Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Exemption With Trust In Miami-Dade

Description

Form popularity

FAQ

The Homestead Exemption is a valuable property tax benefit that can save homeowners up to $50,000 on their taxable value. The first $25,000 of this exemption applies to all taxing authorities. The second $25,000 excludes School Board taxes and applies to properties with assessed values greater than $50,000.

You are 65 years of age, or older, on January 1; You qualify for, and receive, the Florida Homestead Exemption; Your total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

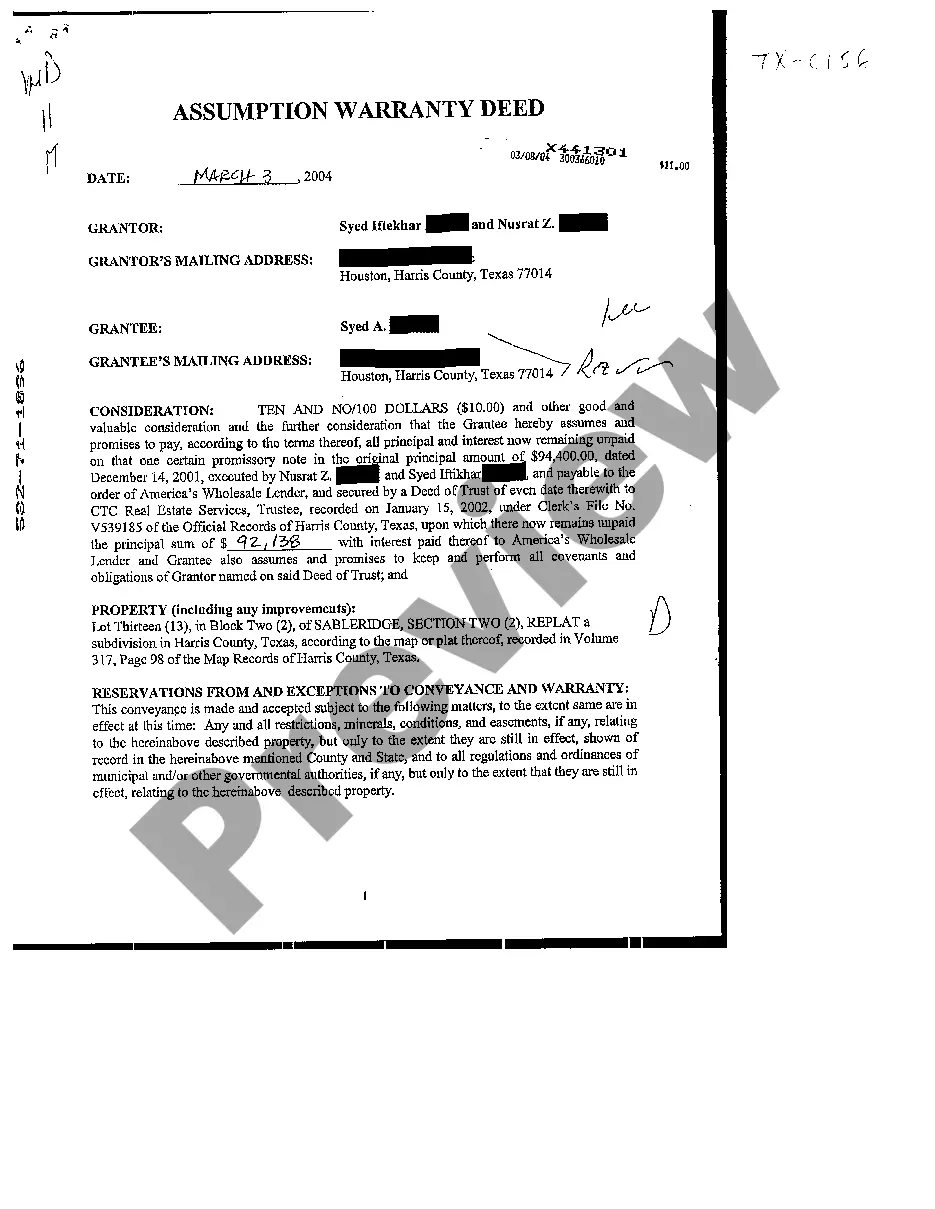

In brief, Florida case law and opinions issued by the Florida Attorney General recognize that Trust beneficiaries can maintain their homestead exemption as long as they meet certain requirements, even though the Florida Constitution does not explicitly address homestead protection for properties held in Trust.

