Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Exemption Form Homestead With Senior Citizens In Palm Beach

Description

Form popularity

FAQ

Senior Citizens + Based on the prior year's income, the household income limit is $36,614 for the 2024 exemption. This does not include tax-exempt bond interest or non-taxable social security income. You will be asked to provide a copy of your Federal 1040 Tax Form or your Social Security 1099 Form.

There are three ways to file: E File. Visit one of our five Service Centers to file in person. Complete the application form, print it out, and mail it to our office.

Palm Beach County Provides an additional exemption of up to $50,000 for seniors 65 and older whose household income falls below a specified limit that adjusts annually.

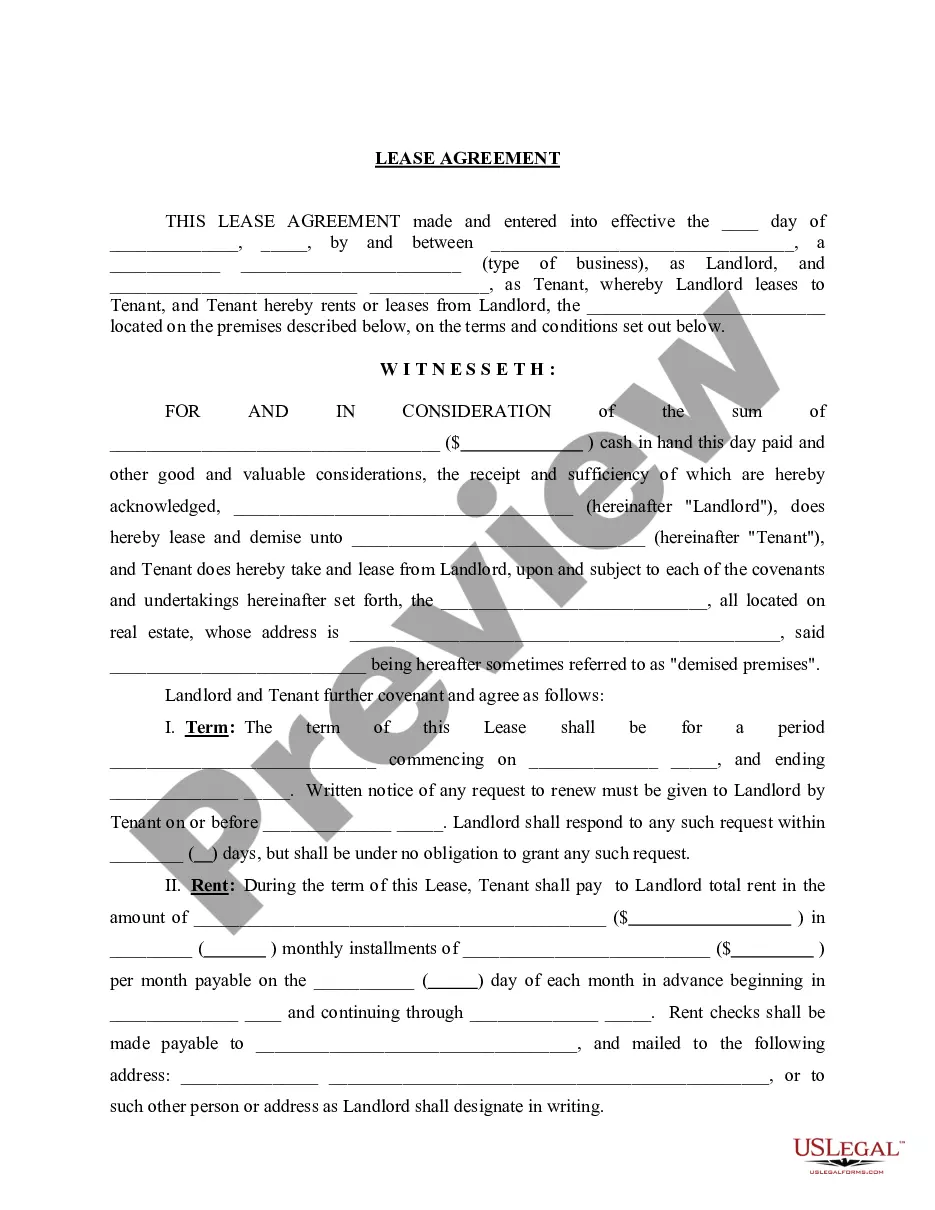

When someone owns property and makes it his or her permanent residence or the permanent residence of his or her dependent, the property owner may be eligible to receive a homestead exemption that would decrease the property's taxable value by as much as $50,000.

