Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Act Information With Tax In Massachusetts

Description

Form popularity

FAQ

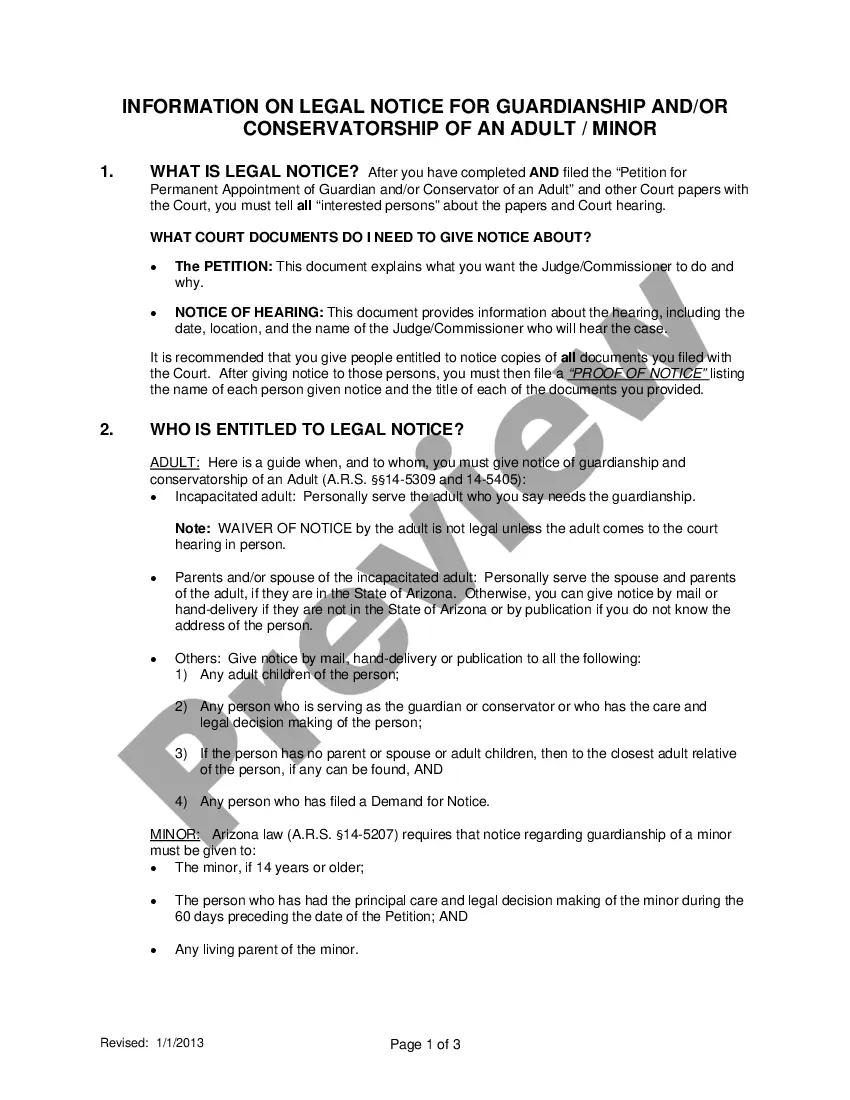

Up to $1,000,000 of Protection is Available. You can file a formal Declaration of Homestead to protect up to $1,000,000 of your home's value. A Declaration of Homestead becomes effective when it is signed by all the property's owners and recorded at the Registry of Deeds.

The Massachusetts Homestead Act is a law under which a homeowner is protected by an Estate of Homestead. A homestead estate provides limited protection of the value of the home, up to $1,000,000, against unsecured creditor claims.

Massachusetts laws Includes clauses for real estate tax exemptions for blind persons, qualifying senior citizens, qualifying surviving spouses, minor children and elderly persons, qualifying veterans, and religious and charitable organizations.

Clauses 41, 41B, 41C or 41C½ provide exemptions to seniors who meet specific ownership, residency, income and asset requirements. Seniors 70 or older may, alternatively, qualify for exemption under Clauses 17, 17C, 17C½ or 17D, which provide a reduced benefit, but have less strict eligibility requirements.

Homestead declaration protects against attachment, seizure, execution on judgment, levy or sale for the payment of debts up to one million dollars ($1,000,000) per residence, per family.

