Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Act Information For Parents In Salt Lake

Description

Form popularity

FAQ

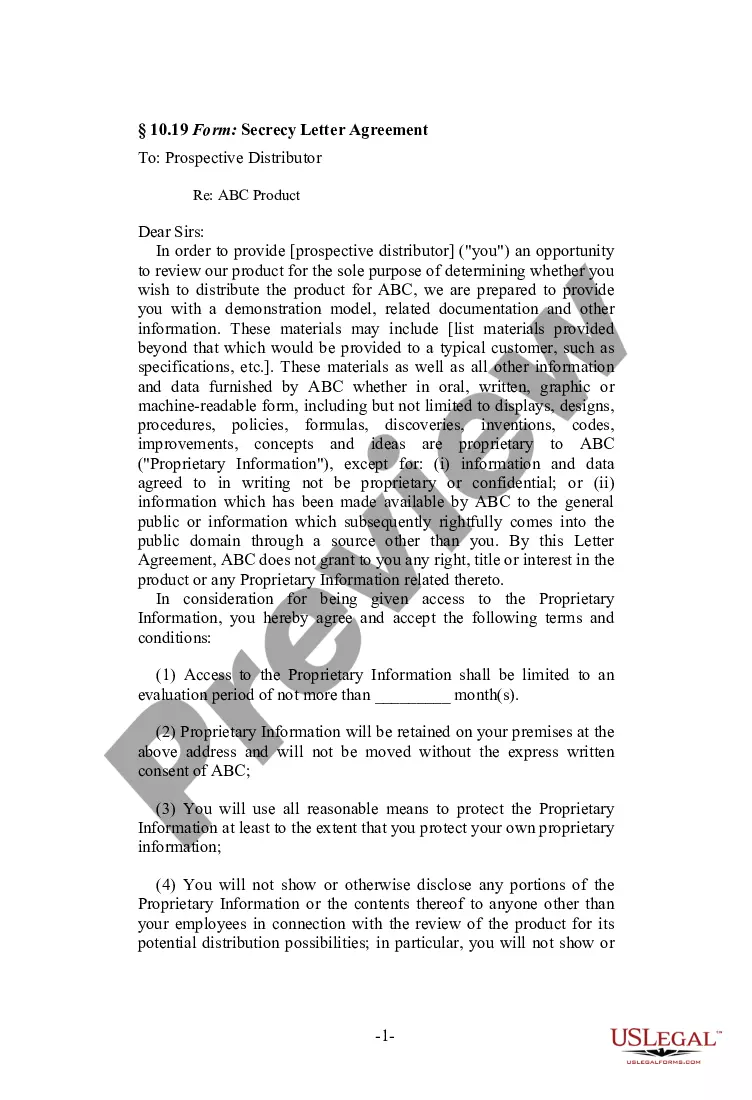

The new law established a three-fold homestead acquisition process: file an application, improve the land, and file for deed of title. Any U.S. citizen, or intended citizen, who had never borne arms against the U.S. Government could file an application and lay claim to 160 acres of surveyed Government land.

California exempts the first $7,000 of residential homestead from property taxes.

A decedent's surviving spouse is entitled to a homestead allowance of $22,500. If there is no surviving spouse, each minor child and each dependent child of the decedent is entitled to a homestead allowance amounting to $22,500 divided by the number of minor and dependent children of the decedent.

Requirements of the Homestead Act Land titles could also be purchased from the government for $1.25 per acre following six months of proven residency. Additional requirements included five years of continuous residence on the land, building a home on it, farming the land and making improvements.

You may be eligible for the primary residential exemption if you occupy your home for 183 consecutive days or more in a calendar year.