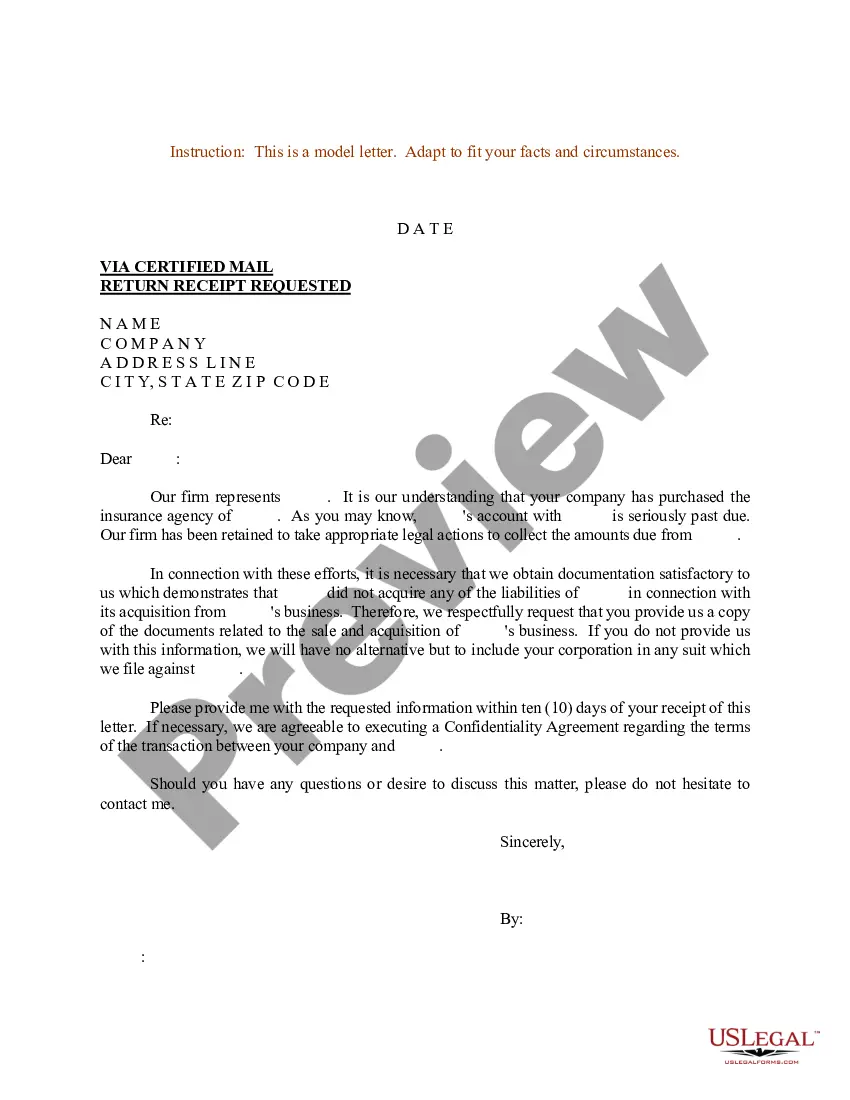

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Property Tax Exemption Form For Veterans In Massachusetts

Description

Form popularity

FAQ

Eligible veterans are entitled to a property tax exemption if their municipality has voted to accept the exemptions.

Social Security benefits are not included in Massachusetts income. For federal purposes, these benefits may be included in federal gross income depending on income thresholds. Pension Income is generally included in both Massachusetts and federal income.

Massachusetts laws Includes clauses for real estate tax exemptions for blind persons, qualifying senior citizens, qualifying surviving spouses, minor children and elderly persons, qualifying veterans, and religious and charitable organizations.

Annuity Payments As part of the HERO Act, the annuity will be increasing from $2,000 to $2,500 over 2 years. Veterans will receive a payment of $1,250 in February of 2025. Starting in August of 2025, veterans will receive one annuity check per year of $2,500. Learn more and apply here.

Homestead Exemption - Additional Benefit Must be 65 or older on or before January 1 of that tax year to qualify. You only apply once-unless circumstances change. For information, call the Tax Assessor's office 662-469-8029.

You must be 70 or older. For Clauses 41C and 41C½, the eligible age may be reduced to 65 or older, by vote of the legislative body of your city or town. You must own and occupy the property as your domicile.

Massachusetts laws Includes clauses for real estate tax exemptions for blind persons, qualifying senior citizens, qualifying surviving spouses, minor children and elderly persons, qualifying veterans, and religious and charitable organizations.