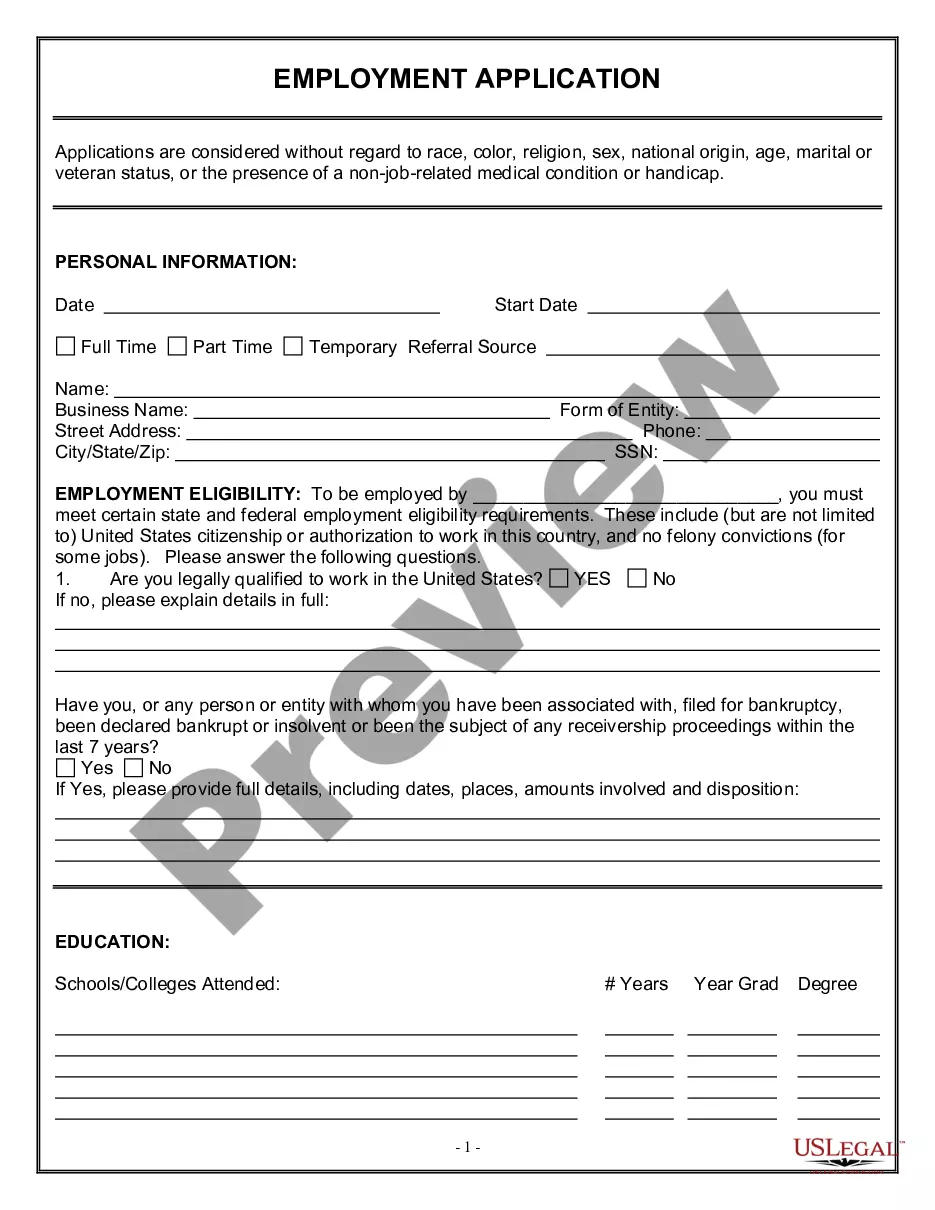

To protect the value of your property up to one million dollars ($1,000,000) per residence, per family, you must file a document called a “Declaration of Homestead”. You can file this form at the Registry of Deeds in the county or district where your property is located, referencing the title/deed to the property.

Contact Your Assessor's Office First, contact your local assessor's office. They can answer questions about your assessment, provide appropriate paperwork, and assist with any special circumstances. Your assessor's office may also provide information that could assist with your tax bill.

The State Tax Form 96-1 is used to apply for personal property tax exemptions for seniors in Massachusetts. It must be completed by seniors who want to apply for a tax exemption on their personal property. The form requires personal information, including name, address, and age.

Massachusetts laws Includes clauses for real estate tax exemptions for blind persons, qualifying senior citizens, qualifying surviving spouses, minor children and elderly persons, qualifying veterans, and religious and charitable organizations.

How is the Homestead established? Section 4 of MGL Ch. 188 provides an automatic exemption available to everyone who owns a home and who occupies or intends to occupy the home as his or her principal residence. This exemption is for $125,000.00.