Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Exemption Fort Worth In Massachusetts

Instant download

Description

Form popularity

FAQ

Qualifying homeowners can get a 35% exemption of the assessed value of a home up to $600,000 (25% for homes over $600,000). Additional deductions are available for seniors, veterans, disabled persons, rehabilitations, and mortgages.

Who can file a Homestead protection? If you own and occupy (or intend to occupy) your home as a principal residence, you can file a homestead protection.

And how to apply for a homestead. Exemption. To learn more check out these links which you can clickMoreAnd how to apply for a homestead. Exemption. To learn more check out these links which you can click in the description.

More info

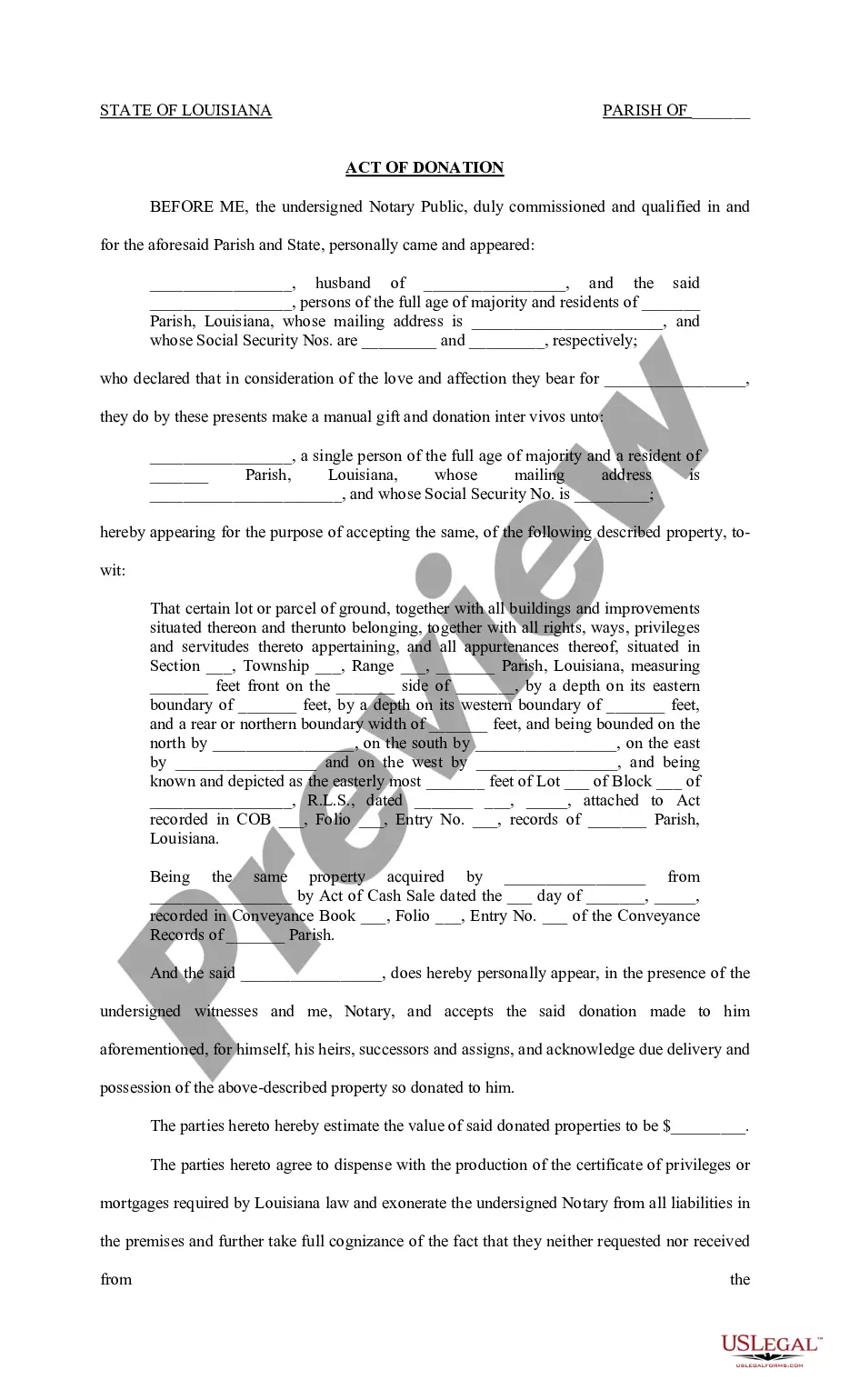

File with your local Registry of Deeds. Check List – Fill out the Homestead Declaration Form completely, sign it and have it notarized.You'll need to complete an application form, provide necessary documentation, and submit it to the appropriate authority. Depending on your state, you can apply for your exemption online or you'll need to visit a local government office to fill out the paperwork. Complete a Homestead Declaration to protect your primary residence against certain creditors and liens with added benefits for those 62 and older. Qualifying individuals must submit an application in order to receive the homestead exemption. Homestead Exemption Application Information.