The answer, in brief, is a resounding yes — with caveats, of course. ing to Section 196.041(2) of the Florida Statutes, it's entirely possible to retain your homestead tax exemption even if your property is held in trust.

Homestead exemption is $25,000 deducted from your assessed value before the taxes are calculated plus an additional homestead exemption up to $25,000 applied to the assessed value above $50,000. The additional exemption does not apply to school taxes.

The Homestead Exemption is a valuable property tax benefit that can save homeowners up to $50,000 on their taxable value. The first $25,000 of this exemption applies to all taxing authorities. The second $25,000 excludes School Board taxes and applies to properties with assessed values greater than $50,000.

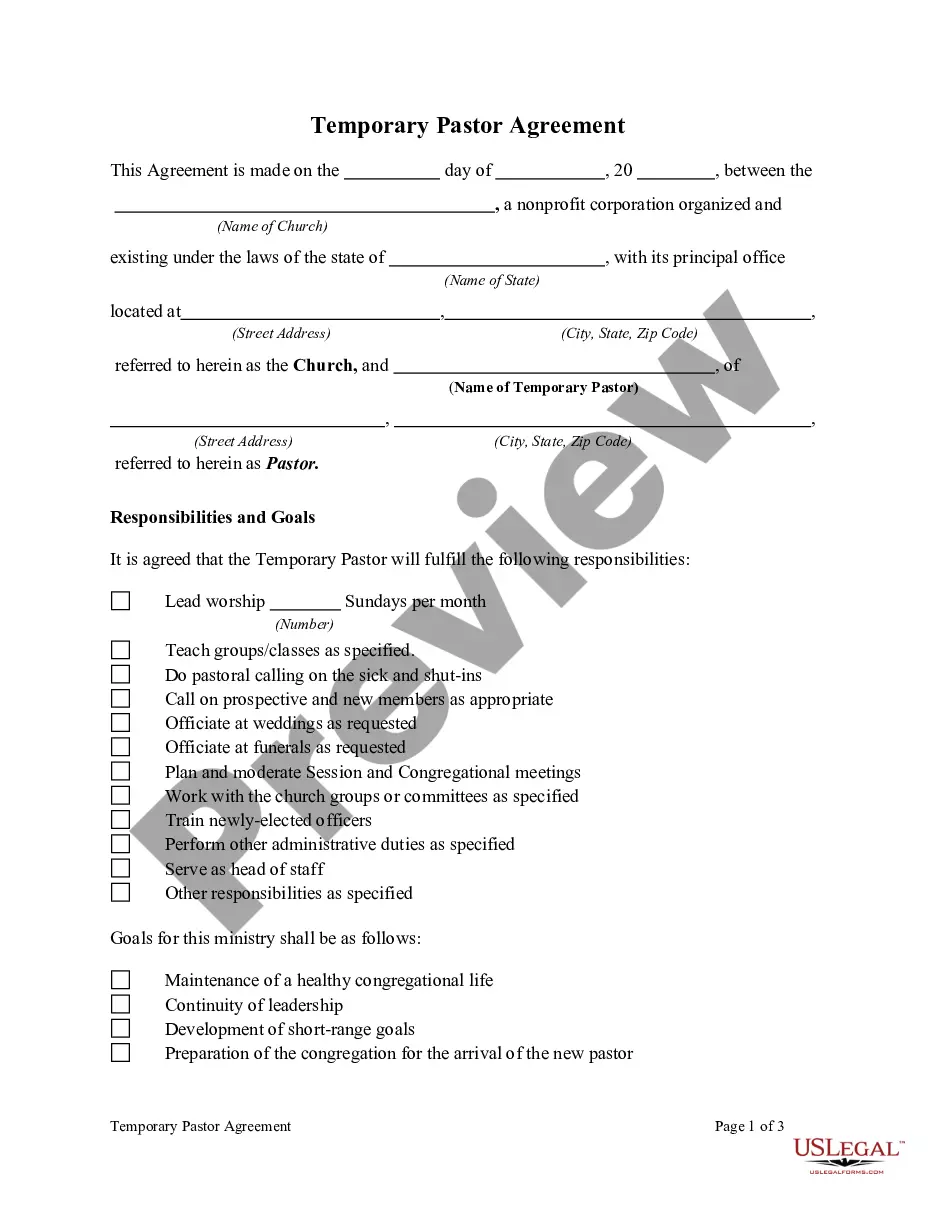

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.