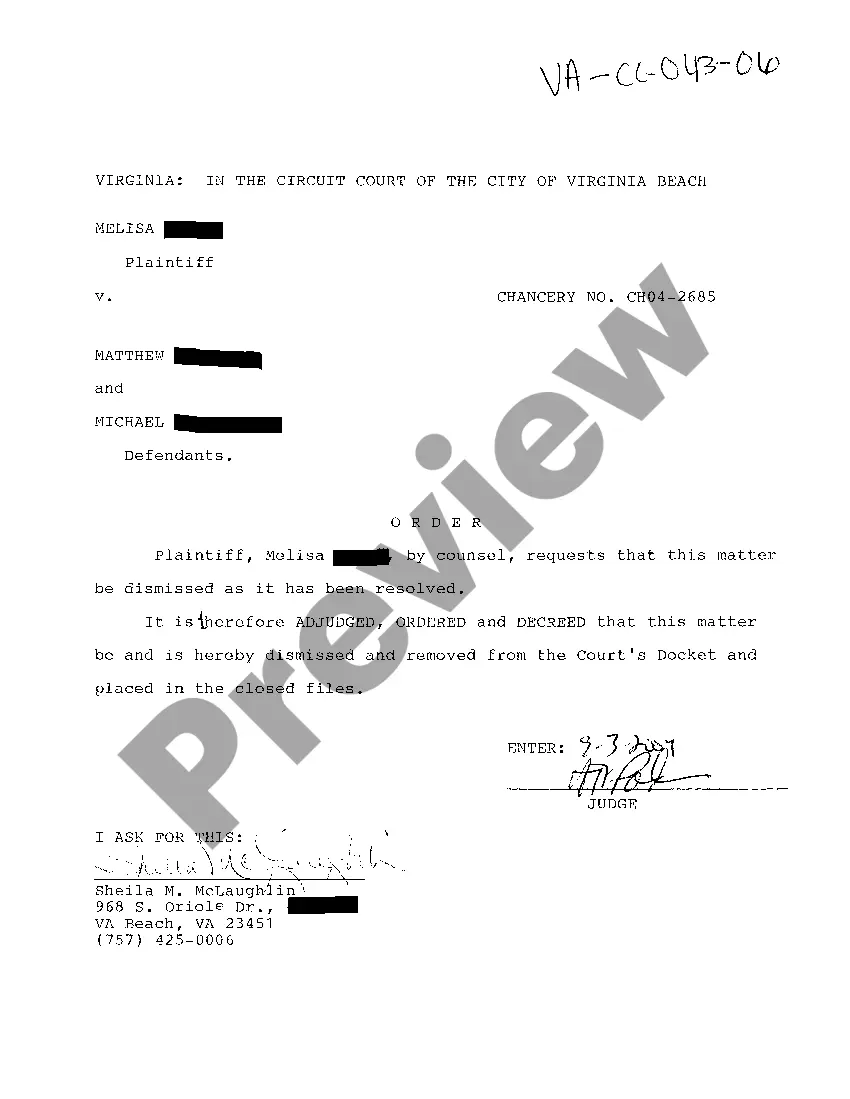

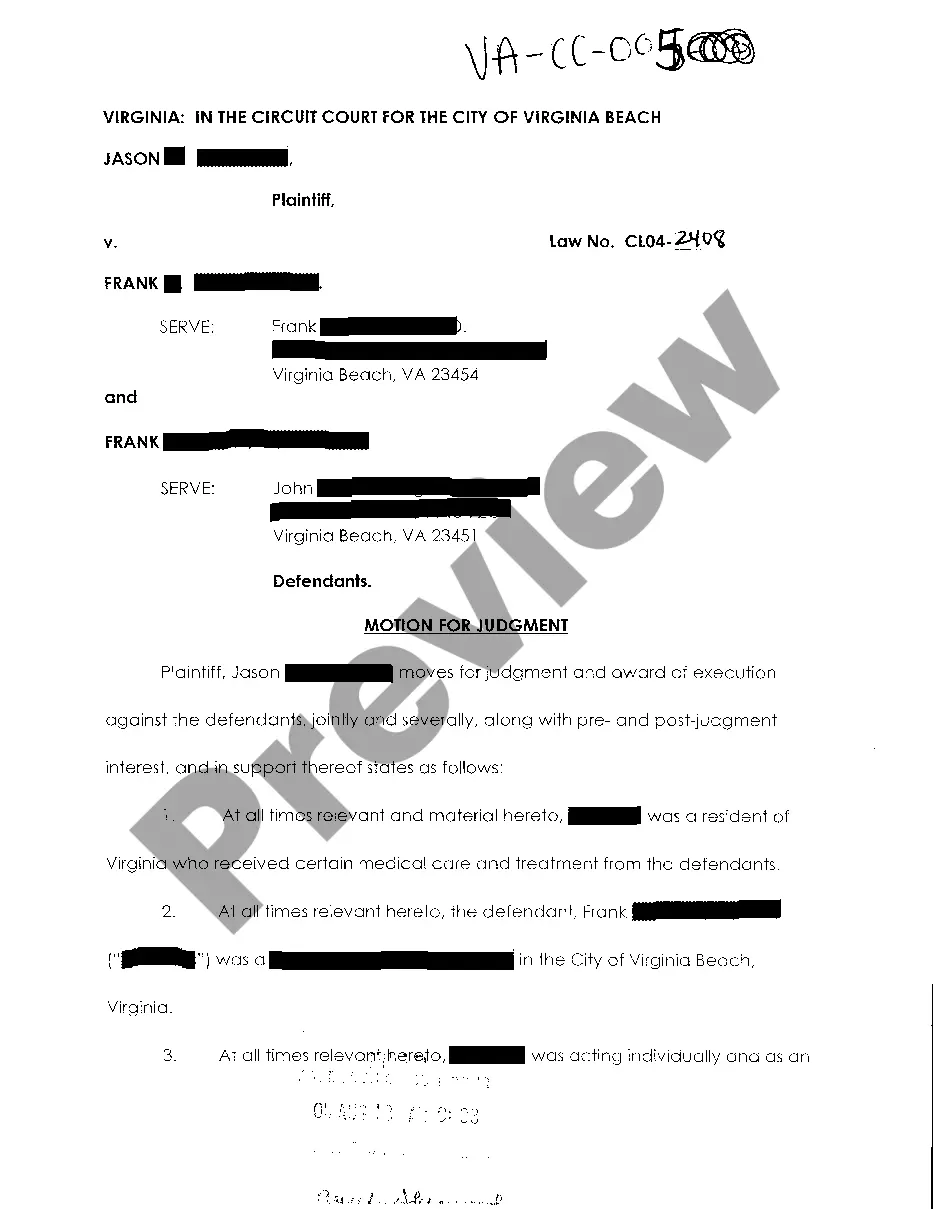

Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Homestead Exemption For Disabled Veterans In Texas

Description

Form popularity

FAQ

The sales tax exemption rules are a bit more complex in Texas. Qualifying disabled vets are exempt from the 6.25% state sales tax only on private party vehicle purchases, not from dealers. To be eligible, you need one of these VA disability ratings: Loss or paralysis of at least one lower extremity.

To qualify for the general residence homestead exemption, a home must meet the definition of a residence homestead and an individual must have an ownership interest in the property and use the property as the individual's principal residence.

Veterans who receive compensation from the VA for a service-connected 100% total and permanent disability rating or of individual unemployability are eligible for 100% property tax exemption on their homestead.

Veterans who receive compensation from the VA for a service-connected 100% total and permanent disability rating or of individual unemployability are eligible for 100% property tax exemption on their homestead.

The sales tax exemption rules are a bit more complex in Texas. Qualifying disabled vets are exempt from the 6.25% state sales tax only on private party vehicle purchases, not from dealers. To be eligible, you need one of these VA disability ratings: Loss or paralysis of at least one lower extremity.

General Exemption Form 50-114. You can use Texas Comptroller Form 50-114 to apply for the General Homestead Exemption. If you turn 65 or become newly disabled, you need to submit new application to obtain the extra exemption. These exemptions use the same Form 50-114 along with Supplemental Affidavit Form 50-144-A.

Veterans who are rated 100% due to service connected disability or in receipt of 100% compensation due to a grant of individual unemployability are entitled to an exemption from taxation of the total appraised value of the Veteran's residence homestead.