Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Exemption Form California In San Diego

Description

Form popularity

FAQ

In 2024, the exemption ranges from a minimum of $349,720 to a maximum of $699,426, based on county median home sale prices. The increased number provides more substantial equity protection for homeowners, acknowledging the varying real estate values across the state.

The protected amount is called the “homestead exemption.” All homeowners automatically have a homeowner's exemption, which protects part of their equity from involuntary sales (foreclosures). Recording a declaration of ownership extends this protection to voluntary sales.

The protected amount is called the “homestead exemption.” All homeowners automatically have a homeowner's exemption, which protects part of their equity from involuntary sales (foreclosures). Recording a declaration of ownership extends this protection to voluntary sales.

The home must have been the principal place of residence of the owner on the lien date, January 1st. To claim the exemption, the homeowner must make a one-time filing with the county assessor where the property is located.

Homeowners exemption reduces taxable value, decreasing annual property tax. Homestead exemption protects home equity from creditor claims and during bankruptcy.

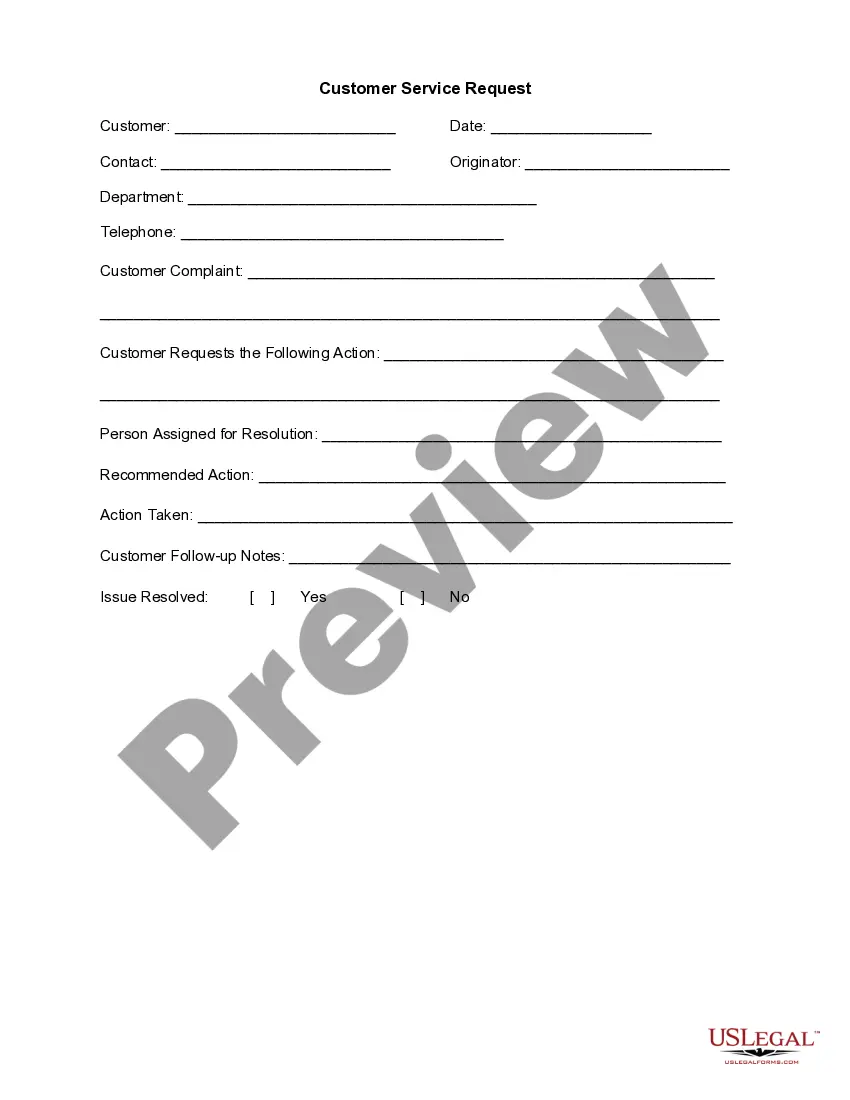

Complete form BOE-266, Claim for Homeowners' Property Tax Exemption. Obtain the claim form from the County Assessor's office where the property is located. Submit the completed form to the same office.

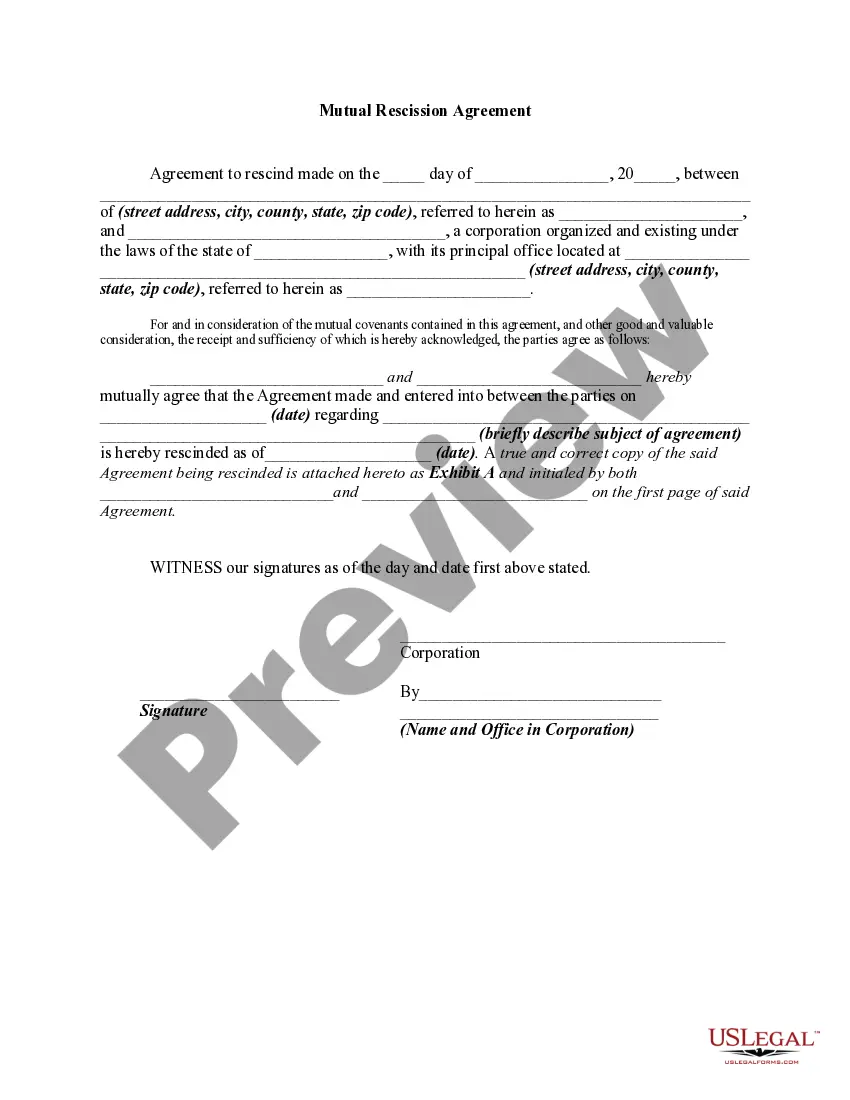

You can file a declared homestead by taking these steps: Buy a declared homestead form from an office-supply store, or download a form from the Registrar-Recorder's website. Fill out the form. Sign the form and have it notarized.