Letter from attorney to opposing counsel requesting documentation concerning homestead exemption for change of venue motion.

Florida Homestead Exemption Example In Washington

Description

Form popularity

FAQ

Filing for a homestead exemption in Florida can lead to substantial property tax savings. The exemption is designed to reduce the taxable value of a homeowner's primary residence, ultimately lowering the overall property tax bill. Florida law provides a generous exemption of up to $50,000 for eligible homesteads.

Florida's homestead law offers protection against forced sale of a primary residence by most creditors, reduces property taxes through exemptions, and limits annual property tax increases under the Save Our Homes cap.

Any property owned by the taxpayer and situated in this state is subject to the taxes exempted by the improper homestead exemption, plus a penalty of 50% of the unpaid taxes for each year and interest at a rate of 15% per annum.

Homestead exemption is $25,000 deducted from your assessed value before the taxes are calculated plus an additional homestead exemption up to $25,000 applied to the assessed value above $50,000. The additional exemption does not apply to school taxes.

The homestead exemption applies to real or personal property that is used by the debtor as their residence. The homestead exemption also applies if a dependent of the owner uses the property as their residence.

While the specifics can vary by state, generally, homestead exemptions are only available for an individual or family's primary residence. This means you cannot claim homestead exemptions in multiple states.

The applica�on for homestead exemp�on (see Form DR- 501) and other exemp�on forms are on property appraisers' websites and on the Department of Revenue's forms webpage. Submit your homestead applica�on to your county property appraiser. Click here for county property appraiser contact and website informa�on.

Washington lets filers use the homestead exemption under either the federal or Washington state exemption system. However, you can't mix exemptions from both lists, so select the system that will protect your most important assets.

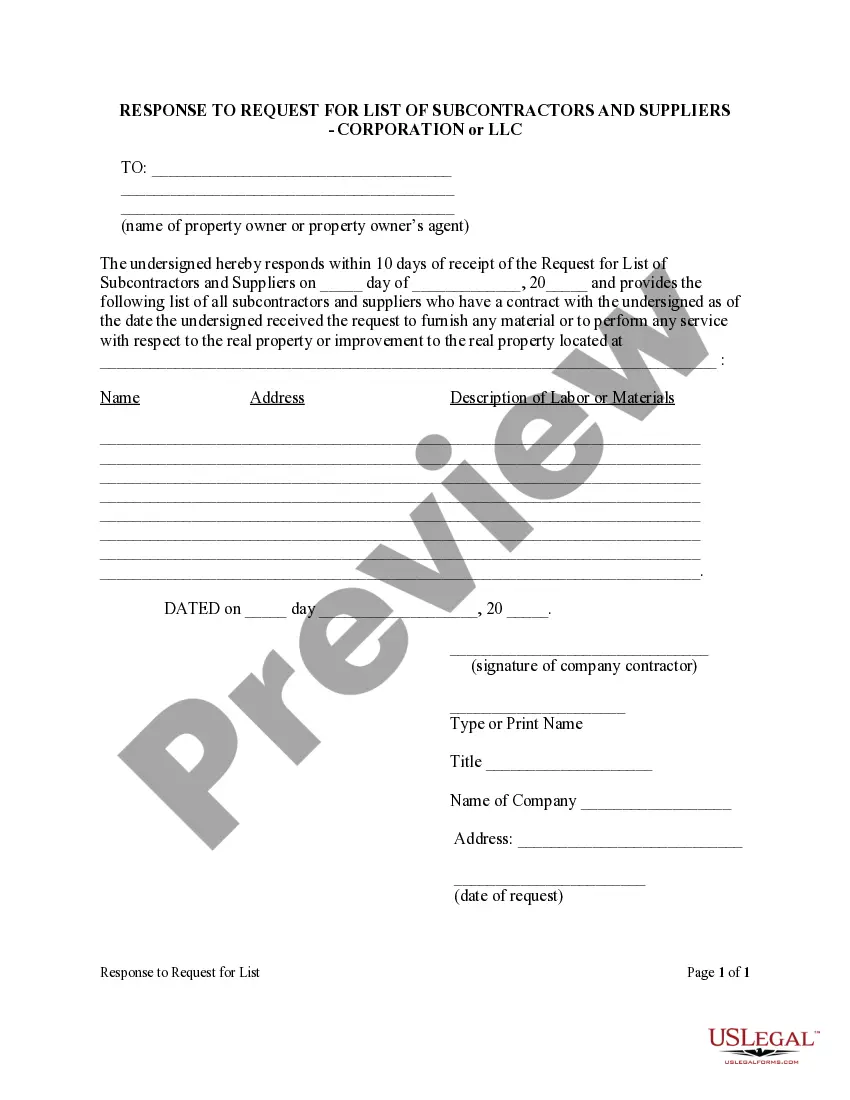

Required Documentation for Homestead Exemption Application Your recorded deed or tax bill. Florida Drivers License or Identification Card. Will need to provide ID# and issue date. Vehicle Registration. Will need to provide tag # and issue date. Permanent Resident Alien Card. Will need to provide ID# and issue date.

Property owned by an honorably discharged veteran who is disabled to a degree of 10% or greater by misfortune, or while serving during wartime service is eligible to receive a $5,000 exemption. Applicants must meet the following qualifications: Must be a permanent Florida resident.