Travel Expenses For Company In Fairfax

State:

Multi-State

County:

Fairfax

Control #:

US-0033-CR

Format:

Word;

Rich Text

Instant download

Description

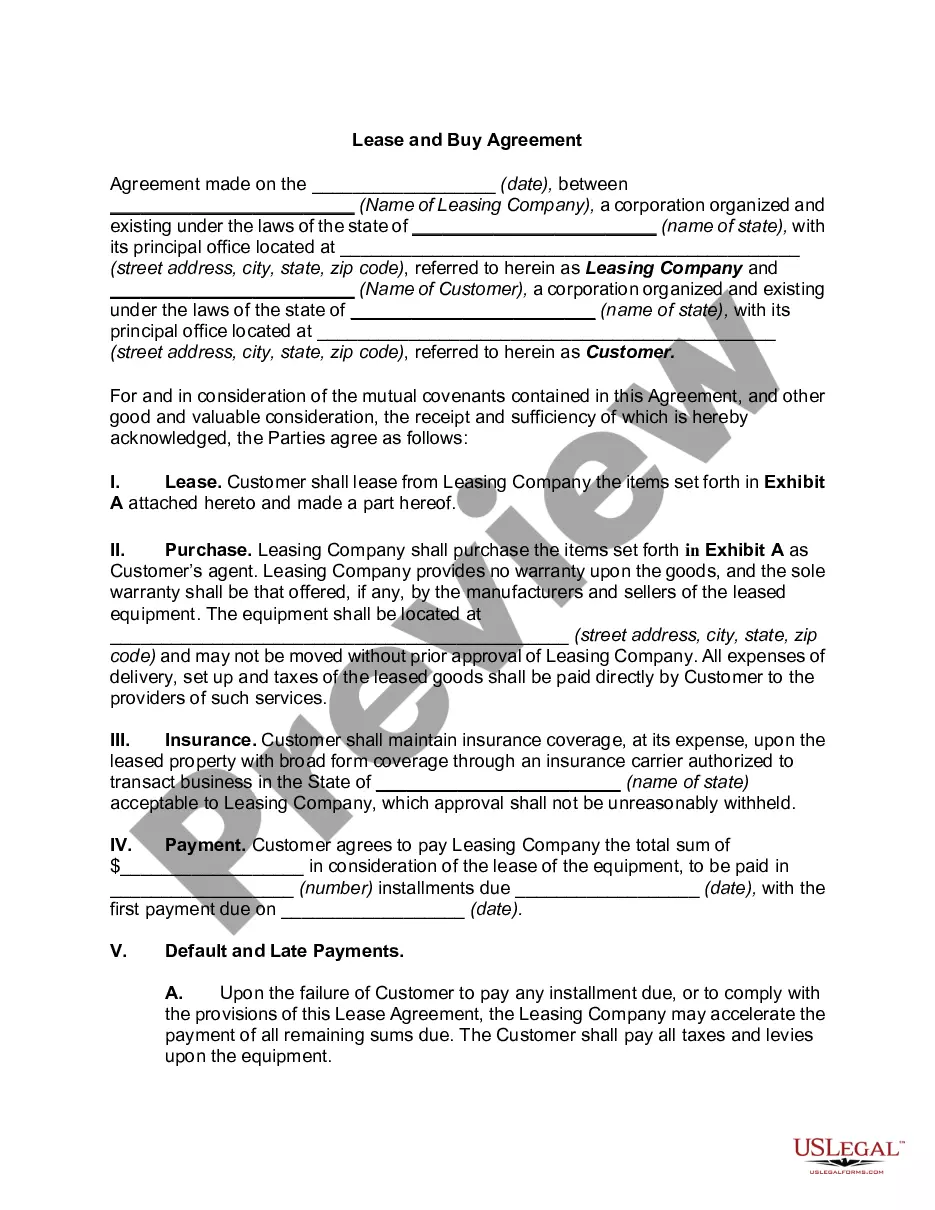

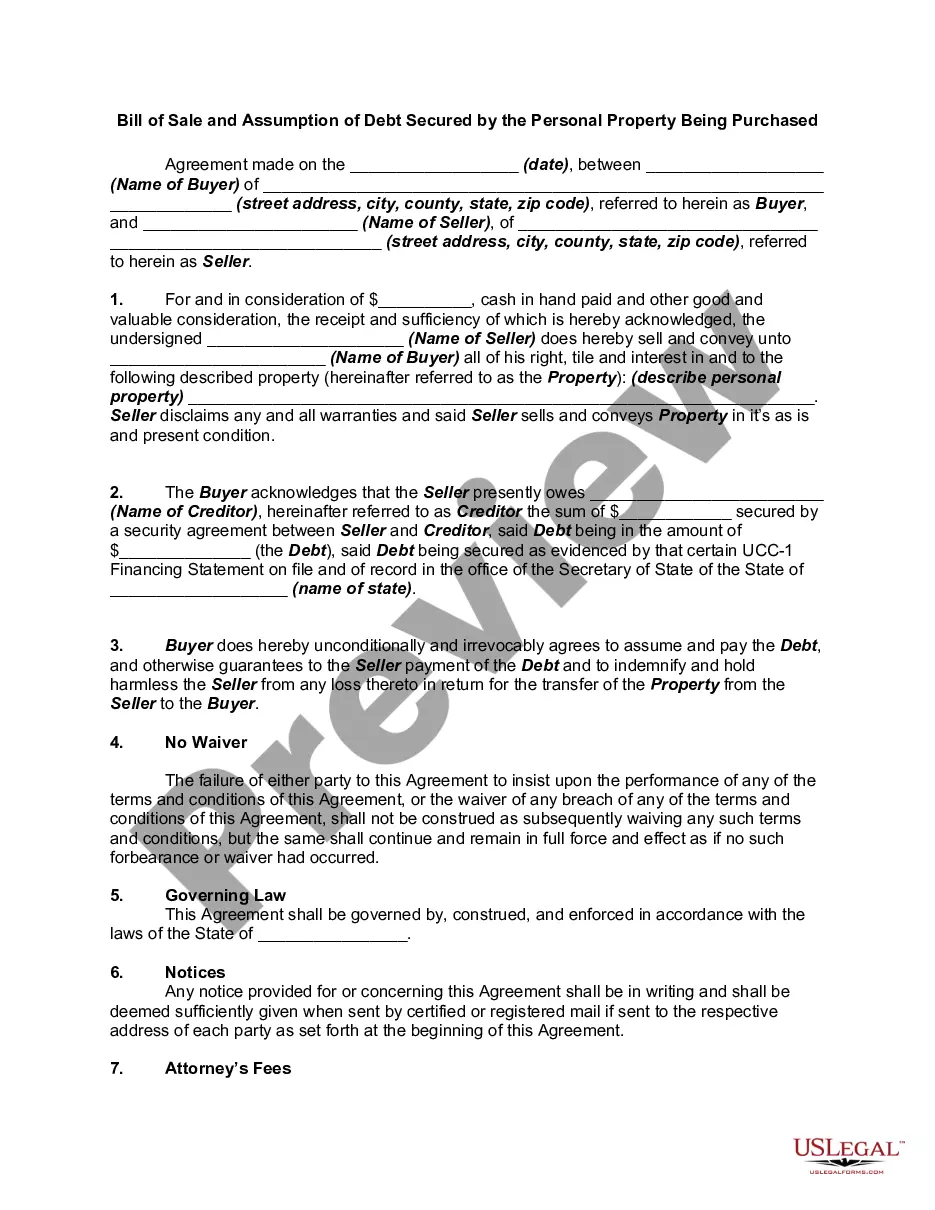

Form with which a corporation may authorize travel expenditures for a director or representative to a specific meeting.

Form popularity

FAQ

The meals and incidental expenses per diem tiers for FY 2024 are unchanged at $59-$79, with the standard M&IE rate unchanged at $59.

If you're traveling to a city in Virginia without a specific per diem rate, the standard federal rates of $110 for lodging and $68 per day for meals and incidentals will apply.

Generally, you can deduct only 50% of qualifying business-related meal expenses. The 50% limit applies to employees, employers, and the self-employed or their clients. Previously, between December 31, 2020, and January 1, 2023, 100% of business meal expenses for food or beverages from a restaurant could be deducted.