Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Pennsylvania Property Tax Exemption For Seniors In San Jose

Description

Form popularity

FAQ

The program's recent expansion became effective on January 16, 2024, when the new claim season opened. The rebate program is open to eligible Pennsylvanians age 65 and older, widows and widowers age 50 and older, and individuals with disabilities age 18 and older.

Older adults and people with disabilities 18 and older in Pennsylvania may be eligible to receive up to $1,000 in rebates.

Visit mypath.pa to access the Department of Revenue's electronic filing system. Or visit the Property Tax/Rent Rebate Program page on the department's website for more information on the program and eligibility.

A person aged 65 years or older, A person who lives in the same household with a spouse who is aged 65 years or older, or. A person aged 50 years or older who is a widow of someone who reached the age of 65 before passing away.

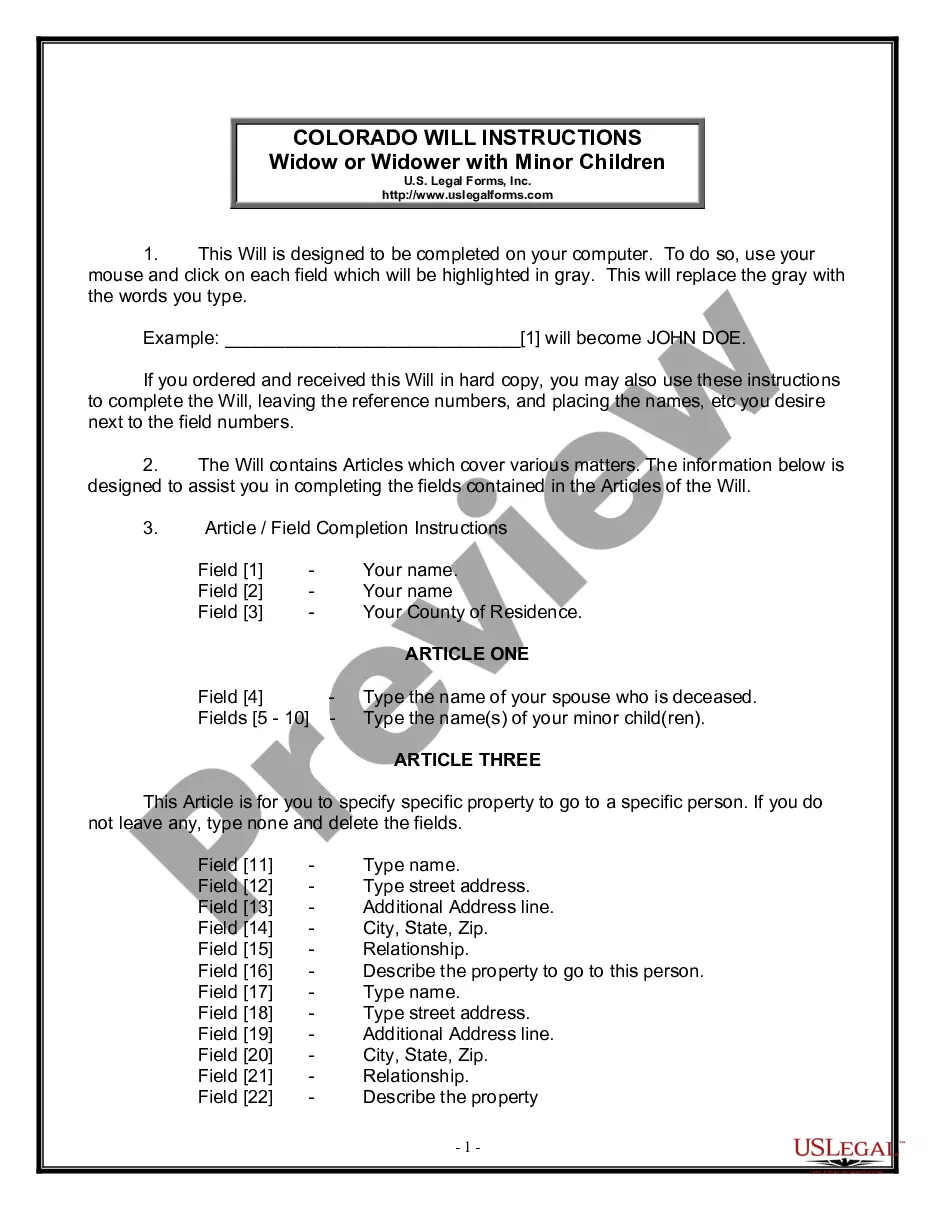

Homeowners should contact their county assessment office (position 48) for a copy of their county's homestead and farmstead application form. The March 1 application deadline for property tax relief is set in the Homeowner Tax Relief Act (Section 341 of Act 72 of 2004).

Homeowners' exemption If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the dwelling's assessed value, resulting in a property tax savings of approximately $70 to $80 annually.

Older adults and people with disabilities 18 and older in Pennsylvania may be eligible to receive up to $1,000 in rebates.