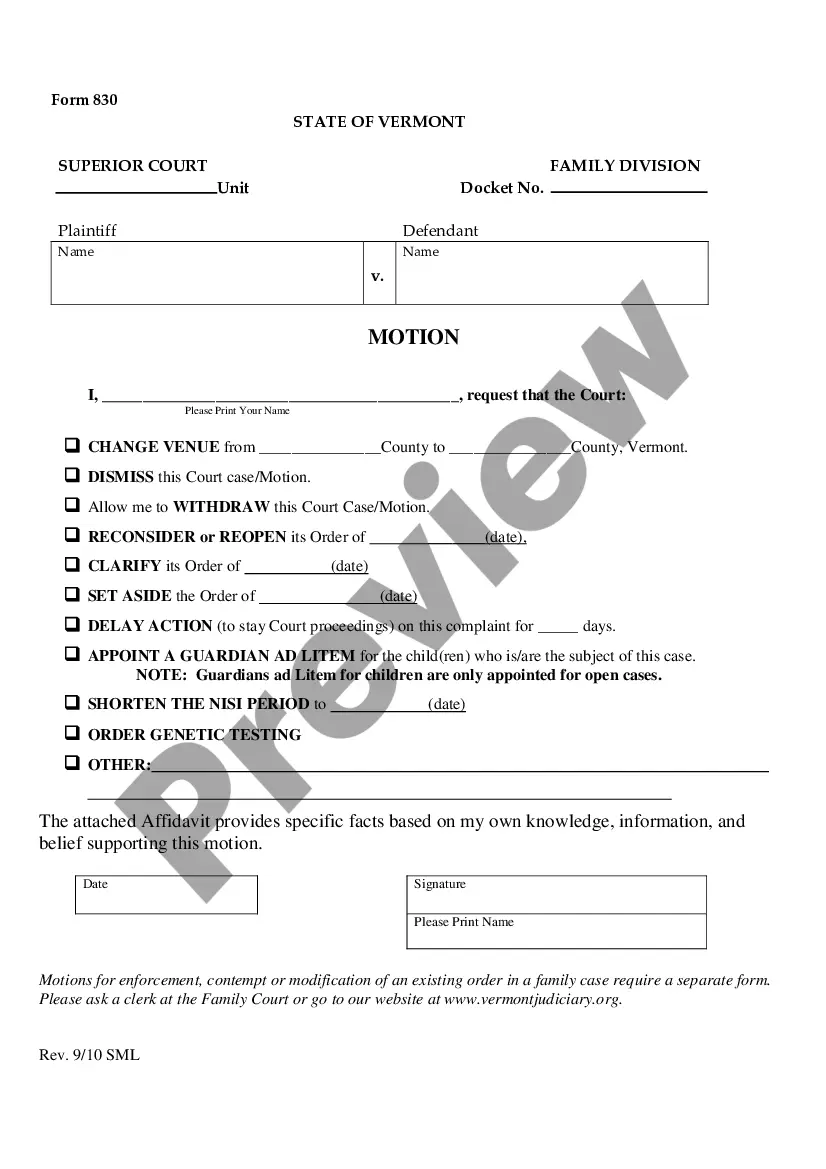

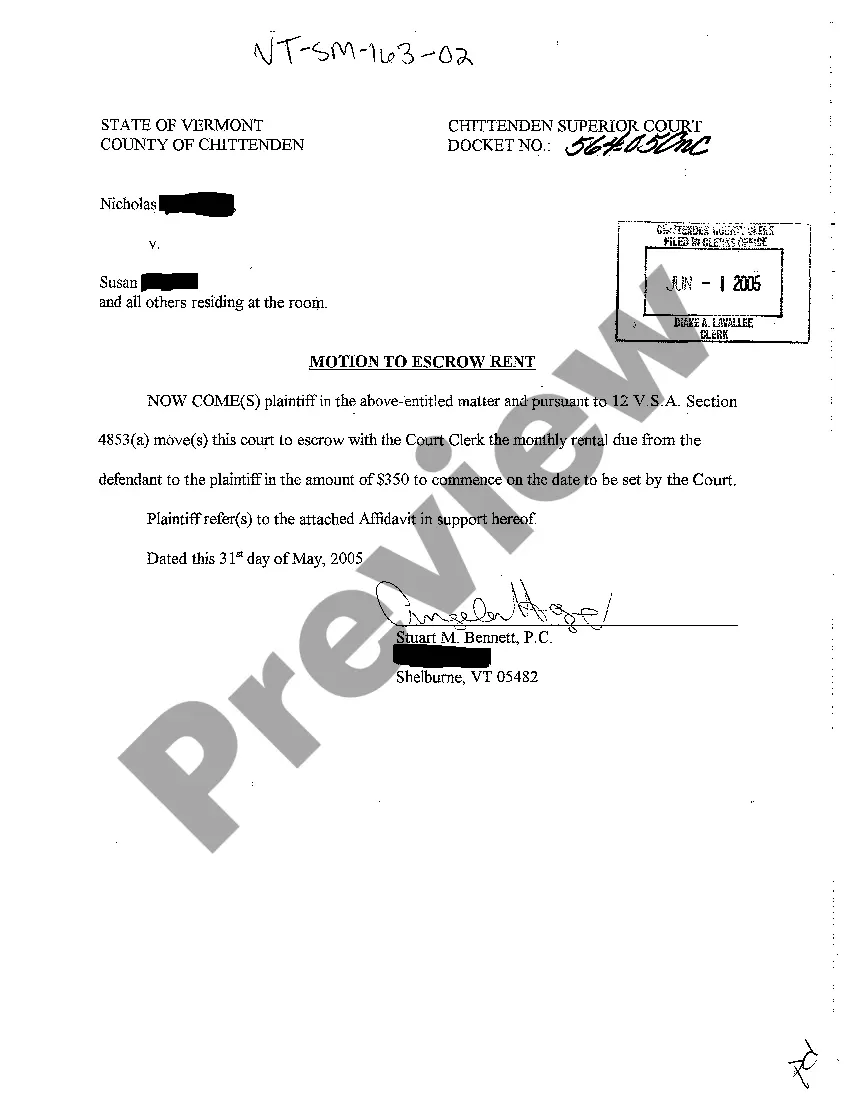

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Exemption With Trust In Hillsborough

