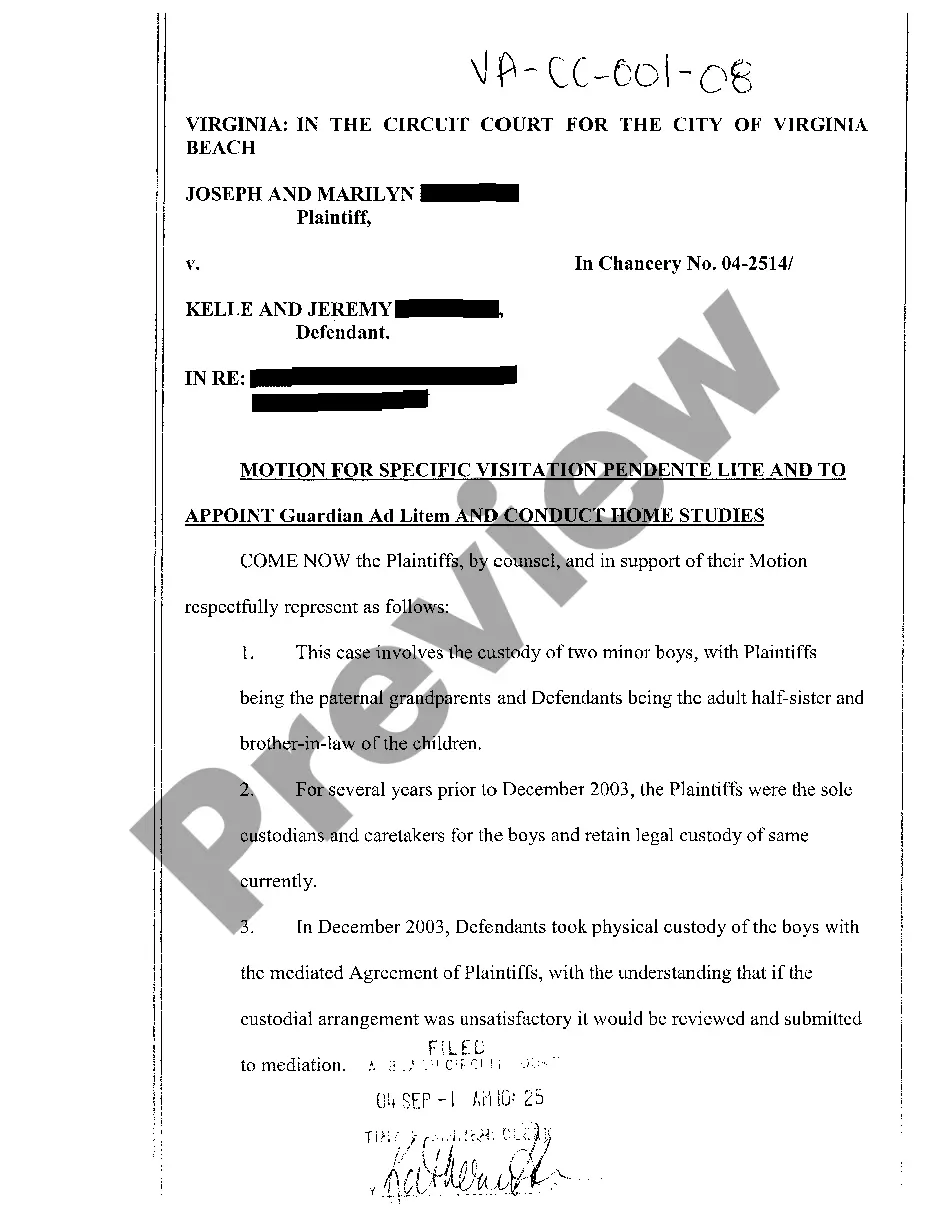

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Florida Homestead Exemption Explained In Pennsylvania

Description

Form popularity

FAQ

You are 65 years of age, or older, on January 1; You qualify for, and receive, the Florida Homestead Exemption; Your total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000.

The Homestead Exemption reduces the taxable portion of your property's assessed value. With this exemption, the property's assessed value is reduced by $100,000. Most homeowners will save about $1,399 a year on their Real Estate Tax bill starting in 2025.

You are no longer eligible for Homestead Exemption if: 1. The residential unit on which you claim homestead exemption is rented. 2. The residential unit is no longer your permanent home.

Must be age 60 or older, or, if married, either spouse must be age 60; or be a widow or widower age 50 to 60 years; or permanently disabled and age 18 to 60 years. The applicant must meet the required age by end of the year of application.

You are 65 years of age, or older, on January 1; You qualify for, and receive, the Florida Homestead Exemption; Your total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

Filing for a homestead exemption in Florida can lead to substantial property tax savings. The exemption is designed to reduce the taxable value of a homeowner's primary residence, ultimately lowering the overall property tax bill. Florida law provides a generous exemption of up to $50,000 for eligible homesteads.

The Homestead Exemption reduces the taxable portion of your property's assessed value. With this exemption, the property's assessed value is reduced by $100,000. Most homeowners will save about $1,399 a year on their Real Estate Tax bill starting in 2025.

While the specifics can vary by state, generally, homestead exemptions are only available for an individual or family's primary residence. This means you cannot claim homestead exemptions in multiple states.