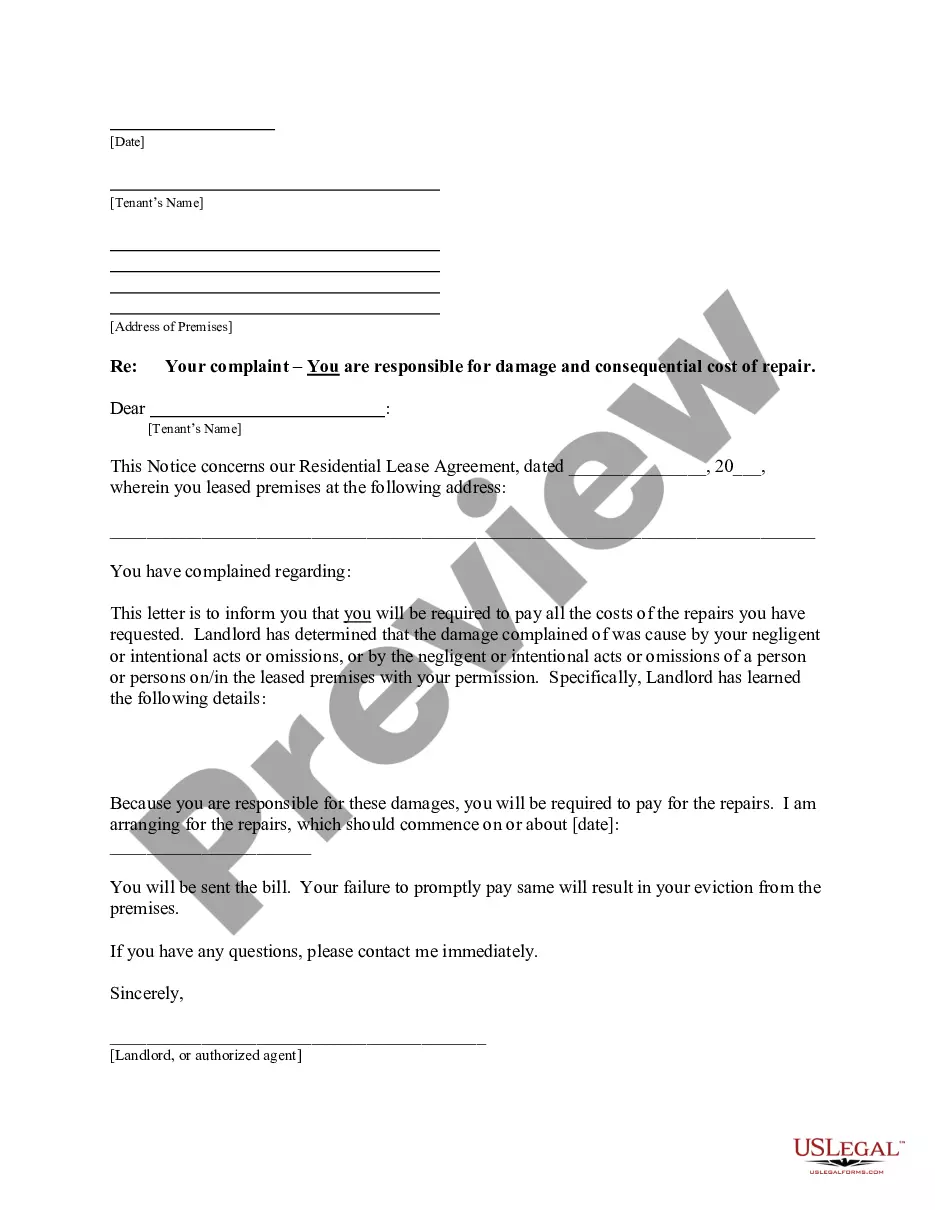

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Exemption Without Drivers License In Hillsborough

Description

Form popularity

FAQ

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

Benefit to Homestead Exemption Florida law allows up to $50,000 to be deducted from the assessed value of a primary / permanent residence. The first $25,000 of value is entirely exempt. The second $25,000 exemption applies to the value between $50,000 - $75,000 and does not include a benefit on the school tax.

To keep things simple, let's say the assessed value of your home is $200,000 and your property tax rate is 1%. Your property tax bill would equal $2,000. But if you were eligible for a homestead tax exemption of $50,000, the taxable value of your home would drop to $150,000, meaning your tax bill would drop to $1,500.

The total household income limitation is the same for both exemptions. It is made available by the Florida Department of Revenue annually and subject to change each year. The adjusted income limitation for the 2024 exemptions is $36,614.

VERIFICATION OF SOCIAL SECURITY NUMBERS for ALL applicants (per F.S. 196.011(1). MUST reflect address for which you are applying for an exemption • Current Florida driver's license is required for ALL applicants. FL ID cards are acceptable for those unable to drive.

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to receive a homestead exemption that would decrease the property's taxable value by as much as $50,000.

You are 65 years of age, or older, on January 1; You qualify for, and receive, the Florida Homestead Exemption; Your total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.