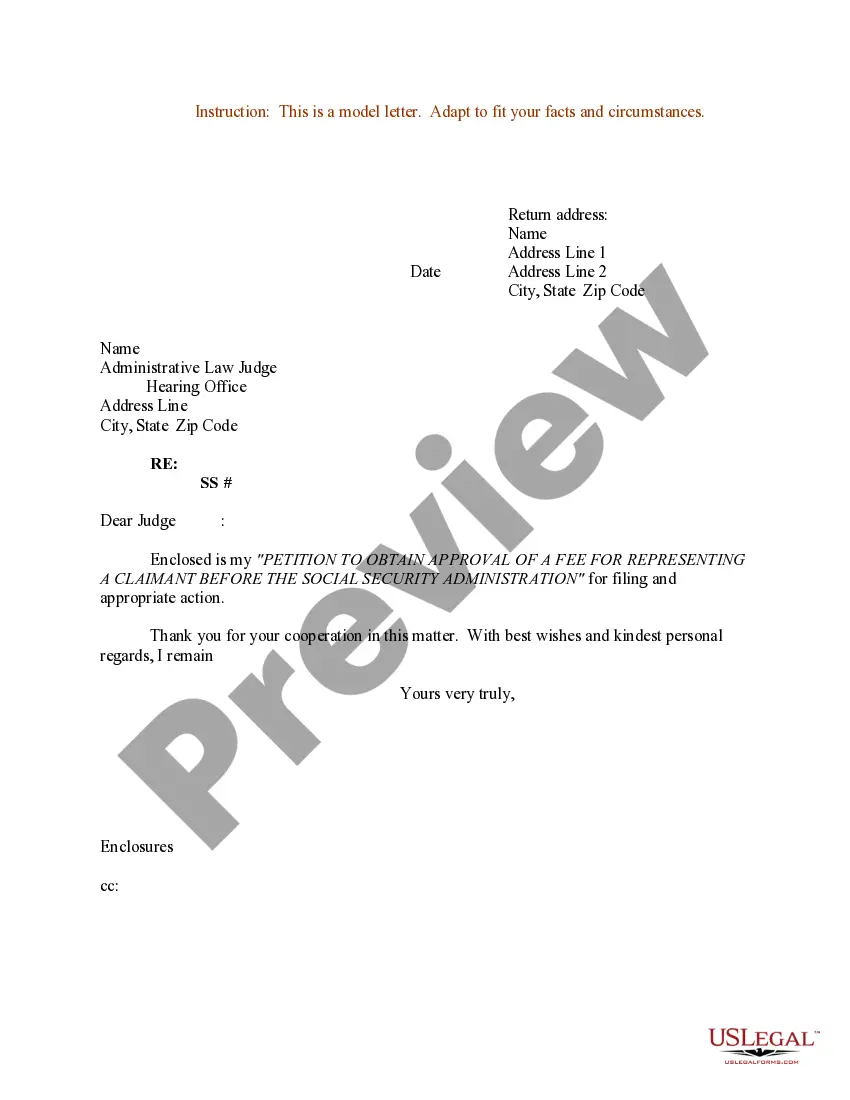

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Application In Texas In Miami-Dade

Description

Form popularity

FAQ

Note: Applications will be processed in the order they are received. We strive to process exemptions as quickly as possible, but at times processing could take up to 90 days to process, per Texas Property Tax Code Section 11.45.

REQUIRED DOCUMENTATION Attach a copy of each property owner's driver's license or state-issued personal identification certificate. The address listed on the driver's license or state-issued personal identification certificate must correspond to the property address for which the exemption is requested.

The Homestead Exemption is a valuable property tax benefit that can save homeowners up to $50,000 on their taxable value. The first $25,000 of this exemption applies to all taxing authorities. The second $25,000 excludes School Board taxes and applies to properties with assessed values greater than $50,000.

Homestead exemption applicants must submit a copy of Texas Driver License (Texas ID for non licensed drivers) Applicants must affirm no other Homestead is claimed in or outside of Texas.

The property must be your principal residence and you cannot claim a homestead exemption on any other property. You must provide a valid Texas driver's license or Texas identification card and the address listed must match the address for which the exemption is requested.

There are multiple ways to file a Homestead Exemption application Form 50-114, however the online option is the fastest, and details are provided in the transcript below.

