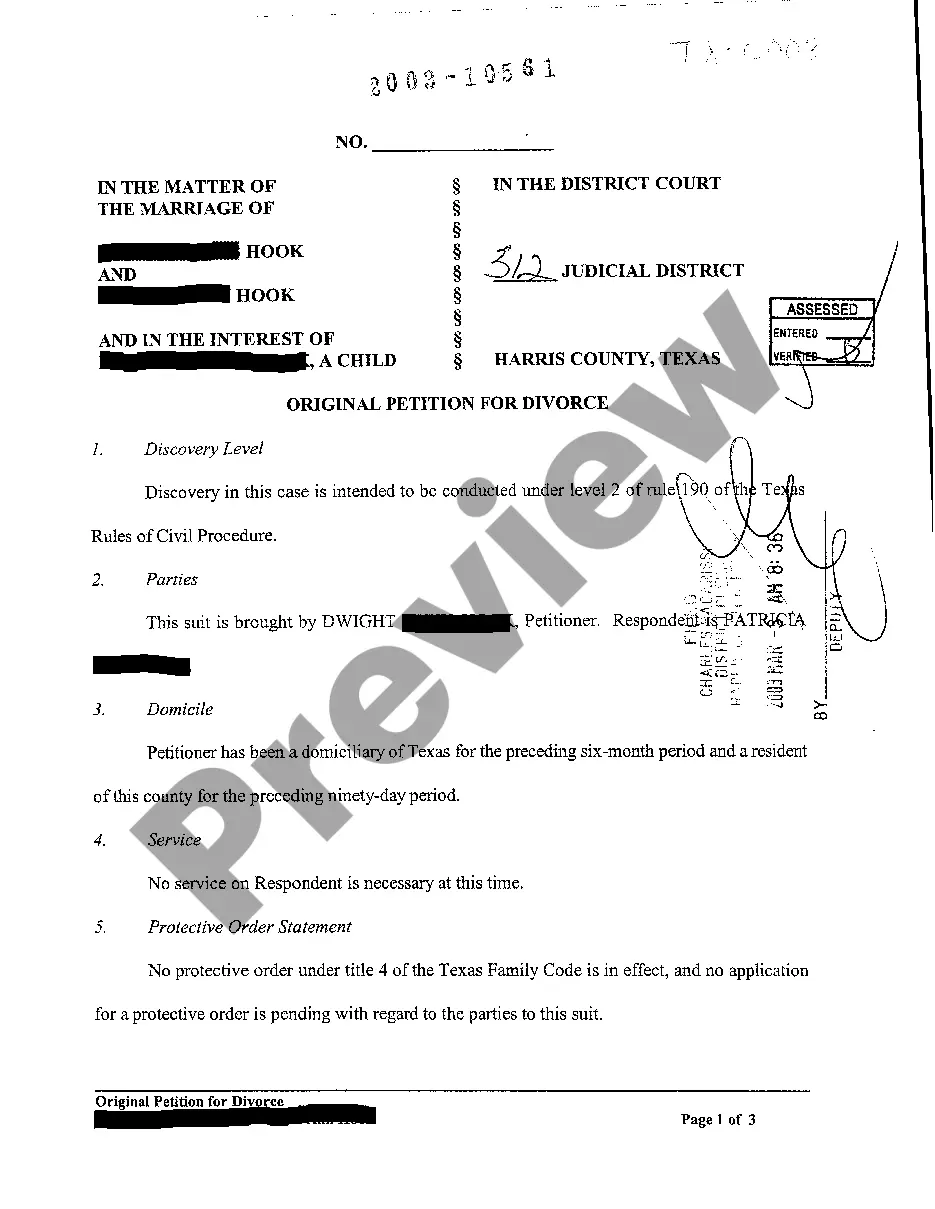

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Florida Homestead Exemption For First Responders In Phoenix

Description

Form popularity

FAQ

Homestead Exemption: Every person who has legal or equitable title to real property in the State of Florida and who resides thereon and in good faith makes it his or her permanent home is eligible to receive a homestead exemption of up to $50,000. The first $25,000 applies to all property taxes.

(2) Any real estate that is owned and used as a homestead by a person who has a total and permanent disability as a result of an injury or injuries sustained in the line of duty while serving as a first responder in this state or during an operation in another state or country authorized by this state or a political ...

Property Tax Exemptions and Additional Benefits Further benefits are available to property owners with disabilities, senior citizens, veterans and active duty military service members, disabled first responders, and properties with specialized uses.

The Basic Rules. The homestead exemption is available to any adult (18 or over) who resides within the state. Only one homestead may be held by a married couple or a single person. The value of the homestead refers to the equity of a single person or married couple.

Claiming a Homestead Exemption The Arizona homestead exemption is automatic, meaning that no written claim is required. If a person desires to waive the exemption, the person must record the waiver in the office of the county recorder.

First-time Homestead Exemption applicants and persons applying for the Homestead Assessment Difference (Portability) can file online.

In addition to the proof of Florida residency, you must be residing on the property as your primary residence as of January 1st. Social Security numbers are required for all owners and their spouses making application, even if the spouse does not own and/or reside on the property, per Florida Statute.