Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Florida Homestead Exemptions For Seniors In Tarrant

Description

Form popularity

FAQ

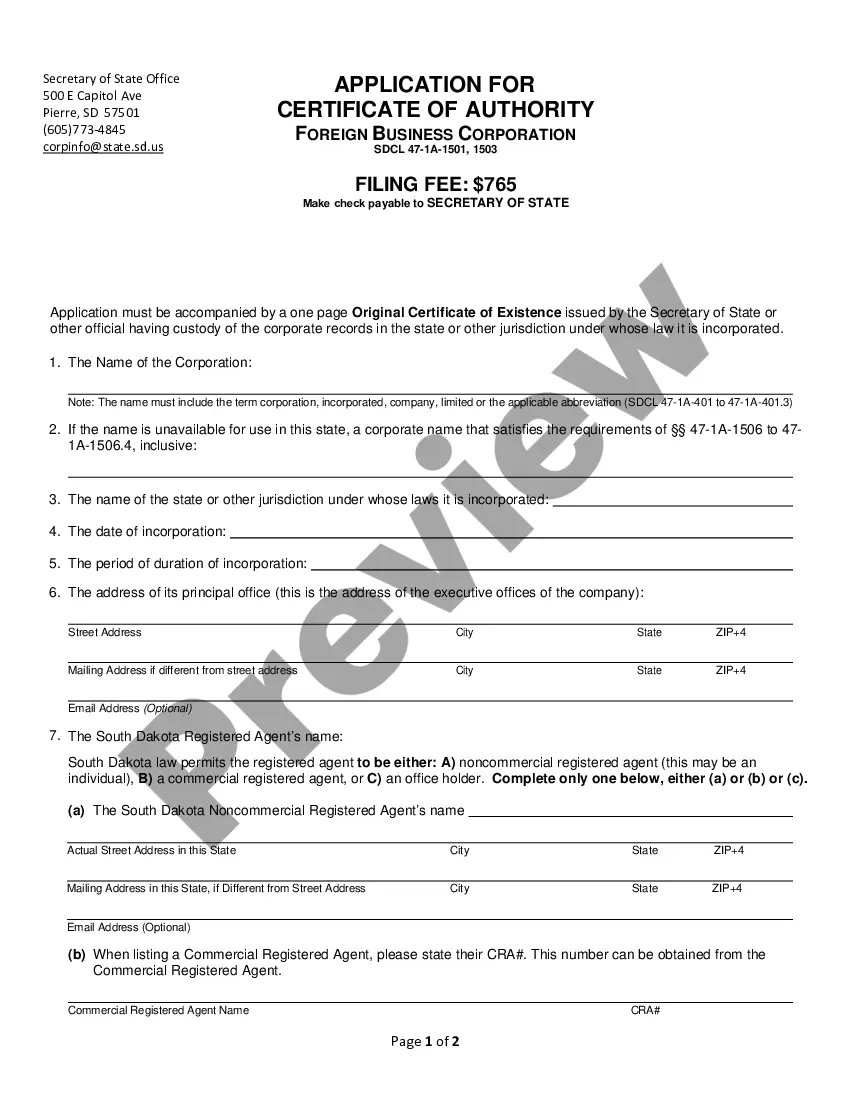

FILING INSTRUCTIONS File this form and all supporting documentation in the tax year for which the exemption is requested with the Tarrant Appraisal District - Attention: Exemption Division By Mail: PO Box 185579 Fort Worth, TX 76181-0579 or at the TAD Dropbox Location: 2500 Handley-Ederville Road, Fort Worth, TX 76118.

In addition to the proof of Florida residency, you must be residing on the property as your primary residence as of January 1st. Social Security numbers are required for all owners and their spouses making application, even if the spouse does not own and/or reside on the property, per Florida Statute.

You are 65 years of age, or older, on January 1; You qualify for, and receive, the Florida Homestead Exemption; Your total 'Household Adjusted Gross Income' for everyone who lives on the property cannot exceed statutory limits.

First-time Homestead Exemption applicants and persons applying for the Homestead Assessment Difference (Portability) can file online.

What is the Senior Exemption? Taxing EntitySenior Exemption Amount2023 Tax Rate Tarrant County $50,000 0.194500 Tarrant Hospital Dist. $50,000 0.194500 Tarrant College Dist. $50,000 0.123270 School District $10,000 1.2031002 more rows

To get a homestead deduction on your Florida taxes, you have to fill out an application form, the DR-501, and demonstrate proof of residence by March 1 of the year for which you wish to qualify.

For persons age 65 or older or disabled, Tax Code Section 11.13(c) requires school districts to provide an additional $10,000 residence homestead exemption. Tax Code Section 11.13(d) allows any taxing unit to adopt a local option residence homestead exemption. This local option exemption cannot be less than $3,000.

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.