Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Act Tax Credit For Seniors In Palm Beach

Description

Form popularity

FAQ

Qualifying seniors receive deductions off their tax bills because they are senior citizens. The senior citizen exemption reduces the tax bill by a sum certain each year. The actual deduction is $5,000 times the local tax rate.

You must live in the home to qualify for the tax break. Some states exempt a certain percentage of a home's value from property taxes, while other states exempt a set dollar amount. If your state uses a percentage method, the exemption will be more valuable to homeowners with more valuable homes.

A person seeking exemption under number 2 above must meet gross income limitations. Gross income includes veterans' and social security benefits. The gross income of all persons residing in the homestead for the prior year cannot exceed $14,500.

You are 65 years of age, or older, on January 1; You qualify for, and receive, the Florida Homestead Exemption; Your total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

Government Senior Citizen - $25,000 for all permanent residents of Florida. - $500 for widows who are permanent residents of Florida. - $500 for permanent residents of Florida who are totally and permanently disabled. - Total exemptions for any real estate owned and used as a homestead by a Quadriplegic.

Long-term Resident Senior Exemption The property must qualify for a homestead exemption. At least one homeowner must be 65 years old as of January 1. Total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits. Have lived in the home for at least 25 years.

The total household income limitation is the same for both exemptions. It is made available by the Florida Department of Revenue annually and subject to change each year. The adjusted income limitation for the 2024 exemptions is $36,614.

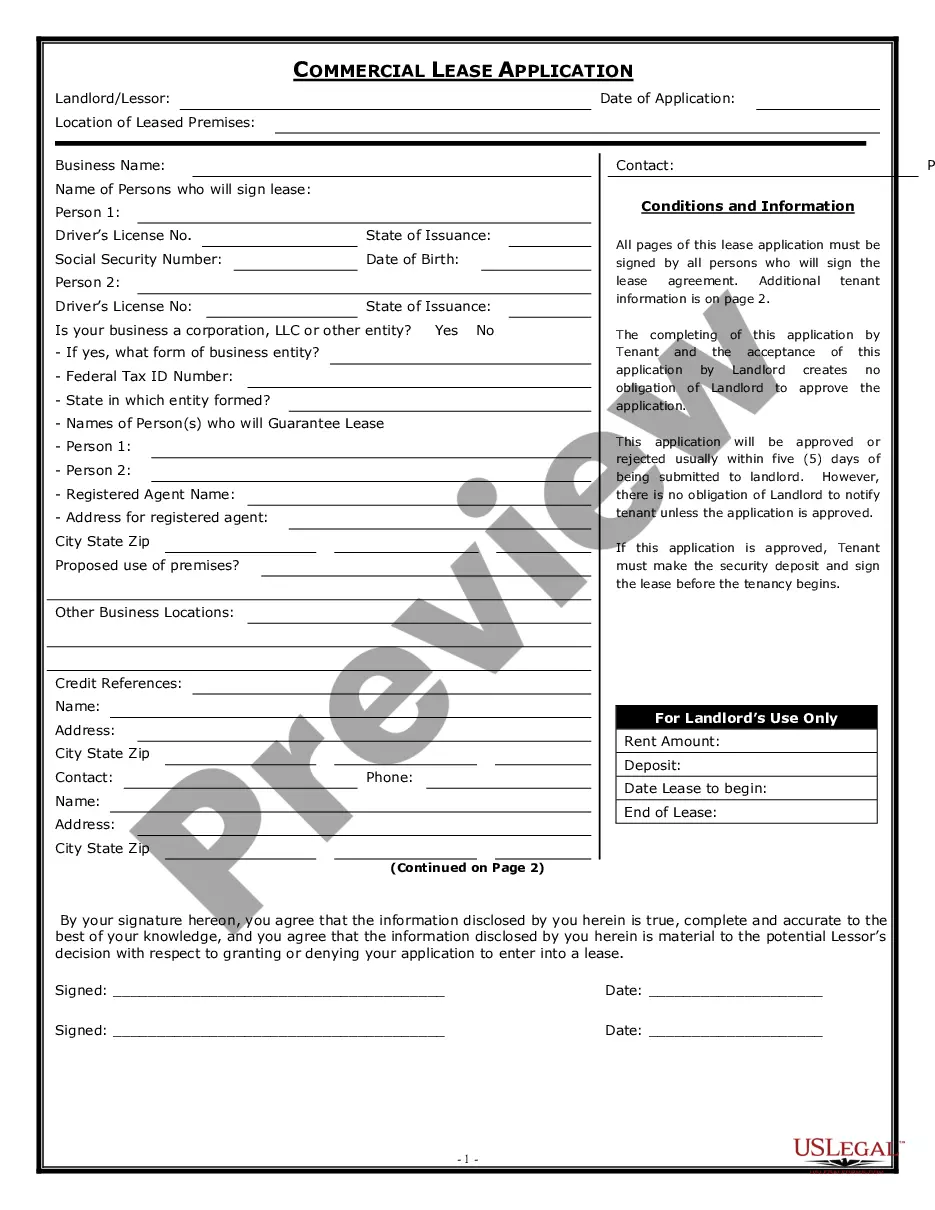

First-time Homestead Exemption applicants and persons applying for the Homestead Assessment Difference (Portability) can file online.

To get a homestead deduction on your Florida taxes, you have to fill out an application form, the DR-501, and demonstrate proof of residence by March 1 of the year for which you wish to qualify.