Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Florida Homestead Exemption For Married Couples In Mecklenburg

Description

Form popularity

FAQ

However, to be eligible for the homestead exemption, the owner must be a permanent resident of Florida and have a present intent of living at the property. Additionally, the owner must apply for the exemption. Generally, a married couple is entitled to only one homestead exemption.

This requirement of the Florida constitution is referred to as 'joinder of spouse' and simply means that the non-owner spouse must sign the deed or mortgage for it to be valid. Joinder of spouse is required even if the other spouse isn't a co-owner of the property and/or is no longer residing on the property.

A married couple or family unit can claim only one homestead or similar residency-based exemption (Florida Constitution, Article VII Section 6(b)).

Art. X, § 4(c), Fla. Const. However, Florida law allows spouses to waive all types of spousal rights, including rights to the homestead.

You are 65 years of age, or older, on January 1; You qualify for, and receive, the Florida Homestead Exemption; Your total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

Technically it's not possible to do that, because you must claim the homestead exemption in the state that is your permananent residence, and you can only have one state as permanent residence since you must spend more than 180 days in that place.

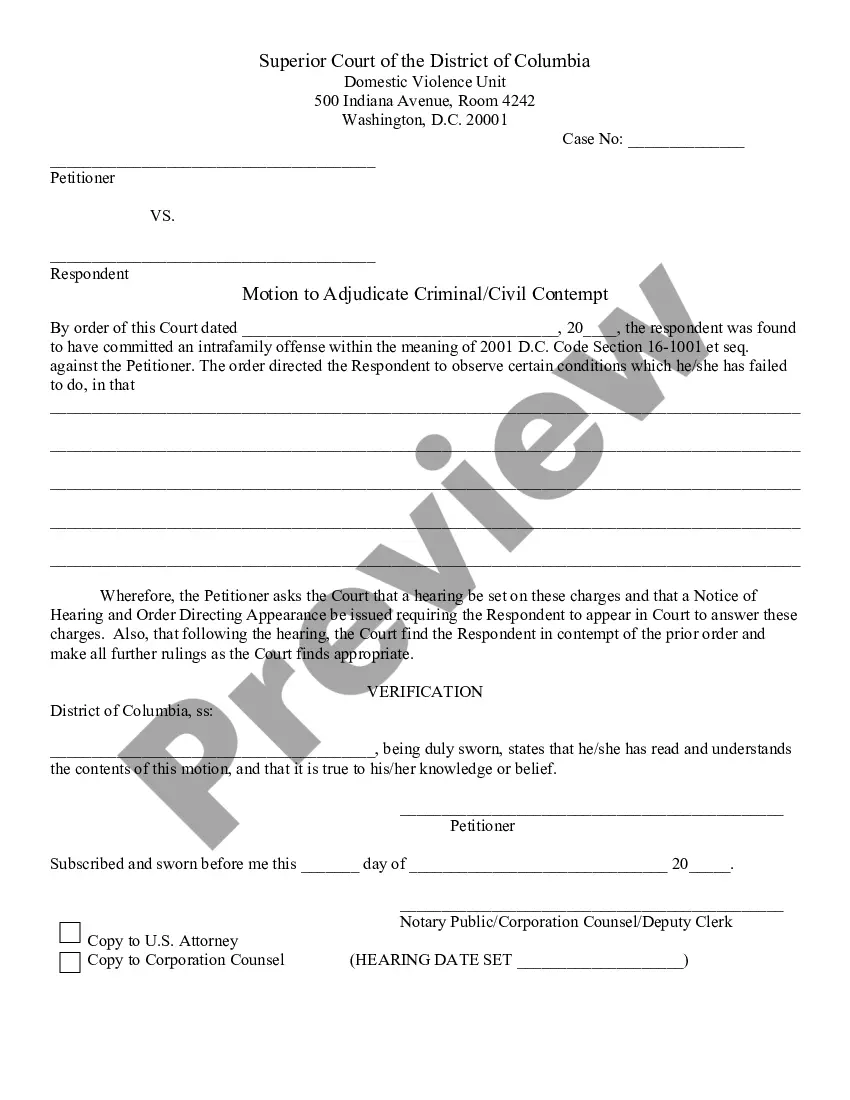

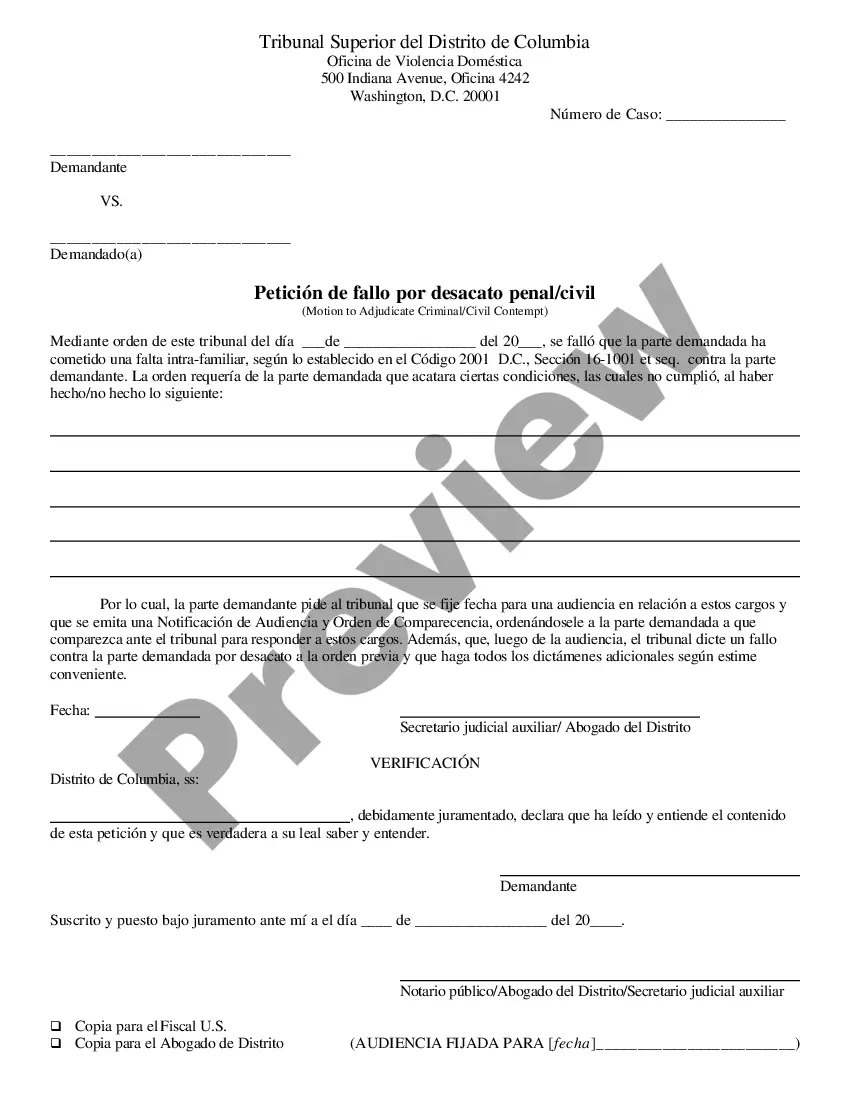

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

Outside of your tax circumstances, having two primary residences is possible on the lender side. For example, a married couple could acquire two primary residences if each spouse buys a primary residence and keeps their mortgages separate. This would mean each spouse having sufficient income on their own to buy a home.

Unfortunately, that is illegal. Under our Florida law, specifically Florida Statutes §196.031 and Section 6(b) Article VII of the Florida Constitution state that no more than one exemption is allowed to any individual or family unit.

The “One Exemption Per Family Unit” Rule Since 1968, the Florida Constitution has stated that only one homestead exemption is allowed per individual or family unit.