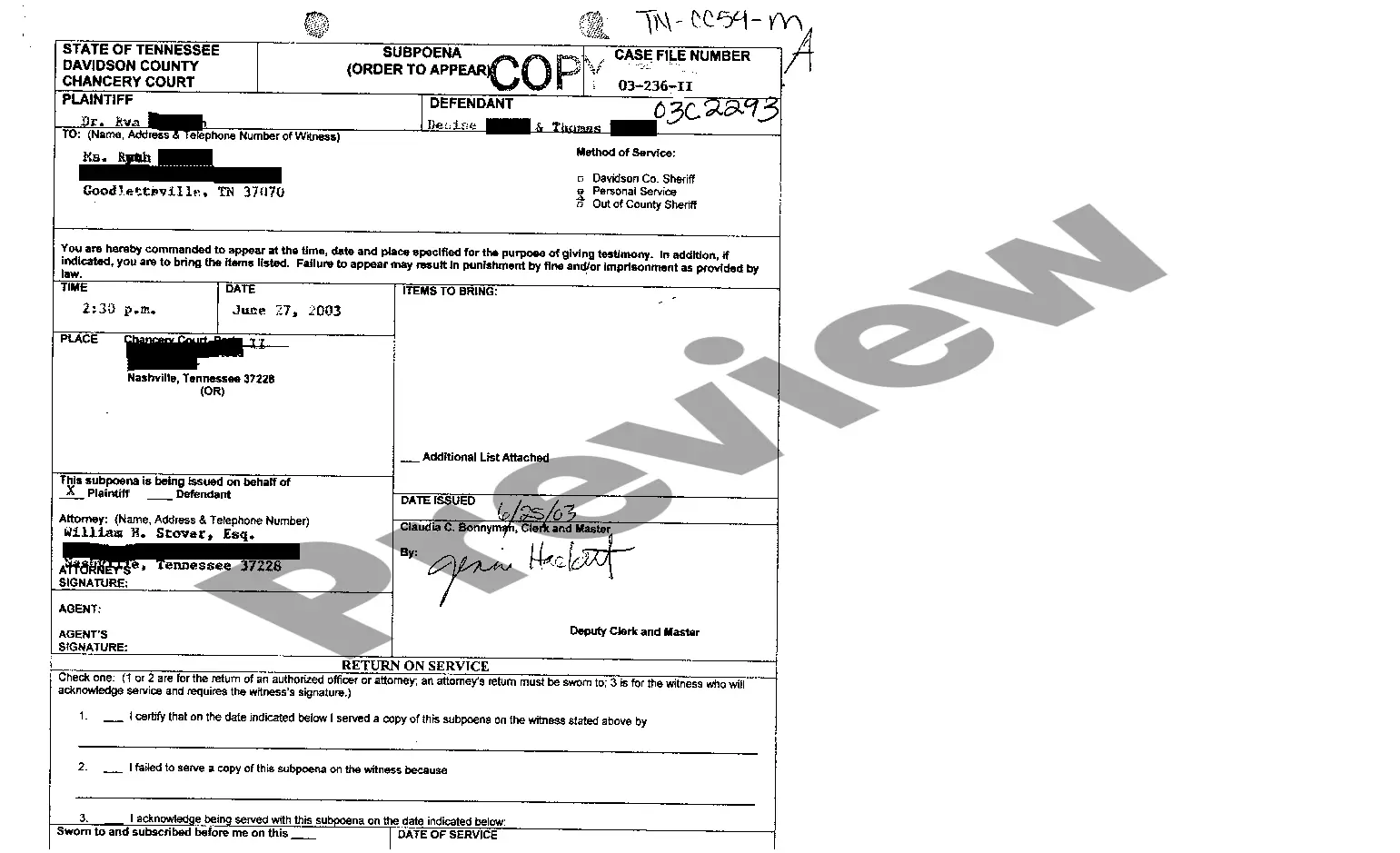

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Nebraska Homestead Exemption Application Form 458 In Santa Clara

Description

Form popularity

FAQ

Homestead Exemption 2025 Household Income Table Single Married or Closely Related Married, Closely Related, or Widowed $0 — 36,000.99 $0 — 42,300.99 $0 — 46,500.99 $36,001 — 37,900.99 $42,301 — 44,600.99 $46,501 — 48,700.99 $37,901 — 39,800.99 $44,601 — 46,900.99 $48,701 — 51,000.999 more rows

Form 458, Nebraska Homestead Exemption Application. Form 458, Schedule I - Income Statement and Instructions. Form 458B, Certification of Disability for Homestead Exemption.

Homeowners' exemption If you own and occupy your home as your principal place of residence, you may be eligible for an exemption of up to $7,000 off the dwelling's assessed value, resulting in a property tax savings of approximately $70 to $80 annually.

The Nebraska homestead exemption program is a property tax relief program for three categories of homeowners: A. Persons over age 65; B. Qualified disabled individuals; or C.

Homestead Exemption 2025 Household Income Table Single Married or Closely Related Percentage of Relief $0 — 36,000.99 $0 — 42,300.99 100% $36,001 — 37,900.99 $42,301 — 44,600.99 90% $37,901 — 39,800.99 $44,601 — 46,900.99 80%9 more rows

A county or local tax assessor's website or office will provide details on available homestead tax exemptions. Some states require an application, available online, and have deadlines.

This Form 458 Schedule I must be filed by persons applying for a homestead exemption, who are not filing as a veteran drawing compensation from the Department of Veteran's Affairs (DVA) or as a paraplegic veteran or multiple amputee whose home was substantially contributed to by the DVA.

Please Note: We are currently accepting E-file applications for the tax year 2025 only. To be eligible for homestead exemption, you must be a permanent resident of Florida, who owns real property as of January 1 of the year in which you are applying.

New applications for Homestead Exemptions may be filed online or in person, at the Property Appraiser's office between January 1 and March 1, with one exception. Florida law allows new Homestead applications only to be filed prior to January 1 of the year the exemption is to be effective.

The deadline is March 1 each year. The deadline to file a timely application for 2025 is March 3, 2025. Under Florida law, failure to file for any exemption by March 1 constitutes a waiver of the exemption privilege for 2025. How do I file?