The first $25,000 applies to all property taxes. The additional $25,000 applies to any assessed value over $50,000 and only to non-school taxes. First time applicants are required to furnish their social security number, and should have available evidence of ownership i.e., deed, contract, etc.

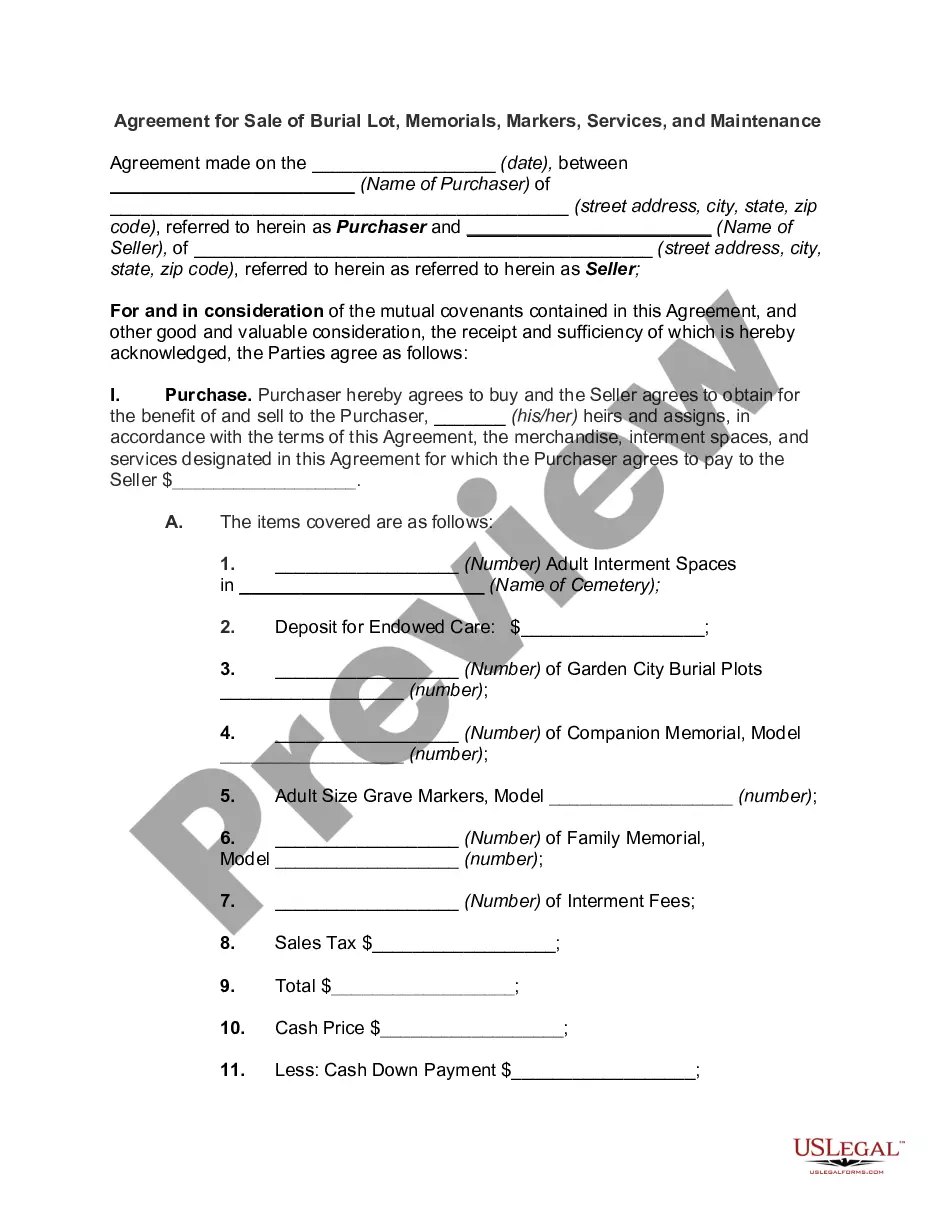

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

Homestead exemption is $25,000 deducted from your assessed value before the taxes are calculated plus an additional homestead exemption up to $25,000 applied to the assessed value above $50,000. The additional exemption does not apply to school taxes.