Description

Form popularity

FAQ

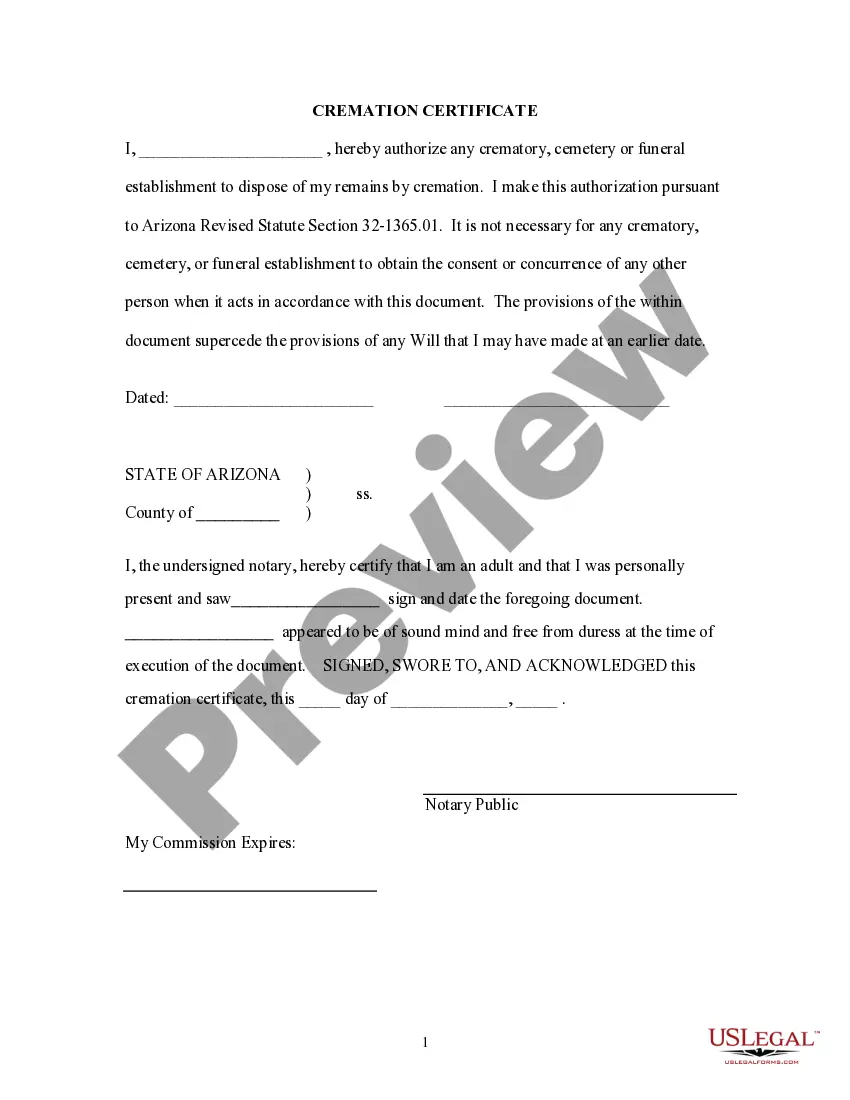

In brief, Florida case law and opinions issued by the Florida Attorney General recognize that Trust beneficiaries can maintain their homestead exemption as long as they meet certain requirements, even though the Florida Constitution does not explicitly address homestead protection for properties held in Trust.

Certain property tax benefits are available to persons age 65 or older in Florida. Eligibility for property tax exemp�ons depends on certain requirements.

Benefit to Homestead Exemption Florida law allows up to $50,000 to be deducted from the assessed value of a primary / permanent residence. The first $25,000 of value is entirely exempt. The second $25,000 exemption applies to the value between $50,000 - $75,000 and does not include a benefit on the school tax.

HOMESTEAD EXEMPTION ELIGIBILITY REQUIREMENTS You must own AND occupy the home as your PERMANENT residence prior to January 1st of the year for which you are applying 2. You must be a US Citizen or permanent US Resident and a Florida resident as of January 1st 3.

Benefit to Homestead Exemption Florida law allows up to $50,000 to be deducted from the assessed value of a primary / permanent residence. The first $25,000 of value is entirely exempt. The second $25,000 exemption applies to the value between $50,000 - $75,000 and does not include a benefit on the school tax.

The Florida Land Trust is a fully revocable grantor trust drafted specifically to buy, hold, finance and sell Florida real estate or other personal property in a confidential or private manner pursuant to the Florida Land Trust Act that was adopted by the Florida legislature in 2006.

2020) (“As to the permissibility of owning a homestead in an irrevocable trust, Florida Attorney General Opinion 72-12 held that an irrevocable trust can own homestead so long as the beneficiary (who is residing in and using the homestead as his or her permanent home) is provided a present possessory right to the ...

The answer, in brief, is a resounding yes — with caveats, of course. ing to Section 196.041(2) of the Florida Statutes, it's entirely possible to retain your homestead tax exemption even if your property is held in trust.

In Florida, placing your property into a revocable trust ensures that the property is not reassessed for tax purposes, provided the transfer is executed correctly. This means that your property taxes should not increase solely because you've transferred your home into a trust for your child or any other beneficiary.

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000.