Nebraska Homestead Exemption For Veterans In Riverside

Description

Form popularity

FAQ

Summary of Nebraska Military and Veteran Benefits: Nebraska offers special benefits for Service members, Veterans and their Families including the Nebraska Veterans Aid Fund, homestead property tax exemptions, tuition assistance for Service members, Veterans and dependents, special vehicle license plates, as well as ...

The Nebraska Homestead Exemption program offers vital property tax relief for homeowners in Nebraska who occupy their primary residence from January 1 through August 15. If you qualify, you may be eligible for a reduction in your property taxes.

Summary of Nebraska Military and Veteran Benefits: Nebraska offers special benefits for Service members, Veterans and their Families including the Nebraska Veterans Aid Fund, homestead property tax exemptions, tuition assistance for Service members, Veterans and dependents, special vehicle license plates, as well as ...

Overall, the highest paying areas for veterans in 2019 included Washington, D.C. ($102,900), Connecticut ($101,000), New Jersey ($98,000), Massachusetts ($92,000), and Michigan ($82,900).

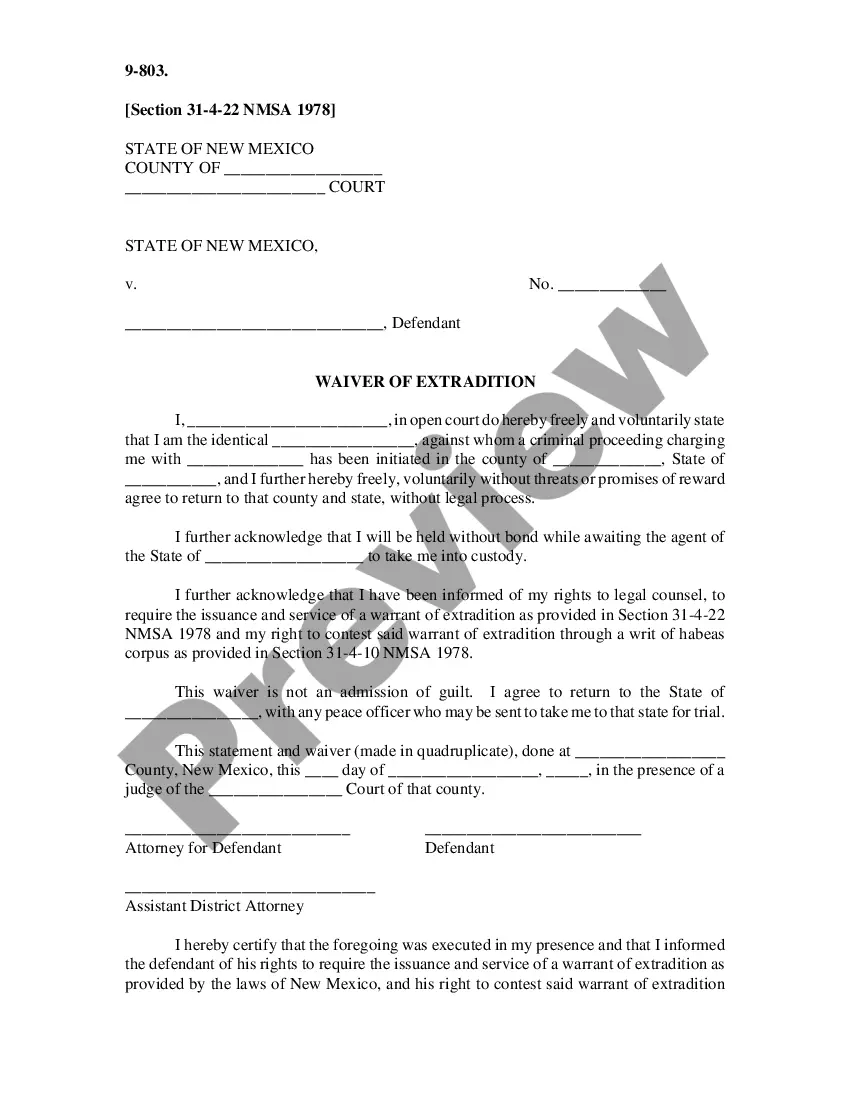

Nebraska Wartime Veteran and Surviving Spouse Homestead Property Tax Exemptions: The Nebraska Homestead Exemption Program offers a full or partial property tax exemption for eligible Veterans and Surviving Spouses on their homestead and one acre of land.

Texas. Texas is often considered one of the best states for disabled veterans. Noteworthy benefits include: Housing Grants: Texas offers various housing grants to disabled veterans, including those for home modifications and weatherization.

All property in the State of Nebraska is subject to property tax, unless an exemption is mandated or permitted by the Nebraska Constitution or by legislation. Government-owned property used for a public purpose is exempt. If the government-owned property is not used for public purpose, it may be considered taxable.

The Nebraska homestead exemption program is a property tax relief program for six categories of homeowners: 1. Persons over age 65 (see page 8); 2. Veterans totally disabled by a nonservice-connected accident or illness (see page 8); 3.

Contact your county assessor for assistance. For more information contact your local county assessor's office, or see revenue.nebraska/PAD, or call 888-475-5101. Instructions for Previous Filers Carefully review any preprinted information to ensure it is complete and correct.