Exemptions - Do You Qualify? Exemption TypeAmount of Exemption Homestead Homestead Additional $25,000 Up to $25,000 Widow/Widower $5,000 Limited Income Senior Citizen exemption In addition to the county-wide exemption, some municipalities offer additional tax savings $25,00012 more rows

You are 65 years of age, or older, on January 1; You qualify for, and receive, the Florida Homestead Exemption; Your total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

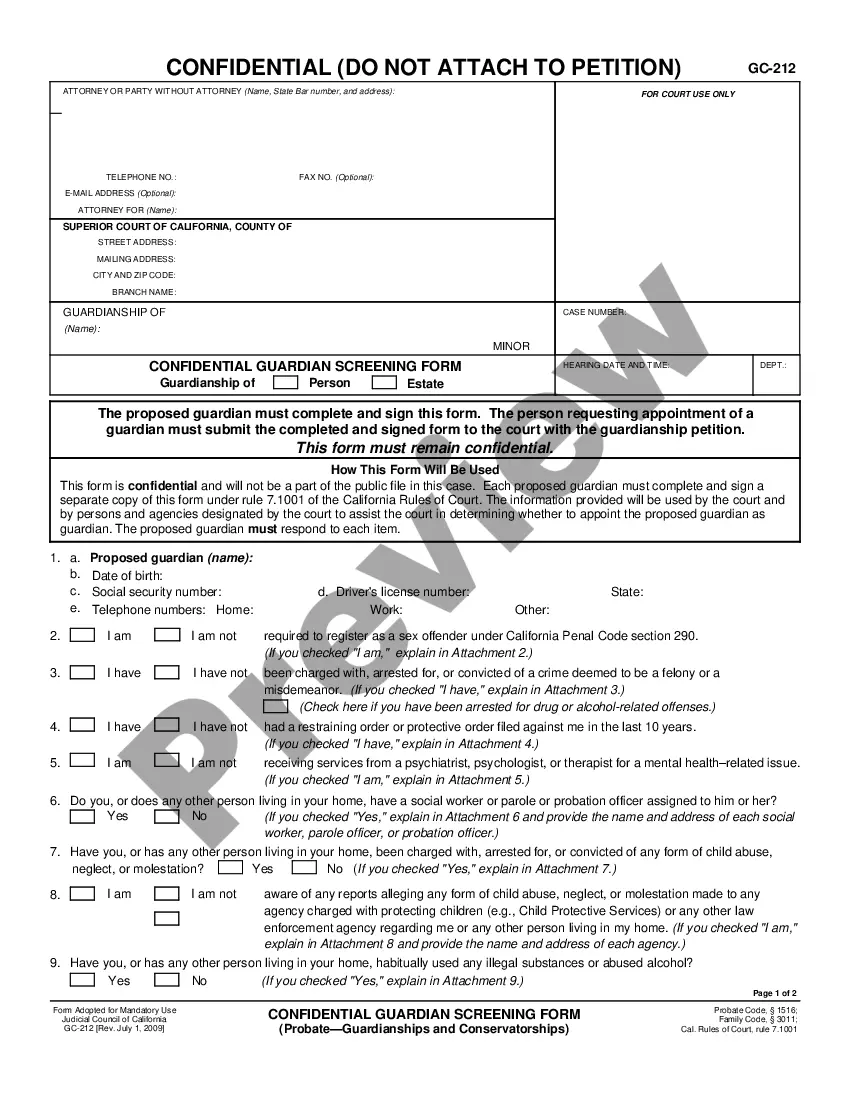

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

Exemptions - Do You Qualify? Exemption TypeAmount of Exemption Homestead Homestead Additional $25,000 Up to $25,000 Widow/Widower $5,000 Limited Income Senior Citizen exemption In addition to the county-wide exemption, some municipalities offer additional tax savings $25,00012 more rows

To be eligible for a homestead exemption, you must own and occupy your home as your permanent residence on January 1. The deadline to file timely for the 2025 Tax Roll is March 1, 2025. Late filing is permitted through early September.

There are three ways to file: E File. Visit one of our five Service Centers to file in person. Complete the application form, print it out, and mail it to our office.