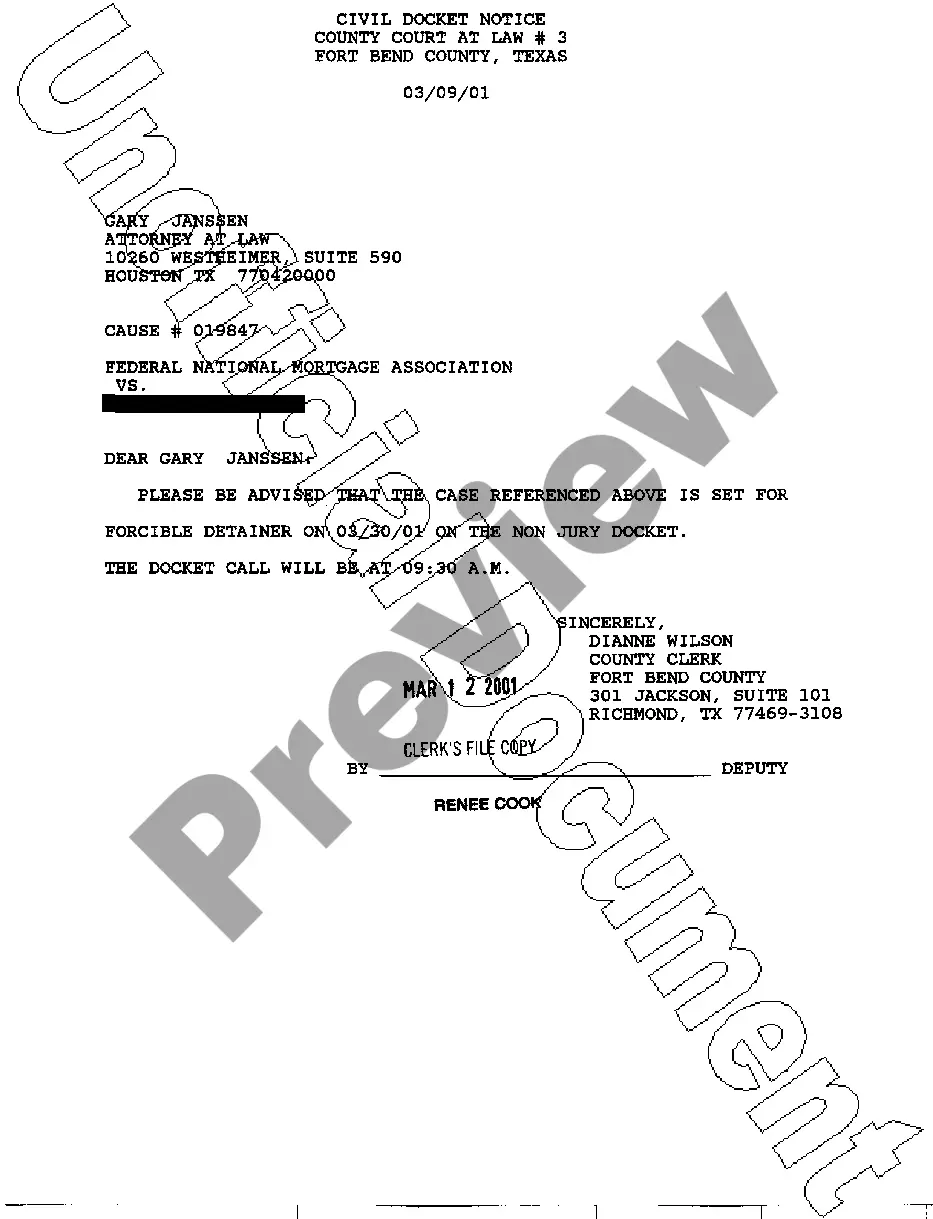

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Act Tax Credit With Itin In King

Description

Form popularity

FAQ

Exemption applications must be filed with your local assessor's office. See our Municipal Profiles for your local assessor's mailing address. Do not file any exemption applications with the NYS Department of Taxation and Finance or with the Office of Real Property Tax Services.

You must live in the home to qualify for the tax break. Some states exempt a certain percentage of a home's value from property taxes, while other states exempt a set dollar amount. If your state uses a percentage method, the exemption will be more valuable to homeowners with more valuable homes.

The exemption is not entered anywhere on your federal income tax return. Homestead exemptions are usually filed at your county courthouse, at the tax assessor's office.

The Senior Tax Credit is available to homeowners at least 65 for whom the property is their principal residence (see the HOTC page for details); Interested homeowners must submit the Homeowners Tax Credit Application to the Maryland State Department of Assessments and Taxation (SDAT).

New for tax year 2022. Residents who are at least 65 on the last day of the tax year may be eligible for a nonrefundable tax credit of up to $1,000. To claim this credit, complete Part M of Form 502CR and follow the instructions for reporting your total credits on Form 502.

A further condition is that the dwelling must be the owner's principal residence and the owner must have lived in it for at least six months of the year, including July 1 of the year for which the credit is applicable, unless the owner was temporarily unable to do so by reason of illness or need of special care.

There are no income limits to receive the Homestead Tax Credit. To apply online, you can visit or you can download a paper application at or request an application be sent to you by calling 410-767-2165 or 1-866-650-8783.

REQUIRED DOCUMENTATION Attach a copy of each property owner's driver's license or state-issued personal identification certificate. The address listed on the driver's license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested.

REQUIRED DOCUMENTATION Attach a copy of each property owner's driver's license or state-issued personal identification certificate. The address listed on the driver's license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested.

The exemption is not entered anywhere on your federal income tax return. Homestead exemptions are usually filed at your county courthouse, at the tax assessor's office.